Answered step by step

Verified Expert Solution

Question

1 Approved Answer

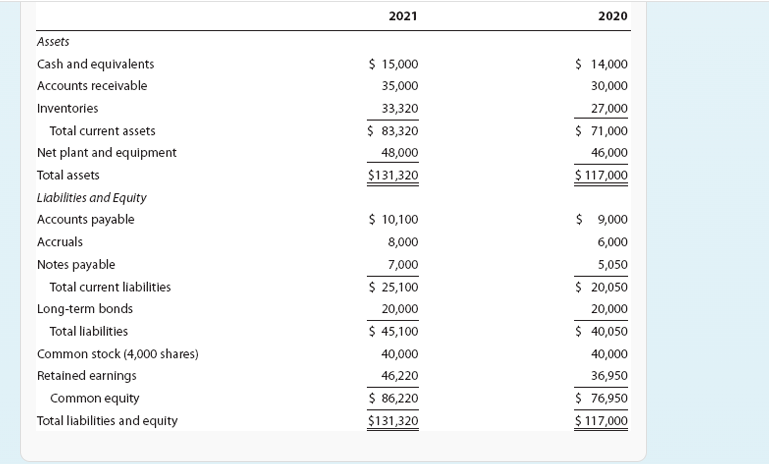

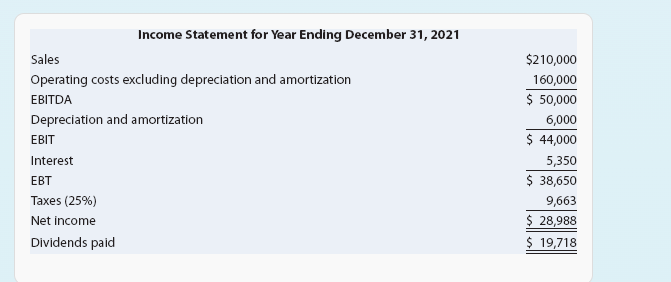

Open Images on a new tab for clarity The number of shares outstanding: 86,220. Price per share: $10. Based on this information, calculate the following

Open Images on a new tab for clarity

The number of shares outstanding: 86,220. Price per share: $10. Based on this information, calculate the following ratios for this year. (You must show your work.):

Current Quick Days sales outstanding Inventory turnover Total assets turnover Profit margin ROA ROE Debt/Total Assets P/E ratio

2021 2020 Assets $ 15,000 35,000 33,320 $ 83,320 48,000 $131,320 $ 14,000 30,000 27,000 $ 71,000 46,000 $ 117,000 Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock (4,000 shares) Retained earnings Common equity Total liabilities and equity $ 10,100 8,000 7,000 $ 25,100 20,000 $ 45,100 40,000 46,220 $ 86,220 $131,320 $ 9,000 6,000 5,050 $ 20,050 20,000 $ 40,050 40,000 36,950 $ 76,950 $ 117,000 Income Statement for Year Ending December 31, 2021 Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and amortization EBIT Interest EBT Taxes (25%) Net income Dividends paid $210,000 160,000 $ 50,000 6,000 $ 44,000 5,350 $ 38,650 9,663 $ 28,988 $ 19,718Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started