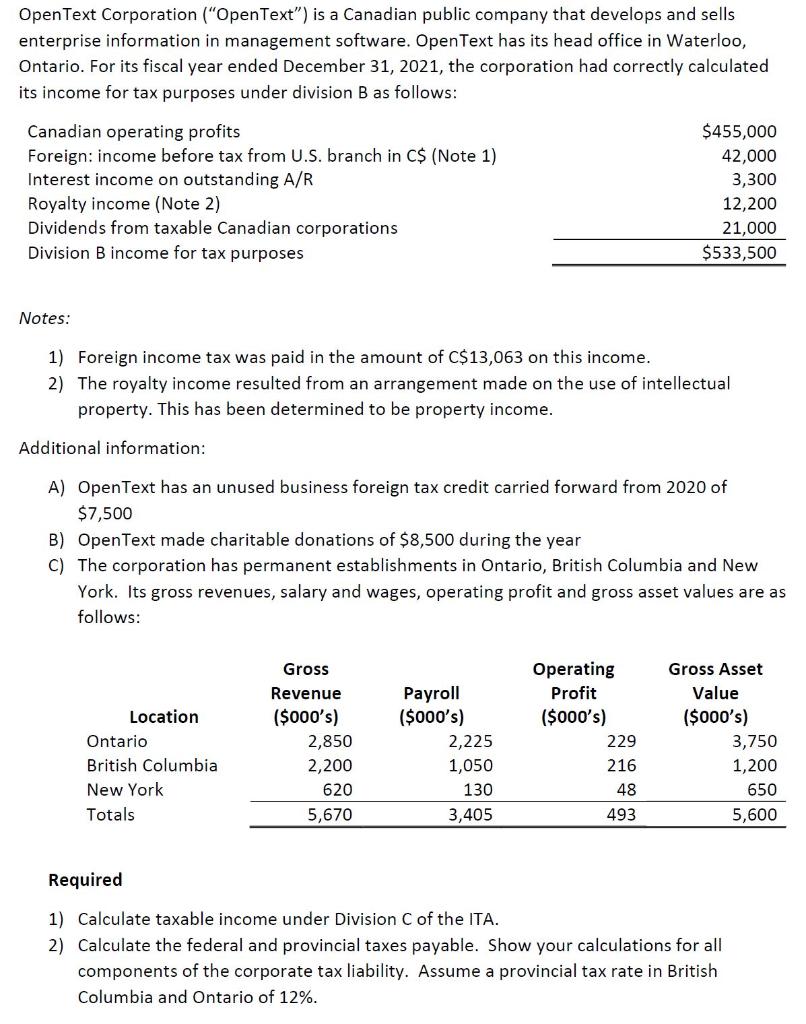

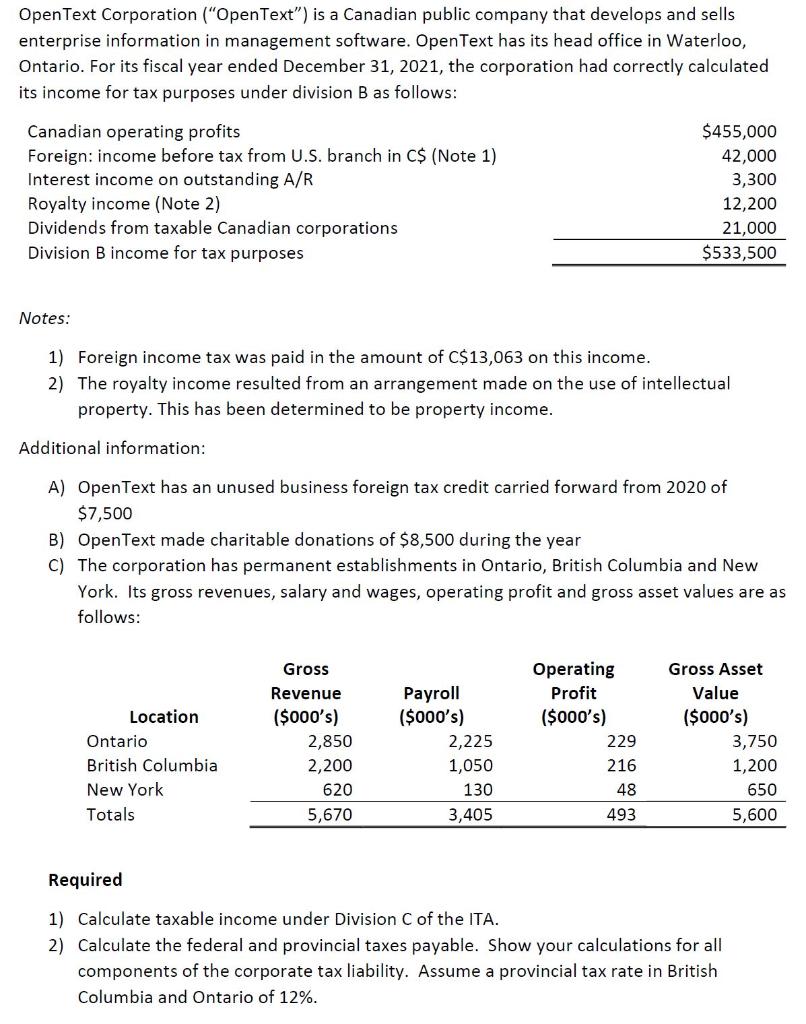

Open Text Corporation ("OpenText") is a Canadian public company that develops and sells enterprise information in management software. Open Text has its head office in Waterloo, Ontario. For its fiscal year ended December 31, 2021, the corporation had correctly calculated its income for tax purposes under division B as follows: Canadian operating profits Foreign: income before tax from U.S. branch in C$ (Note 1) Interest income on outstanding A/R Royalty income (Note 2) Dividends from taxable Canadian corporations Division B income for tax purposes $455,000 42,000 3,300 12,200 21,000 $533,500 Notes: 1) Foreign income tax was paid in the amount of C$13,063 on this income. 2) The royalty income resulted from an arrangement made on the use of intellectual property. This has been determined to be property income. Additional information: A) Open Text has an unused business foreign tax credit carried forward from 2020 of $7,500 B) Open Text made charitable donations of $8,500 during the year C) The corporation has permanent establishments in Ontario, British Columbia and New York. Its gross revenues, salary and wages, operating profit and gross asset values are as follows: Location Ontario British Columbia New York Totals Gross Revenue ($000's) 2,850 2,200 620 5,670 Payroll ($000's) 2,225 1,050 130 3,405 Operating Profit ($000's) 229 216 48 493 Gross Asset Value ($000's) 3,750 1,200 650 5,600 Required 1) Calculate taxable income under Division C of the ITA. 2) Calculate the federal and provincial taxes payable. Show your calculations for all components of the corporate tax liability. Assume a provincial tax rate in British Columbia and Ontario of 12%. Open Text Corporation ("OpenText") is a Canadian public company that develops and sells enterprise information in management software. Open Text has its head office in Waterloo, Ontario. For its fiscal year ended December 31, 2021, the corporation had correctly calculated its income for tax purposes under division B as follows: Canadian operating profits Foreign: income before tax from U.S. branch in C$ (Note 1) Interest income on outstanding A/R Royalty income (Note 2) Dividends from taxable Canadian corporations Division B income for tax purposes $455,000 42,000 3,300 12,200 21,000 $533,500 Notes: 1) Foreign income tax was paid in the amount of C$13,063 on this income. 2) The royalty income resulted from an arrangement made on the use of intellectual property. This has been determined to be property income. Additional information: A) Open Text has an unused business foreign tax credit carried forward from 2020 of $7,500 B) Open Text made charitable donations of $8,500 during the year C) The corporation has permanent establishments in Ontario, British Columbia and New York. Its gross revenues, salary and wages, operating profit and gross asset values are as follows: Location Ontario British Columbia New York Totals Gross Revenue ($000's) 2,850 2,200 620 5,670 Payroll ($000's) 2,225 1,050 130 3,405 Operating Profit ($000's) 229 216 48 493 Gross Asset Value ($000's) 3,750 1,200 650 5,600 Required 1) Calculate taxable income under Division C of the ITA. 2) Calculate the federal and provincial taxes payable. Show your calculations for all components of the corporate tax liability. Assume a provincial tax rate in British Columbia and Ontario of 12%