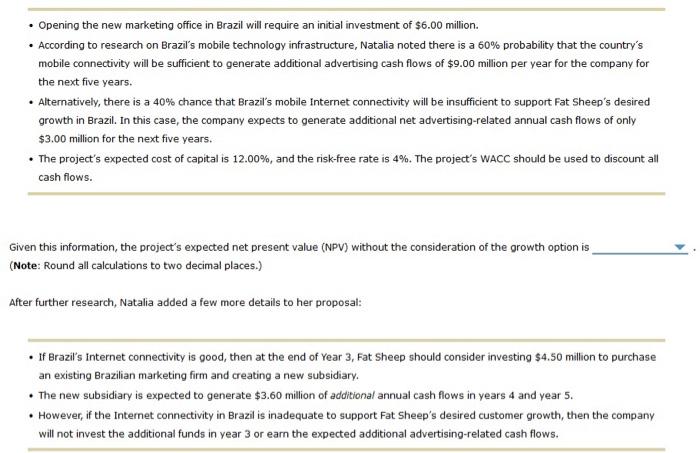

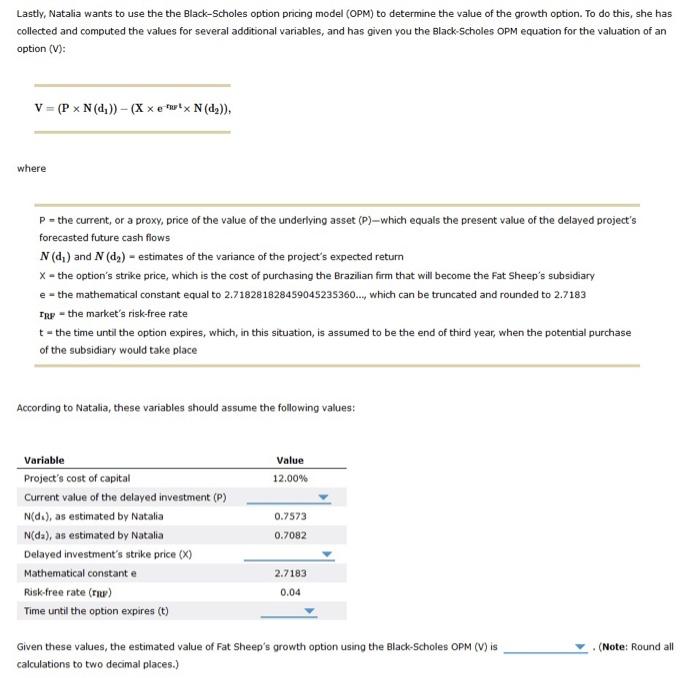

Opening the new marketing office in Brazil will require an initial investment of $6.00 million. According to research on Brazil's mobile technology infrastructure, Natalia noted there is a 60% probability that the country's mobile connectivity will be sufficient to generate additional advertising cash flows of $9.00 million per year for the company for the next five years. Alternatively, there is a 40% chance that Brazil's mobile Internet connectivity will be insufficient to support Fat Sheep's desired growth in Brazil. In this case, the company expects to generate additional net advertising-related annual cash flows of only $3.00 million for the next five years. The project's expected cost of capital is 12.00%, and the risk-free rate is 4%. The project's WACC should be used to discount all cash flows. Given this information, the project's expected net present value (NPV) without the consideration of the growth option is (Note: Round all calculations to two decimal places.) After further research, Natalia added a few more details to her proposal: If Brazil's internet connectivity is good, then at the end of Year 3, Fat Sheep should consider investing $4.50 million to purchase an existing Brazilian marketing firm and creating a new subsidiary. . The new subsidiary is expected to generate $3.60 million of additional annual cash flows in years 4 and year 5. However, if the Internet connectivity in Brazil is inadequate to support Fat Sheep's desired customer growth, then the company will not invest the additional funds in year 3 or earn the expected additional advertising-related cash flows. Lastly, Natalia wants to use the the Black-Scholes option pricing model (OPM) to determine the value of the growth option. To do this, she has collected and computed the values for several additional variables, and has given you the Black-Scholes OPM equation for the valuation of an option (V): V V= (P x N (d)) - (x x e "IP"> N(d)), where P = the current, or a proxy, price of the value of the underlying asset (P)-which equals the present value of the delayed project's forecasted future cash flows N(d) and N (da) - estimates of the variance of the project's expected return X - the option's strike price, which is the cost of purchasing the Brazilian firm that will become the Fat Sheep's subsidiary e-the mathematical constant equal to 2.718281828459045235360..., which can be truncated and rounded to 2.7183 FRP the market's risk-free rate t - the time until the option expires, which, in this situation, is assumed to be the end of third year, when the potential purchase of the subsidiary would take place According to Natalia, these variables should assume the following values: Value 12.00% Variable Project's cost of capital Current value of the delayed investment (P) N(d.), as estimated by Natalia N(da), as estimated by Natalia Delayed investment's strike price (X) Mathematical constante Risk-free rate (TIP) Time until the option expires (t) 0.7573 0.7082 2.7183 0.04 (Note: Round all Given these values, the estimated value of Fat Sheep's growth option using the Black-Scholes OPM (V) is calculations to two decimal places.) Opening the new marketing office in Brazil will require an initial investment of $6.00 million. According to research on Brazil's mobile technology infrastructure, Natalia noted there is a 60% probability that the country's mobile connectivity will be sufficient to generate additional advertising cash flows of $9.00 million per year for the company for the next five years. Alternatively, there is a 40% chance that Brazil's mobile Internet connectivity will be insufficient to support Fat Sheep's desired growth in Brazil. In this case, the company expects to generate additional net advertising-related annual cash flows of only $3.00 million for the next five years. The project's expected cost of capital is 12.00%, and the risk-free rate is 4%. The project's WACC should be used to discount all cash flows. Given this information, the project's expected net present value (NPV) without the consideration of the growth option is (Note: Round all calculations to two decimal places.) After further research, Natalia added a few more details to her proposal: If Brazil's internet connectivity is good, then at the end of Year 3, Fat Sheep should consider investing $4.50 million to purchase an existing Brazilian marketing firm and creating a new subsidiary. . The new subsidiary is expected to generate $3.60 million of additional annual cash flows in years 4 and year 5. However, if the Internet connectivity in Brazil is inadequate to support Fat Sheep's desired customer growth, then the company will not invest the additional funds in year 3 or earn the expected additional advertising-related cash flows. Lastly, Natalia wants to use the the Black-Scholes option pricing model (OPM) to determine the value of the growth option. To do this, she has collected and computed the values for several additional variables, and has given you the Black-Scholes OPM equation for the valuation of an option (V): V V= (P x N (d)) - (x x e "IP"> N(d)), where P = the current, or a proxy, price of the value of the underlying asset (P)-which equals the present value of the delayed project's forecasted future cash flows N(d) and N (da) - estimates of the variance of the project's expected return X - the option's strike price, which is the cost of purchasing the Brazilian firm that will become the Fat Sheep's subsidiary e-the mathematical constant equal to 2.718281828459045235360..., which can be truncated and rounded to 2.7183 FRP the market's risk-free rate t - the time until the option expires, which, in this situation, is assumed to be the end of third year, when the potential purchase of the subsidiary would take place According to Natalia, these variables should assume the following values: Value 12.00% Variable Project's cost of capital Current value of the delayed investment (P) N(d.), as estimated by Natalia N(da), as estimated by Natalia Delayed investment's strike price (X) Mathematical constante Risk-free rate (TIP) Time until the option expires (t) 0.7573 0.7082 2.7183 0.04 (Note: Round all Given these values, the estimated value of Fat Sheep's growth option using the Black-Scholes OPM (V) is calculations to two decimal places.)