Operating Budgets: Finish all graphs! Thank you!

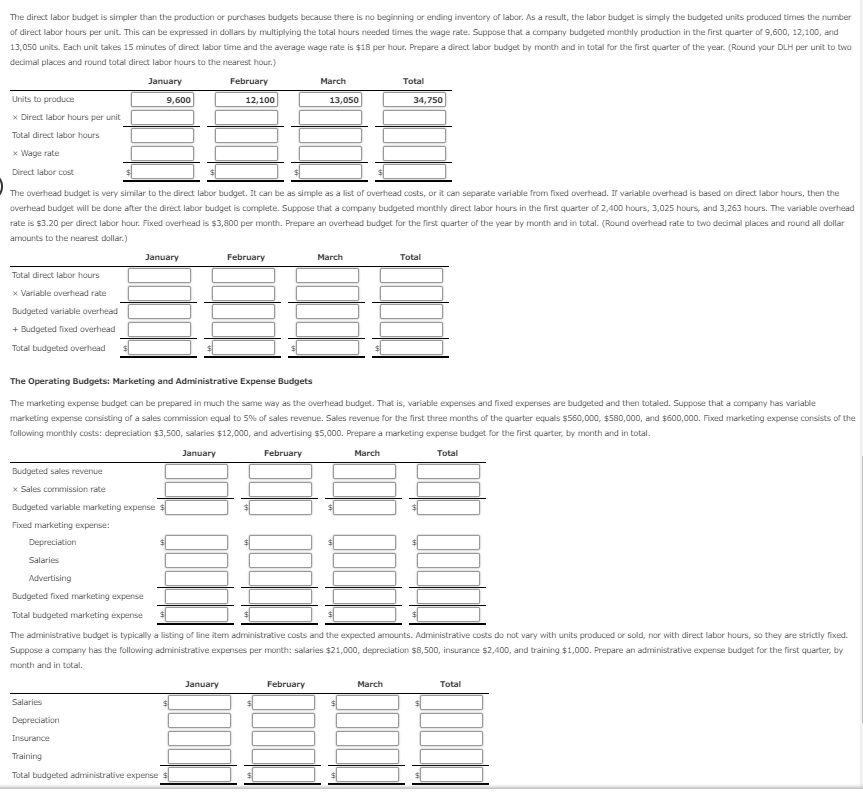

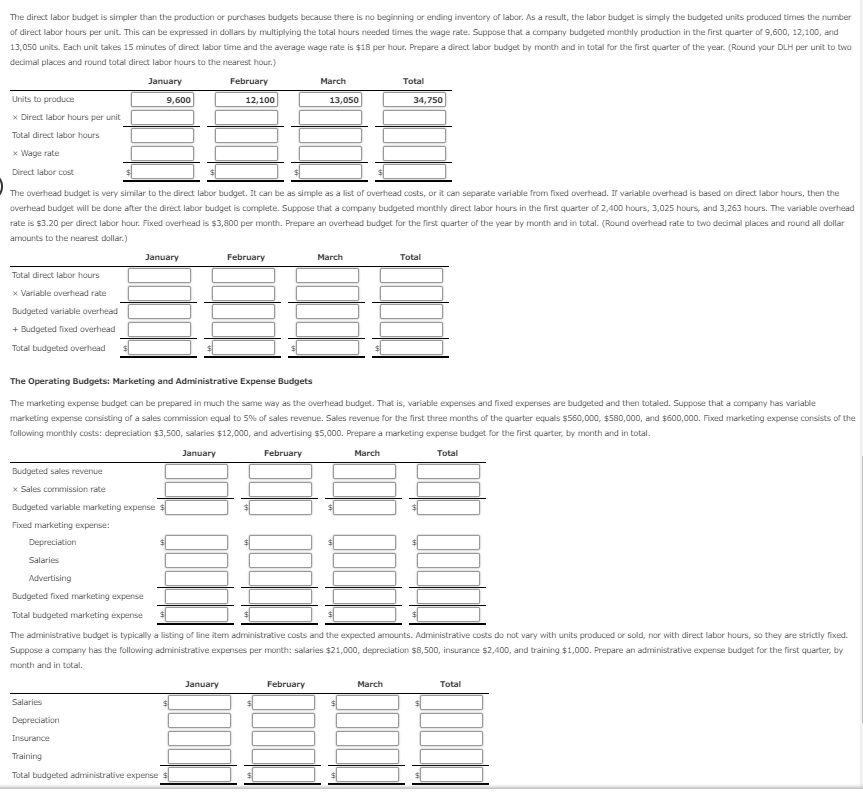

The direct labor budget is simpler than the production or purchases budgets because there is no beginning or ending inventory of labor. As a result, the labor budget is simply the budgeted units produced times the number of direct labor hours per unit. This can be expressed in dollars by multiplying the total hours needed times the wage rate. Suppose that a companry budgeted monthly production in the first quarter of 9,600, 12,100, and 13,050 units. Each unit takes 15 minutes or direct labor time and the average wa e rate is18 per hour. Prepare a direct labor budget by mort, and in total for the first quarter or the year. Round your DLH per unit to two decimal places and round total direct labor hours to the nearest hour.) March Total Units to produce x Direct labor hours per unit Total direct labor hours 9,600 12,100 13,050 34,750 Wage rate Direct labor cost The overhead budget is very similar to the direct labor budget. It can be as simple as a list of overhead costs, or it can separate variable from fixed overhead. I variable overhead is based on diredt labor hours, then the overhead budget will be done alter the direct labor budget is complete. Suppose that a company budgeted monthly direct labor hours in the first quarter of 2,400 hours, 3,025 hours, and 3,263 hours. The variable overhead rate is $3.20 per direct labor hour. Fixed overhead is $3,800 per month. Prepare an overhead budget for the first quarter of the year by morth and in total. (Round overhead rate to two decimal places and round all dollar amounts to the nearest dollar.) March Total Total direct labor hours Variable overhead rate +Budgeted fixed overhead Total budgeted overhead The Operating Budgets: Marketing and Administrative Expense Budgets The marketing expense budget can be prepared in much the same way as the overhead budget. That is, variable expenses and fixed expenses are budgeted and then totaled. Suppose that a company has variable marketing expense donsisting or a sales commission equal to 5% of sales revenue. Sales revenue for the first three months or the quarter equals S560 000 $580,000, and $600,000 Fixed marketing expense consists of the following monthly costs: depreciation3,500 salaries 12,000, and advertising S5,000. Prepare a marketing expense budget for the first quarter, by month and in total. March Total Budgeted sales revenue Budgeted variable marketing expense Fixed marketing expense: Salaries Budgeted fixed marketing expense Total budgeted marketing expense The administrative budget is typically a listing of line item administrative costs and the expected amounts. Suppose a comp any has the rollo in administrative expenses per month: salaries 21,000, depreciation S8,500 insurance S2,400, and training1,000. Prepare an administrative e per month and in total. costs do not vary with units produced or sold, nor with direct labor hours, so they are strictly fixed. e budget ror the first quarter, by March Total Salaries Total budgeted administrative expense