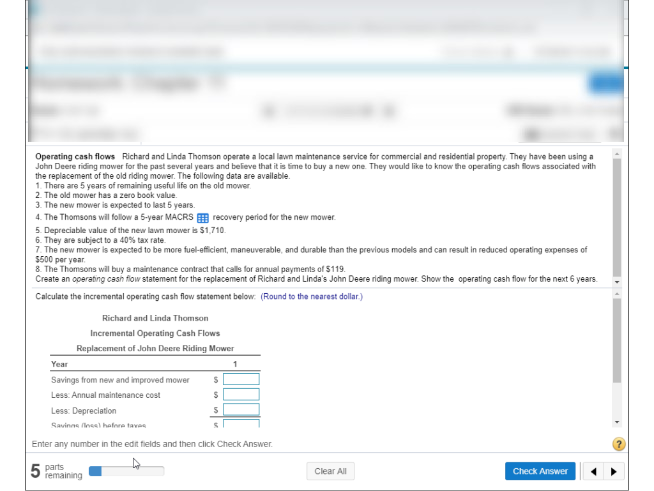

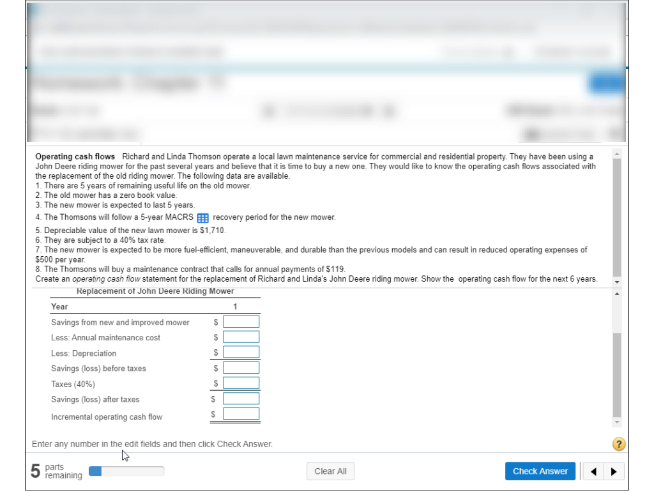

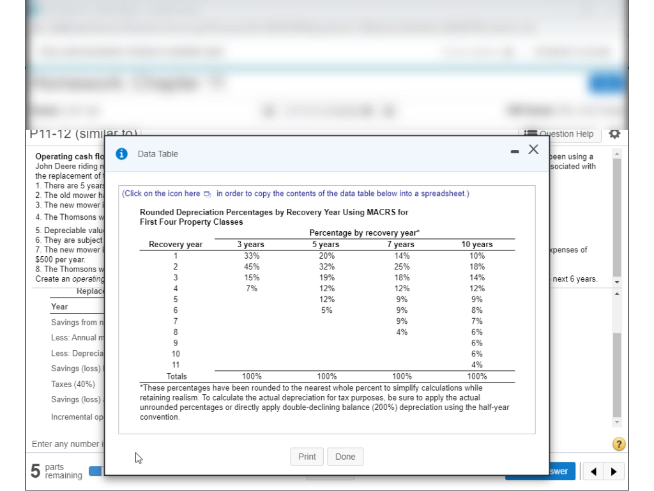

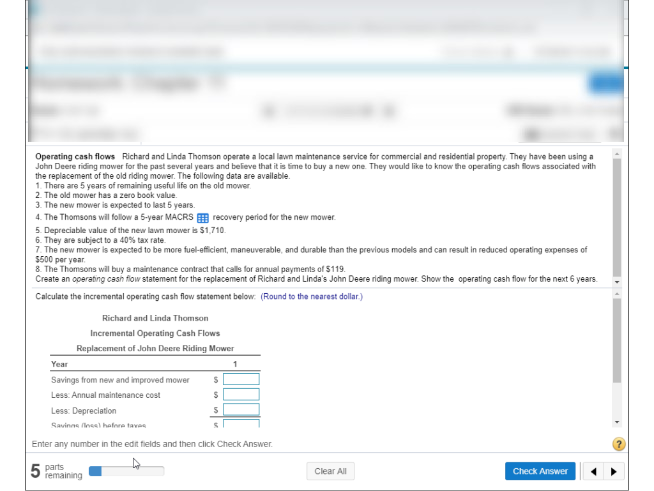

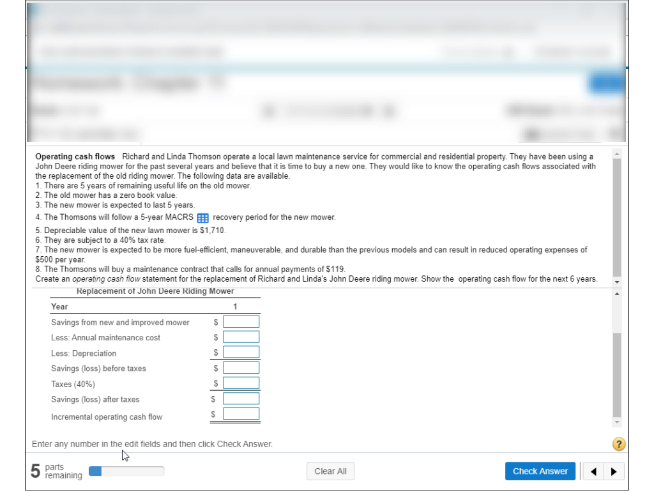

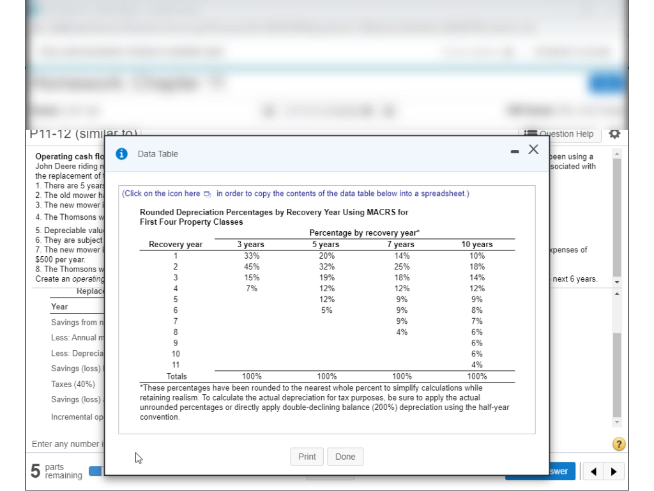

Operating cash flows Richard and Linda Thomson operate a local lawn maintenance service for commercial and residential property. They have been using a John Deere riding mower for the past several years and believe that it is time to buy a new one. They would like to know the operating cash flows associated with the replacement of the old riding mower. The following data are available. 1. There are 5 years of remaining useful life on the old mower 2. The old mower has a zero book value. 3. The new mower is expected to last 5 years. 4. The Thomsons will follow a 5-year MACRS recovery period for the new mower. 5. Depreciable value of the new lawn mower is $1,710. 6. They are subject to a 40% tax rate. 7. The new mower is expected to be more fuel-efficient, maneuverable, and durable than the previous models and can result in reduced operating expenses of 5500 per year 8. The Thomsons will buy a maintenance contract that calls for annual payments of $119. Create an operating cash flow statement for the replacement of Richard and Linda's John Deere riding mower Show the operating cash flow for the next 6 years. Calculate the incremental operating cash flow statement below: (Round to the nearest dollar) Richard and Linda Thomson Incremental Operating Cash Flows Replacement of John Deere Riding Mower Year Savings from new and improved mower S Less Annual maintenance cost $ Less: Depreciation 5 Savinnene har Enter any number in the edit fields and then click Check Answer 1 5 parts Clear All remaining Check Answer Operating cash flows Richard and Linda Thomson operate a local lawn maintenance service for commercial and residential property. They have been using a John Deere riding mower for the past several years and believe that it is time to buy a new one. They would like to know the operating cash flows associated with the replacement of the old riding mower. The following data are available. 1. There are 5 years of remaining useful life on the old mower 2. The old mower has a zero book value 3. The new mower is expected to last 5 years 4. The Thomsons will follow a 5-year MACRS recovery period for the new mower. 5. Depreciable value of the new lawn mower is $1,710. 6. They are subject to a 40% tax rate 7. The new mower is expected to be more fuel-efficient, maneuverable, and durable than the previous models and can result in reduced operating expenses of 5500 per year 8. The Thomsons will buy a maintenance contract that calls for annual payments of $119. Create an operating cash flow statement for the replacement of Richard and Linda's John Deere riding mower Show the operating cash flow for the next 6 years. Replacement of John Deere Riding Mower Year 1 Savings from new and improved mower $ Less Annual maintenance cost $ Less Depreciation $ Savings loss) before taxes $ Taxes (40%) $ Savings loss) after taxes 5 Incremental operating cash flow $ Enter any number in the edit fields and then click Check Answer 5 parts Clear All remaining Check Answer P11-12 (similar tal Ayestion Help - X Operating cash fld Data Table been using a John Deere riding sociated with the replacement of 1. There are 5 year 2. The old mower (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) 3. The new mower 4. The Thomsons Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes 5. Depreciable valul Percentage by recovery year 6. They are subject Recovery year 7. The new mower 3 years 5 years 7 years 10 years 5500 per year 33% 20% 14% 10% penses of 8. The Thomsons w 45% 32% 25% 18% Create an operating 19% 18% next 6 years Replac 79 12% 12% 12% 9% 9% Year 5% 8% Savings from 9% 7% Less Annual 6% 6% Less. Deprecia 10 6% 11 Savings (loss) Totals 100% 100% 100% 100% Taxes (40%) "These percentages have been rounded to the nearest whole percent to simplify calculations while Savings loss) retaining realism To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (2009) depreciation using the half-year Incremental convention Enter any number Print Done 5 parts swer remaining