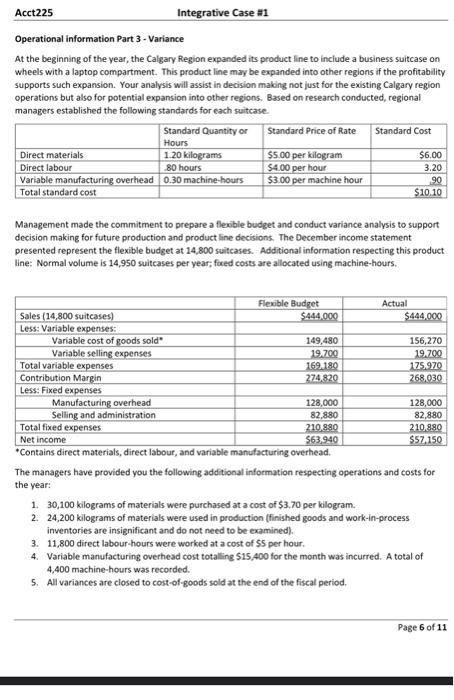

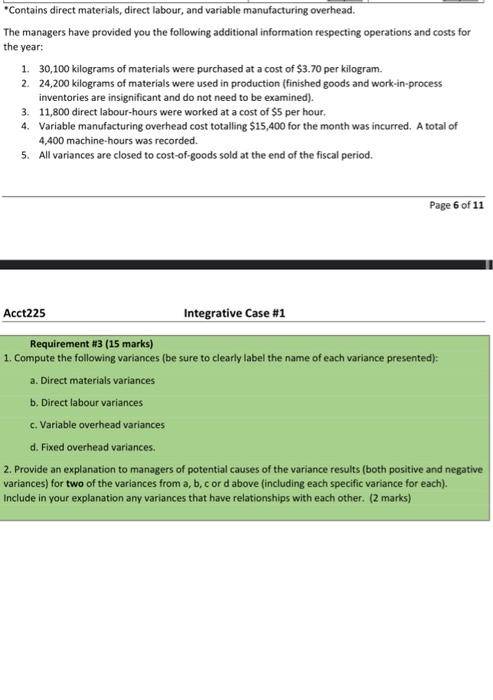

Operational information Part 3-Variance At the beginning of the year, the Calgary Region expanded its product line to include a business suitcase on wheels with a laptop compartment. This product line may be expanded into other regions if the profitability supports such expansion. Your analysis will assist in decision making not just for the existing Calgary region operations but also for potential expansion into other regions. Based on research conducted, regional managers established the following standards for each suitcase. Management made the commitment to prepare a fexible budget and conduct variance analysis to support decision making for future production and product line decisions. The December income statement presented represent the flexible budget at 14,800 suitcases. Additional information respecting this product line: Normal volume is 14,950 suitcases per year; fxed costs are allocated using machine-hours. The managers have provided you the following additional information respecting operations and costs for the year: 1. 30,100 kilograms of materials were purchased at a cost of $3,70 per kilogram. 2. 24,200 kilograms of materials were used in production (finished goods and work-in-process inventories are insignificant and do not need to be examined). 3. 11,800 direct labour-hours were worked at a cost of $5 per hour. 4. Variable manufacturing overhead cost totalling $15,400 for the month was incurred. A total of 4,400 machine-hours was recorded. 5. All variances are closed to cost-of-goods sold at the end of the fiscal period. "Contains direct materials, direct labour, and variable manufacturing overhead. The managers have provided you the following additional information respecting operations and costs for the year: 1. 30,100 kilograms of materials were purchased at a cost of $3.70 per kilogram. 2. 24,200 kilograms of materials were used in production (finished goods and work-in-process inventories are insignificant and do not need to be examined). 3. 11,800 direct labour-hours were worked at a cost of $5 per hour. 4. Variable manufacturing overhead cost totalling $15,400 for the month was incurred, A total of 4,400 machine-hours was recorded. 5. All variances are closed to cost-of-goods sold at the end of the fiscal period. Page 6 of 11 Acct225 Integrative Case \#1 Requirement #3 (15 marks) 1. Compute the following variances (be sure to clearly label the name of each variance presented): a. Direct materials variances b. Direct labour variances c. Variable overhead variances d. Fixed overhead variances. 2. Provide an explanation to managers of potential causes of the variance results (both positive and negative variances) for two of the variances from a, b, c or d above (including each specific variance for each). Include in your explanation any variances that have relationships with each other. (2 marks)