Answered step by step

Verified Expert Solution

Question

1 Approved Answer

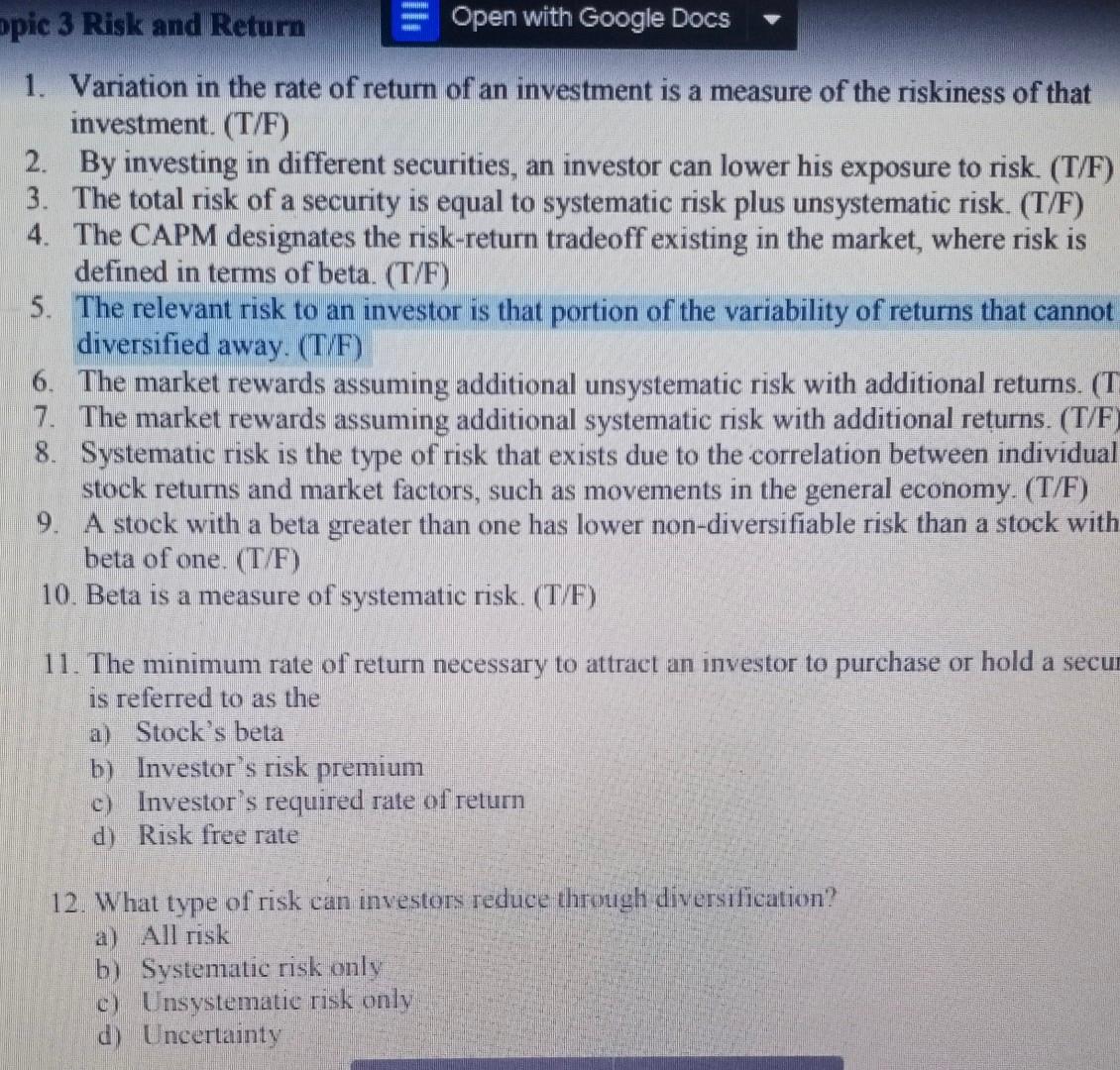

opic 3 Risk and Retur Open with Google Docs 1. Variation in the rate of return of an investment is a measure of the riskiness

opic 3 Risk and Retur Open with Google Docs 1. Variation in the rate of return of an investment is a measure of the riskiness of that investment. (T/F) 2. By investing in different securities, an investor can lower his exposure to risk. (T/F) 3. The total risk of a security is equal to systematic risk plus unsystematic risk. (T/F) 4. The CAPM designates the risk-return tradeoff existing in the market, where risk is defined in terms of beta. (T/F) 5. The relevant risk to an investor is that portion of the variability of returns that cannot diversified away. (T/F) 6. The market rewards assuming additional unsystematic risk with additional returns. (T 7. The market rewards assuming additional systematic risk with additional returns. (T/F) 8. Systematic risk is the type of risk that exists due to the correlation between individual stock returns and market factors, such as movements in the general economy. (T/F) 9. A stock with a beta greater than one has lower non-diversifiable risk than a stock with beta of one. (T/F) 10. Beta is a measure of systematic risk. (T/F) 11. The minimum rate of return necessary to attract an investor to purchase or hold a secu is referred to as the a) Stock's beta b) Investor's risk premium c) Investor's required rate of return d) Risk free rate 12. What type of risk can investors reduce through diversification? a) All risk b) Systematic risk only c) Unsystematic risk only d) Uncertainty

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started