Answered step by step

Verified Expert Solution

Question

1 Approved Answer

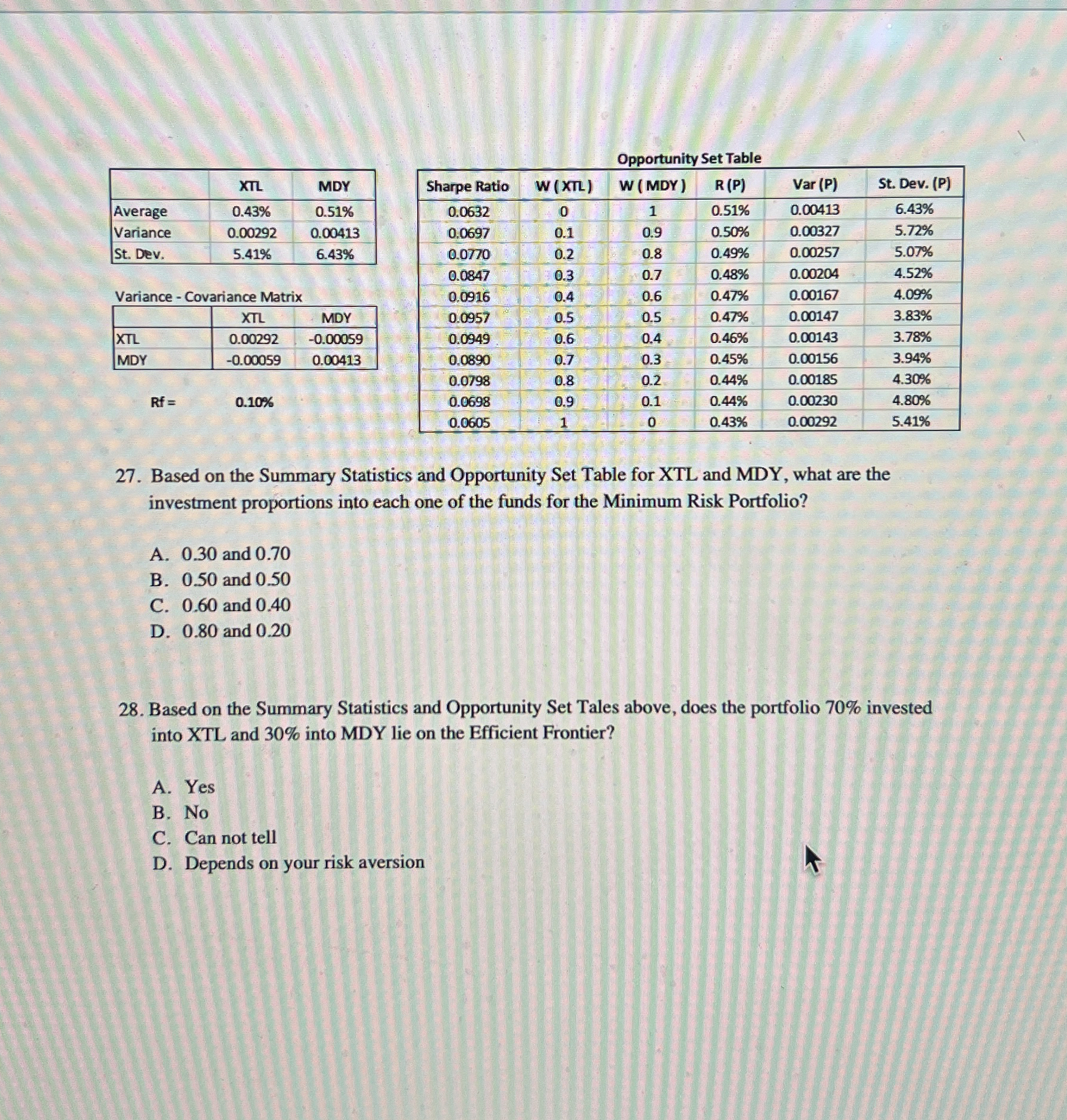

Opportunity Set Table Variance - Covariance Matrix R f = , 0 . 1 0 % Based on the Summary Statistics and Opportunity Set Table

Opportunity Set Table

Variance Covariance Matrix

Based on the Summary Statistics and Opportunity Set Table for XTL and MDY what are the

investment proportions into each one of the funds for the Minimum Risk Portfolio?

A and

B and

C and

D and

Based on the Summary Statistics and Opportunity Set Tales above, does the portfolio invested

into XTL and into MDY lie on the Efficient Frontier?

A Yes

B No

C Can not tell

D Depends on your risk aversion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started