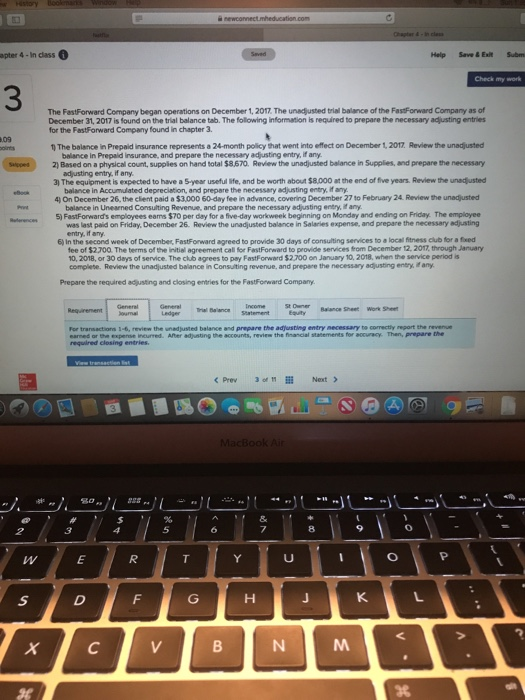

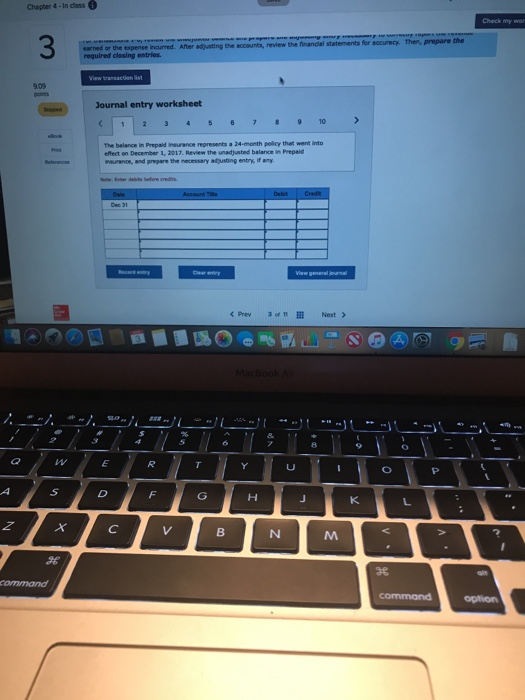

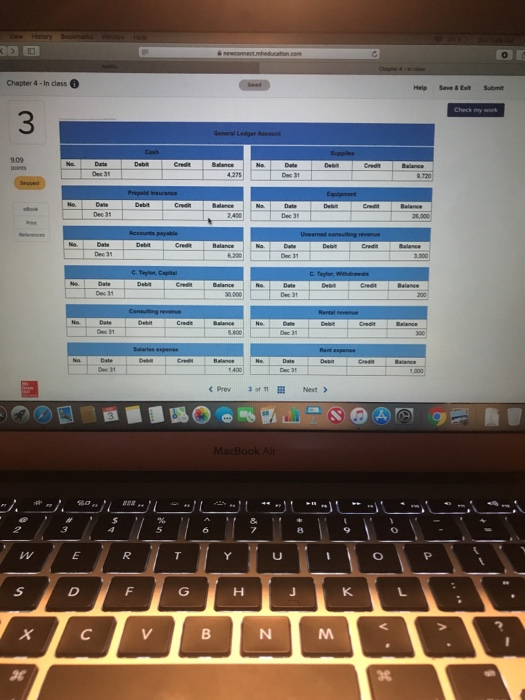

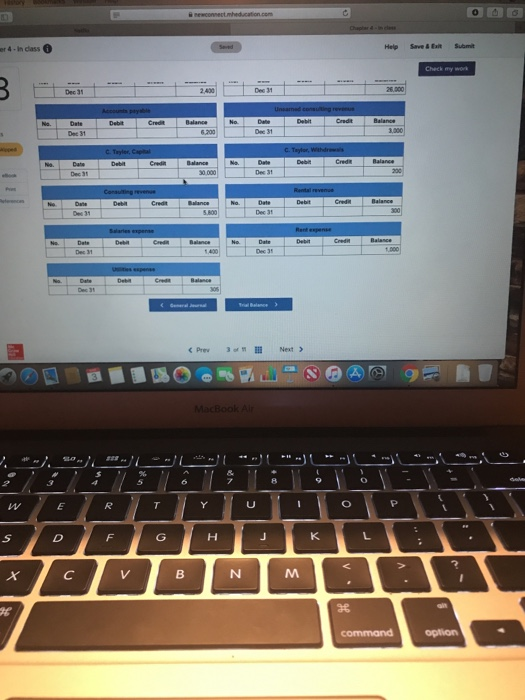

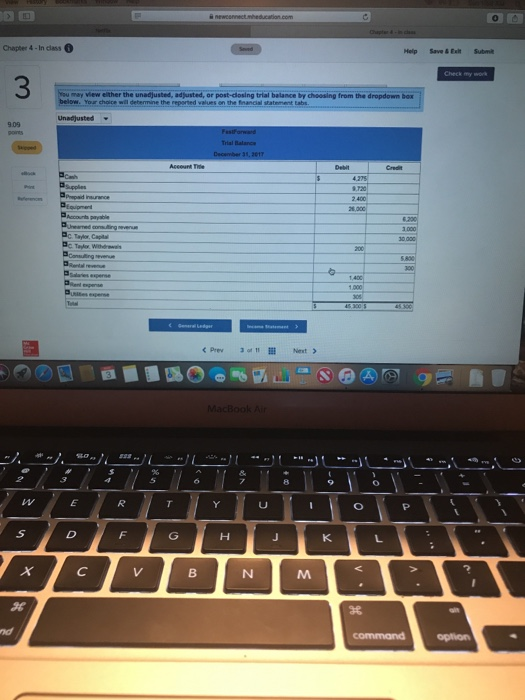

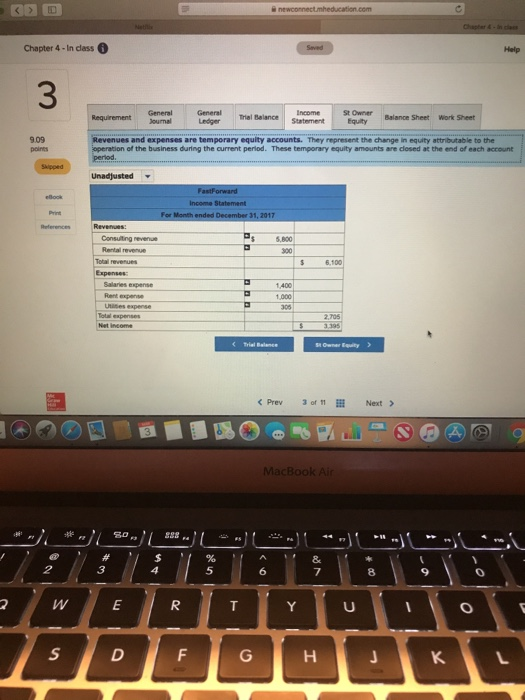

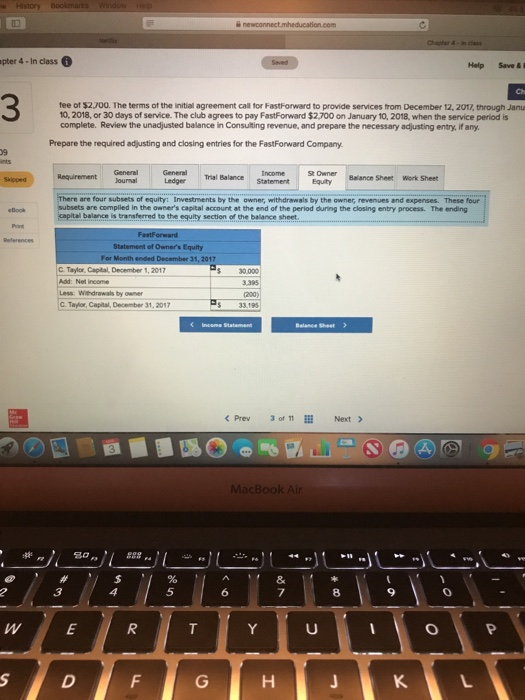

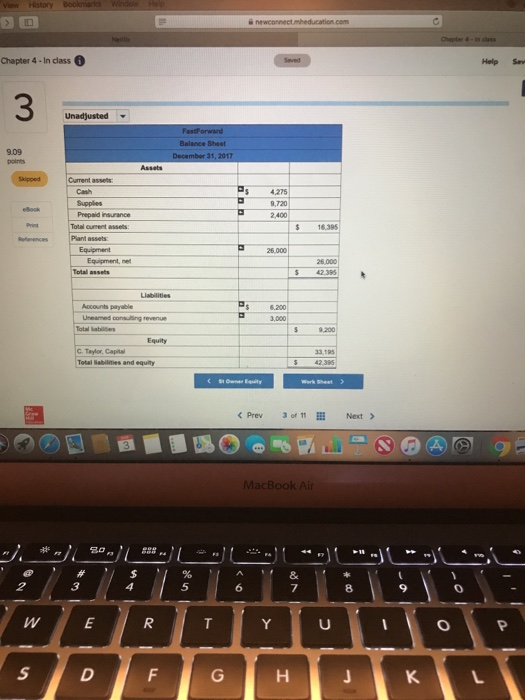

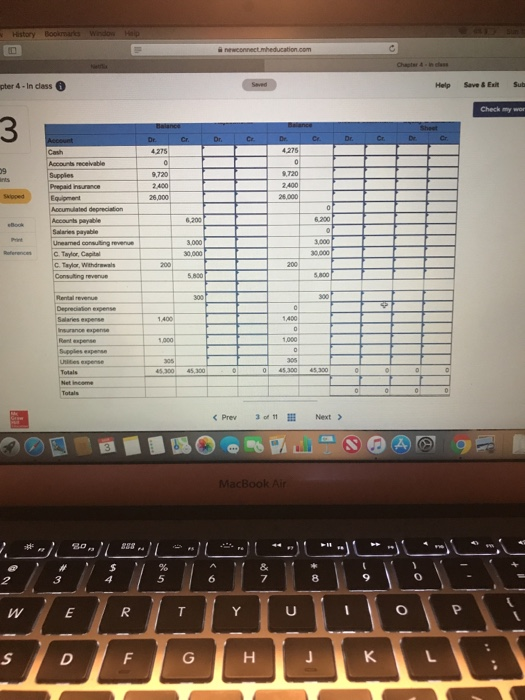

opter 4 -In class Help Save&ExitSubm 3 The FastForward Company began operations on December 1, 2017. The unadjusted trial balance of the FastForward Company as of December 31, 2017 is found on the trial balance tab. The following information is required to prepare the necessary adjusting entries for the FastForward Company found in chapter 3. 1) The balance in Prepaid insurance represents a 24-month policy that went into effect on December 1, 2017. Revilew the unadjusted balance in Prepaid insurance, and prepare the necessary adjusting entry, if any toes 2, Based on a physical count, suppies on hand total sa 70, Review the unadjusted balance in Supptes, and prepare the necessary adjusting entry. if any balance in Accumulated depreciation, and prepare the necessary adjusting entry, if any balance in Unearned Consulting Revenue, and prepare the necessary adjusting entry,if any. was last paid on Friday, December 26. Review the unadjusted balance in Salaries expense, and prepare the necessary djusting 3) The equipment is expected to have a 5year useful life, and be worth about $8000 at the end of five years. Review the unadjusted 4 On December 26, the client paid a $3,000 60-day fee in advance, covering December 27 to February 24. Review the unadjusted 5) FastForward's employees eams $70 per day for a five-day workweek beginning on Monday and ending on Friday. The employee 6) In the second week of December, FastForward agreed to provide 30 days of consulting services to a local fitness club for a fxed 10, 2018, or 30 days of service. The club agrees to pey FastForward $2,700 on January 10, 2018, when the service period is entry, if amy fee of $270Q The terms of the initial agreement call for FastForward to provide services from December 12, 2017, through January complete. Review the unadjusted balance in Consuting revenue, and prepere the necessary adjusting entry, if any Prepare the required adjusting and closing entries for the FastForward Company. Work Shee Ledger Trial BalanceIncme St Owner Equity Balance Shee transactions -6, review the unadjusted balance and prepare the adjusting entry necessay te eonety spot the resene C Prev 3 of Next 8 9 Chapter 4 In dlass 6 3 closing entries. 909 a Journal entry worksheet 123456 7 910 The balance in Prepaid insurance represents a 24-month policy that went into nsuranoe, and prepare the necessary atjusting entry, if any 8 command option Chapter 4 -in dlass Help Save&Exit Submit 3 Dec 3 Dec 31 Prev 3 of "11 Next > * "/. so,"/Ler ../i-..// .. t , t -....11 ,','\ -.1 8 Help Save & EsitSubmit er 4 -In class Dec 31 K. Chapter 4-In class Help Save&Exit Subm C Prev Next Chapter 4-In dless 3 S st owner Balance Sheet Requirement Sournal el Balance |.income work Sheet edger Statement Equity 9.09 and expenses are temporary equity accounts. They represent the change in equity attributable to the operation of the business during the current period. These temporary equity amounts are closed at the end of each account Unadjusted Income Statement References Revenues: $ 5.8001 6,100 2,705 3 8 pter 4-In class Help Save& fee of $2,700. The terms of the initial agreement call for FastForward to provide services from December 12, 2017, through Janu 10, 2018, or 30 days of service. The club agrees to pay FastForward $2,700 on January 10, 2018, when the service period is complete. Review the unadjusted balance in Consulting revenue, and prepare the necessary adjusting entry, if any. Prepare the required adjusting and closing entries for the FastForward Company. 09 RequirementJournal St Owner Balance Sheet Work Sheet Ledger Trial Balance Income Statement Equity There are four subsets of equity: Investments by the owner, withdrawals by the owner, revenues and expenses. These four subsets are compiled in the owner's capital account at the end of the period during the closing entry process. The ending capital belanice Is traneterred to the equity section or the balance sheet Statement of Owner's Equity C. Taylor, Capital, December 1, 2017 Aod: Net income Less Withdrawals by owner C. Taylor, Capital, December 31, 2017 S 30.000 5 33,193

5 6 8 9 WE Chapter 4-In dlass Help Sav 3 Unadjusted Balance Sheet Current assets 9,720 Prepid insurance 2.400 5 16.395 Plant assets 26,000 Equipment, net 26.000 42.395 Aocounts paryable Ps 620 Equity C Taylor, Capital Total iabilities and 33,195 42 35 sa,, 6 7 8 W E Ul pter 4- In class Help Save&Exit Sub Check my wwor 3 9 9,720 ,720 Peepaid insurance Salaries payable C. Taylor, Capital 1400 Uities expense 8 K