option E: 951.26

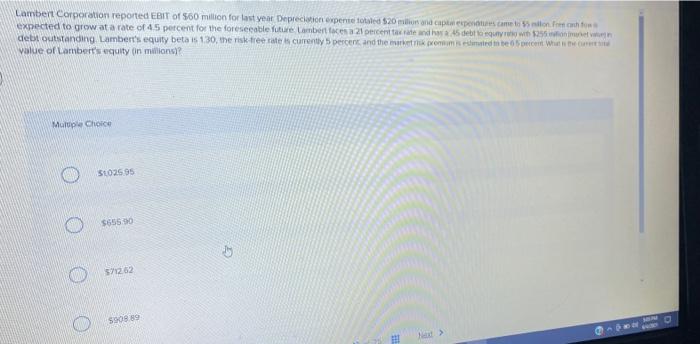

Lambert Corporation reported EBIT of 560 million for last year Depreciation experte totale $20 million and presentes come in the expected to grow at a rate of 45 percent for the foreseeable future Lambert faces 21 percentax rate and 45 debito quy 25 debt outstanding Lambert's equity beta is 130, the risk free rate is currently 5 percent and the newest te on What the value of Lambert's quity on millions? Multiple Choice S102595 o 56950 G 571252 S9009 Lambert Corporation reported EBIT of 500 milion for last year. Depreciation expense totaled $20 million and capital expenditures came to 55 milion Free cach towie expected to grow at a rate of 45 percent for the foreseeable future. Lambert faces a 21 percent tax rate and has a 45 debt to equity ratio with $255 milion wet value debt outstanding, Lambert's equity beta is 1.30. the risk tree rate is currently 5 percent, and the market risk premium is estimated to be 65 percent What is the current total value of Lambert's equity on miliona Mun Choice SEO SUS Multiple Choice $1,025.95 ho $655.90 571262 5908 89 595126 Lambert Corporation reported EBIT of 560 million for last year Depreciation experte totale $20 million and presentes come in the expected to grow at a rate of 45 percent for the foreseeable future Lambert faces 21 percentax rate and 45 debito quy 25 debt outstanding Lambert's equity beta is 130, the risk free rate is currently 5 percent and the newest te on What the value of Lambert's quity on millions? Multiple Choice S102595 o 56950 G 571252 S9009 Lambert Corporation reported EBIT of 500 milion for last year. Depreciation expense totaled $20 million and capital expenditures came to 55 milion Free cach towie expected to grow at a rate of 45 percent for the foreseeable future. Lambert faces a 21 percent tax rate and has a 45 debt to equity ratio with $255 milion wet value debt outstanding, Lambert's equity beta is 1.30. the risk tree rate is currently 5 percent, and the market risk premium is estimated to be 65 percent What is the current total value of Lambert's equity on miliona Mun Choice SEO SUS Multiple Choice $1,025.95 ho $655.90 571262 5908 89 595126