Answered step by step

Verified Expert Solution

Question

1 Approved Answer

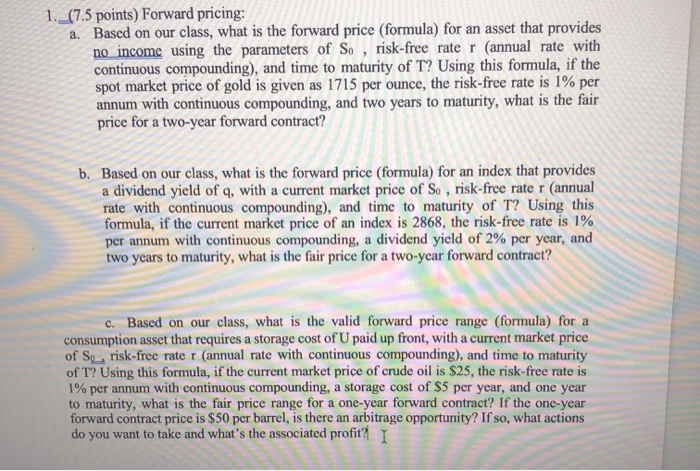

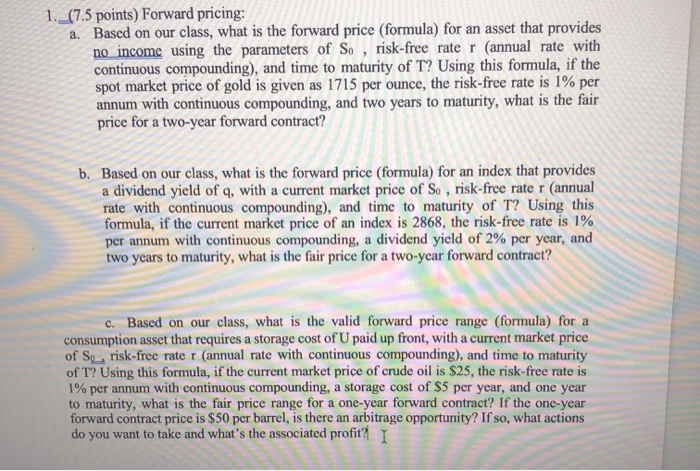

Options Derivitaves. Please answer all A-C Correction. Pertaining to FORWARD PRICING** 1. (7.5 points) Forward pricing: a. Based on our class, what is the forward

Options Derivitaves. Please answer all A-C

Correction. Pertaining to FORWARD PRICING**

1. (7.5 points) Forward pricing: a. Based on our class, what is the forward price (formula) for an asset that provides no income using the parameters of So, risk-free rater (annual rate with continuous compounding), and time to maturity of T? Using this formula, if the spot market price of gold is given as 1715 per ounce, the risk-free rate is 1% per annum with continuous compounding, and two years to maturity, what is the fair price for a two-year forward contract? b. Based on our class, what is the forward price (formula) for an index that provides a dividend yield of q, with a current market price of So, risk-free rate r (annual rate with continuous compounding), and time to maturity of T? Using this formula, if the current market price of an index is 2868, the risk-free rate is 1% per annum with continuous compounding, a dividend yield of 2% per year, and two years to maturity, what is the fair price for a two-year forward contract? c. Based on our class, what is the valid forward price range (formula) for a consumption asset that requires a storage cost of U paid up front, with a current market price of Se, risk-free rater (annual rate with continuous compounding), and time to maturity of T? Using this formula, if the current market price of crude oil is $25, the risk-free rate is 1% per annum with continuous compounding, a storage cost of $5 per year, and one year to maturity, what is the fair price range for a one-year forward contract? If the one-year forward contract price is $50 per barrel, is there an arbitrage opportunity? If so, what actions do you want to take and what's the associated profit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started