Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Options: Financial Asset, Financial Liability, Real Asset, Real Liability. The new financial asset is (Destroyed or Created) Lanni's promissory note held by the bank. A

Options: Financial Asset, Financial Liability, Real Asset, Real Liability.

The new financial asset is (Destroyed or Created) Lanni's promissory note held by the bank.

A new financial asset is (Destroyed or Created) if Microsoft issues new shares

The loan is (Destroyed or Created). The transaction since it is retired when paid.

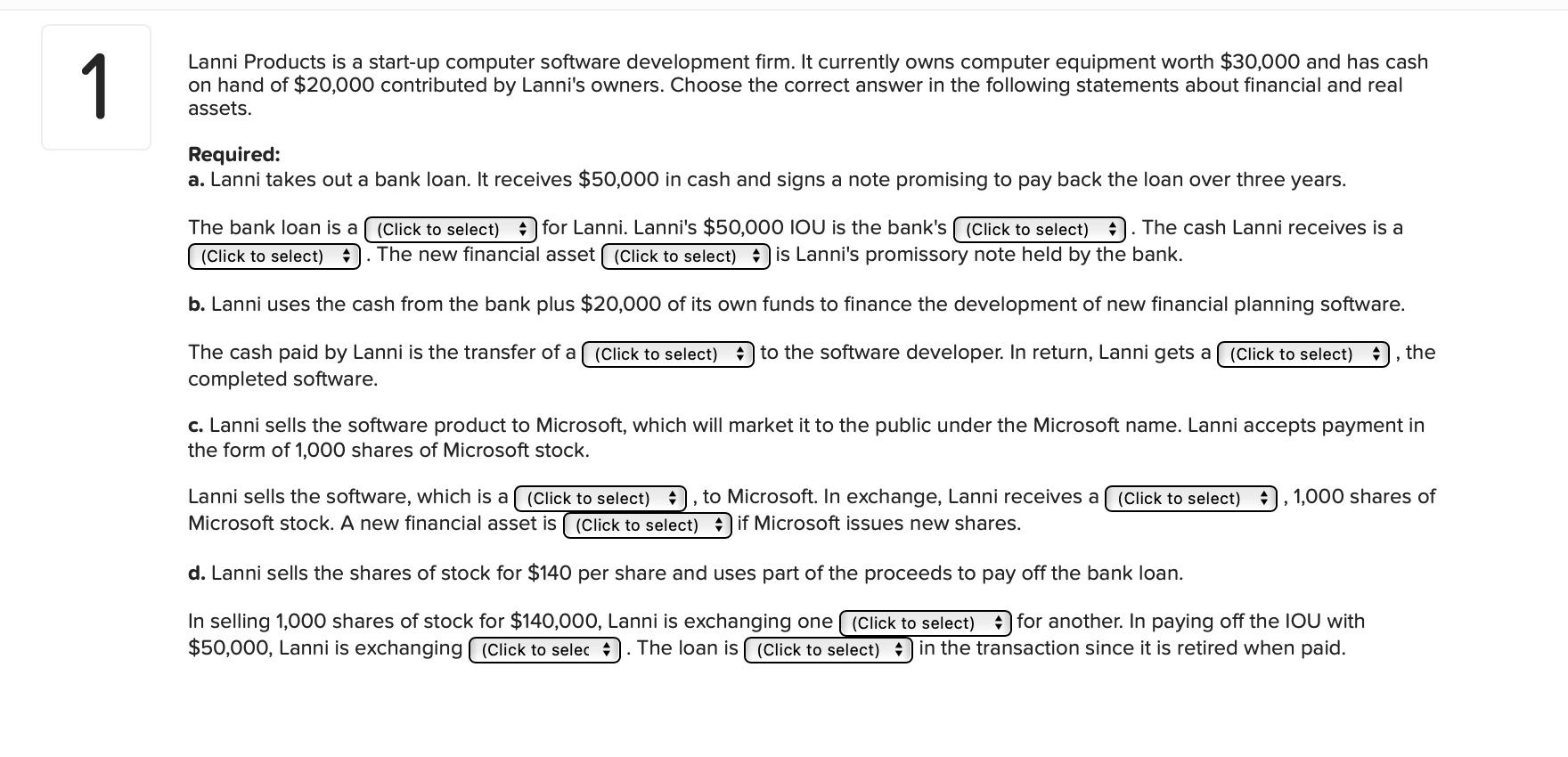

1 Lanni Products is a start-up computer software development firm. It currently owns computer equipment worth $30,000 and has cash on hand of $20,000 contributed by Lanni's owners. Choose the correct answer in the following statements about financial and real assets. Required: a. Lanni takes out a bank loan. It receives $50,000 in cash and signs a note promising to pay back the loan over three years. The bank loan is a (Click to select) (Click to select) for Lanni. Lanni's $50,000 IOU is the bank's [ (Click to select) The new financial asset (Click to select) is Lanni's promissory note held by the bank. b. Lanni uses the cash from the bank plus $20,000 of its own funds to finance the development of new financial planning software. The cash paid by Lanni is the transfer of a(Click to select) to the software developer. In return, Lanni gets a [(Click to select), the completed software. The cash Lanni receives is a c. Lanni sells the software product to Microsoft, which will market it to the public under the Microsoft name. Lanni accepts payment in the form of 1,000 shares of Microsoft stock. Lanni sells the software, which is a (Click to select) to Microsoft. In exchange, Lanni receives a (Click to select) Microsoft stock. A new financial asset is (Click to select) if Microsoft issues new shares. 1,000 shares of d. Lanni sells the shares of stock for $140 per share and uses part of the proceeds to pay off the bank loan. In selling 1,000 shares of stock for $140,000, Lanni is exchanging one (Click to select) for another. In paying off the IOU with $50,000, Lanni is exchanging (Click to selec). The loan is (Click to select) in the transaction since it is retired when paid. 1 Lanni Products is a start-up computer software development firm. It currently owns computer equipment worth $30,000 and has cash on hand of $20,000 contributed by Lanni's owners. Choose the correct answer in the following statements about financial and real assets. Required: a. Lanni takes out a bank loan. It receives $50,000 in cash and signs a note promising to pay back the loan over three years. The bank loan is a (Click to select) (Click to select) for Lanni. Lanni's $50,000 IOU is the bank's [ (Click to select) The new financial asset (Click to select) is Lanni's promissory note held by the bank. b. Lanni uses the cash from the bank plus $20,000 of its own funds to finance the development of new financial planning software. The cash paid by Lanni is the transfer of a(Click to select) to the software developer. In return, Lanni gets a [(Click to select), the completed software. The cash Lanni receives is a c. Lanni sells the software product to Microsoft, which will market it to the public under the Microsoft name. Lanni accepts payment in the form of 1,000 shares of Microsoft stock. Lanni sells the software, which is a (Click to select) to Microsoft. In exchange, Lanni receives a (Click to select) Microsoft stock. A new financial asset is (Click to select) if Microsoft issues new shares. 1,000 shares of d. Lanni sells the shares of stock for $140 per share and uses part of the proceeds to pay off the bank loan. In selling 1,000 shares of stock for $140,000, Lanni is exchanging one (Click to select) for another. In paying off the IOU with $50,000, Lanni is exchanging (Click to selec). The loan is (Click to select) in the transaction since it is retired when paidStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started