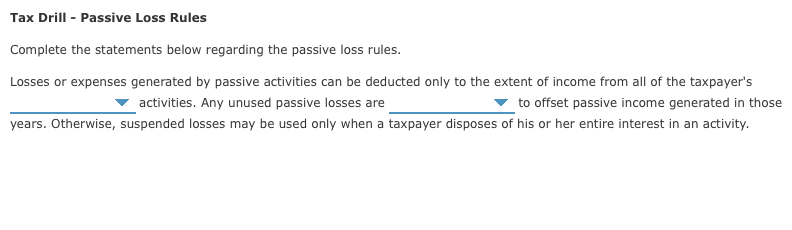

Question: options for 1: active, passive, active & portfolio, portfolio & passive Tax Drill - Passive Loss Rules Complete the statements below regarding the passive loss

options for 1: active, passive, active & portfolio, portfolio & passive

Tax Drill - Passive Loss Rules Complete the statements below regarding the passive loss rules. Losses or expenses generated by passive activities can be deducted only to the extent of income from all of the taxpayer's activities. Any unused passive losses are to offset passive income generated in those years. Otherwise, suspended losses may be used only when a taxpayer disposes of his or her entire interest in an activity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts