Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Options Ish ACG 3111-Intermediate II Chapter 18 Assignment Spring 2019 Due no later than 11:59 pm, CDT, Wednesday, April 3. You may work in groups,

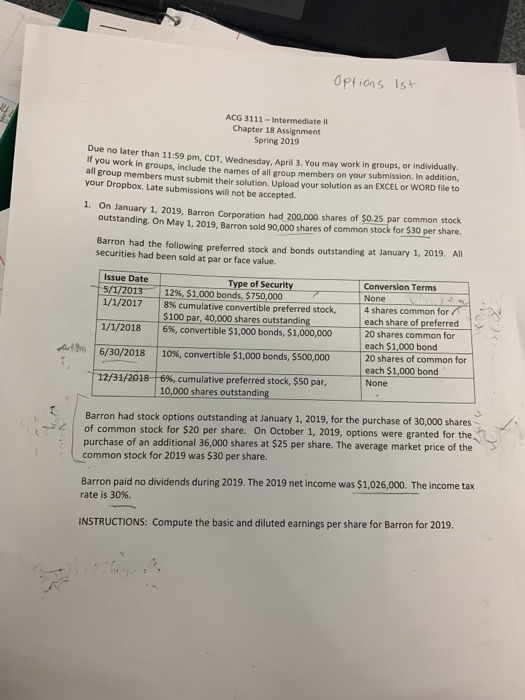

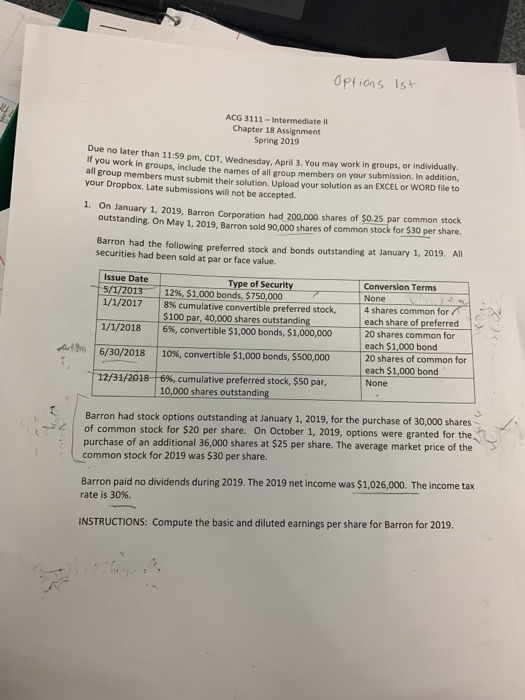

Options Ish ACG 3111-Intermediate II Chapter 18 Assignment Spring 2019 Due no later than 11:59 pm, CDT, Wednesday, April 3. You may work in groups, or individually. Ir you work in groups, include the names of all group members on your submission. in addition, group members must submit their solution. Upload your solution as an EXCEL or WORD file to all your Dropbox. Late submissions will not be accepted. 1. On January 1, 2019, Barron Corporation had 200,000 shares of $0.25 par common stock outstanding. On May 1, 2019, Barron sold 90,000 shares of common stock for $30 per share Barron had the following preferred stock and bonds outstanding at January 1, 2019. All securities had been sold at par or face value Issue Date Conversion Terms None 4 shares each share of preferred 20 shares common for each $1,000 bond 20 shares of common for each $1,000 bond None Type of Security 5/1/2013- I 12%. S 1,000 bonds, $750,000 1/1/2017 1/1/2018 6/30/2018 12/31/2018-6%, cumulative preferred stock, SSO par, | 8% cumulative convertible preferred stock, S100 par, 40,000 shares outstanding | 6%, convertible $1,000 bonds, $1,000,000 Authn 10%, convertible S1,000 bonds,$500,000 10,000 shares outstanding Barron had stock options outstanding at January 1, 2019, for the purchase of 30,000 shares purchase of an additional 36,000 shares at $25 per share. The average market price of the common stock for 2019 was $30 per share. Barron paid no dividends during 2019. The 2019 net income was $1,026,000. The income tax of common stock for $20 per share. On October 1, 2019, options were granted for the rate is 30%. INSTRUCTIONS: Compute the basic and diluted earnings per share for Barron for 2019

Options Ish ACG 3111-Intermediate II Chapter 18 Assignment Spring 2019 Due no later than 11:59 pm, CDT, Wednesday, April 3. You may work in groups, or individually. Ir you work in groups, include the names of all group members on your submission. in addition, group members must submit their solution. Upload your solution as an EXCEL or WORD file to all your Dropbox. Late submissions will not be accepted. 1. On January 1, 2019, Barron Corporation had 200,000 shares of $0.25 par common stock outstanding. On May 1, 2019, Barron sold 90,000 shares of common stock for $30 per share Barron had the following preferred stock and bonds outstanding at January 1, 2019. All securities had been sold at par or face value Issue Date Conversion Terms None 4 shares each share of preferred 20 shares common for each $1,000 bond 20 shares of common for each $1,000 bond None Type of Security 5/1/2013- I 12%. S 1,000 bonds, $750,000 1/1/2017 1/1/2018 6/30/2018 12/31/2018-6%, cumulative preferred stock, SSO par, | 8% cumulative convertible preferred stock, S100 par, 40,000 shares outstanding | 6%, convertible $1,000 bonds, $1,000,000 Authn 10%, convertible S1,000 bonds,$500,000 10,000 shares outstanding Barron had stock options outstanding at January 1, 2019, for the purchase of 30,000 shares purchase of an additional 36,000 shares at $25 per share. The average market price of the common stock for 2019 was $30 per share. Barron paid no dividends during 2019. The 2019 net income was $1,026,000. The income tax of common stock for $20 per share. On October 1, 2019, options were granted for the rate is 30%. INSTRUCTIONS: Compute the basic and diluted earnings per share for Barron for 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started