Answered step by step

Verified Expert Solution

Question

1 Approved Answer

options return 1 0 highest 1 Stocks 1 2 % 1 0 2 Mutual funds 8 . 5 % 6 3 Bonds 3 . 5

options

return

highest

Stocks

Mutual funds

Bonds

Gold

To maximize such portfolio, we would create an objective function, with variables Let S be stocks; M be mutual funds; B for bonds, G for gold.

Cindy has $ million to invest, but wishes to keep some in cash liquidity in the event that the market is down, and she does not want to sell any of her investment to pay her expenses.

Bonds should be at least in her portfolio

Gold should be at least in her portfolio

Average risk factor for her portfolio should NOT exceed

Her good friend, Tommy devised a linear Programmins LP Model, in accordance with her constraints. Model suggested a return of $ a year, a return. The portfolio resembles a 'Growth and Income' Model, consisted of about equity, bonds and gold.

However, with the recent vaccine rollout, and oxpecting a Recovery Phase to take place in Cindy now wishes to run another LP Model.

She now likes to keep a cash position of $ fout of her $ million, only to invest $ million enough for years for her living expenses, without cashing in from her portfolio. She now wants at least $ million in bonds vs of her portfolio last time and NO gold position. Her risk appetite level has now changed to and not her previlous :

What is her new optimal return maximize

Select

What annual return in her portfolio? Select

What is the in bonds in the portfolio?

Dollars invested in mutual funds? Select

What is the in mutual funds in the portfolio

Select

Dollars invested in stocks? Select

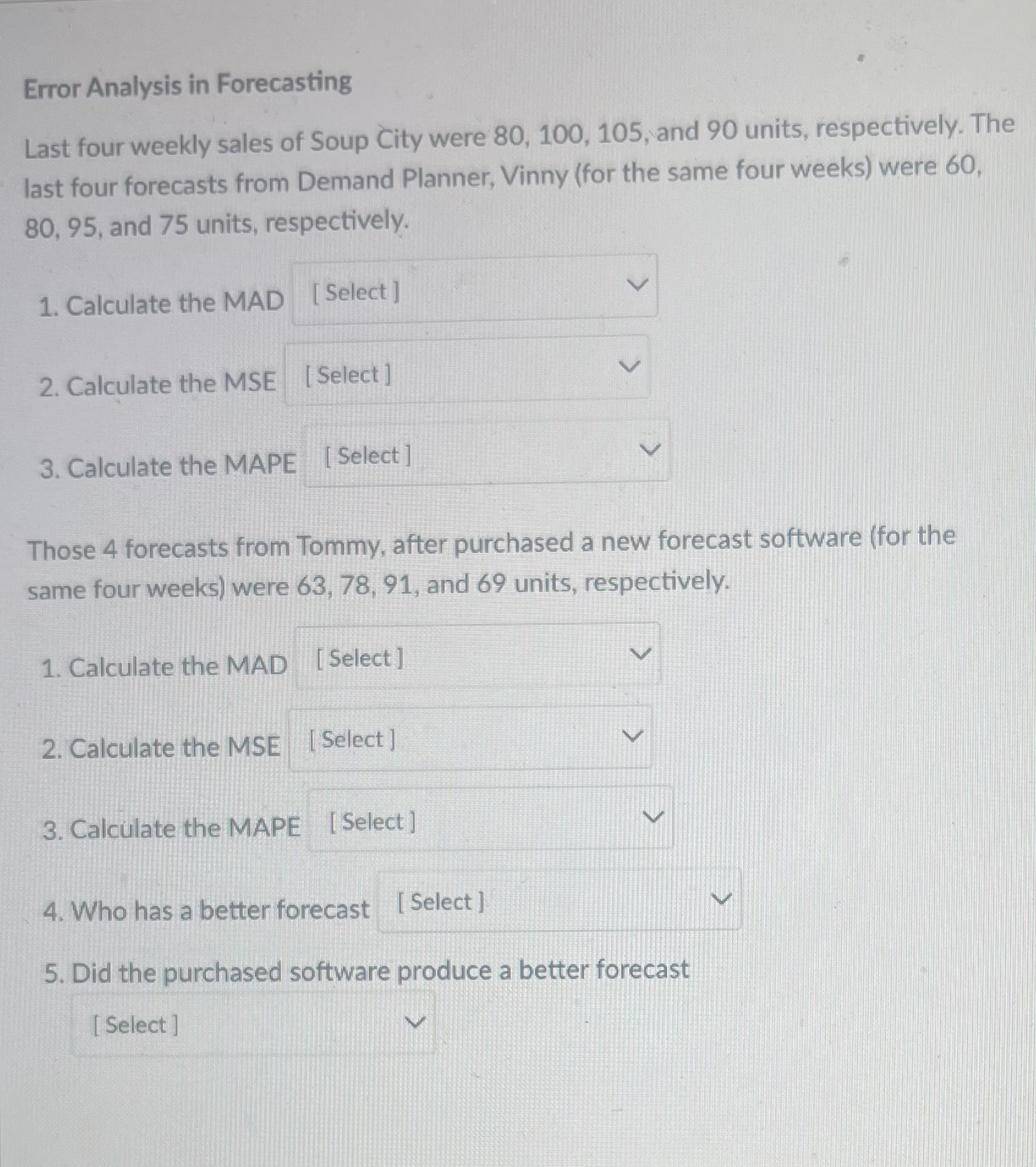

Error Analysis in Forecasting

Last four weekly sales of Soup City were and units, respectively. The

last four forecasts from Demand Planner, Vinny for the same four weeks were

and units, respectively.

Calculate the MAD

Calculate the MSE

Calculate the MAP

Those forecasts from Tommy, after purchased a new forecast software for the

same four weeks were and units, respectively.

Calculate the MAD

Calculate the MSE

Calculate the MAPE

Who has a better forecast

Did the purchased software produce a better forecast

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started