Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Options that is blank is irrelevant Namberry (Pty) Ltd Namberry (Pty) Ltd is a grower and producer of various types of berries along the banks

Options that is blank is irrelevant

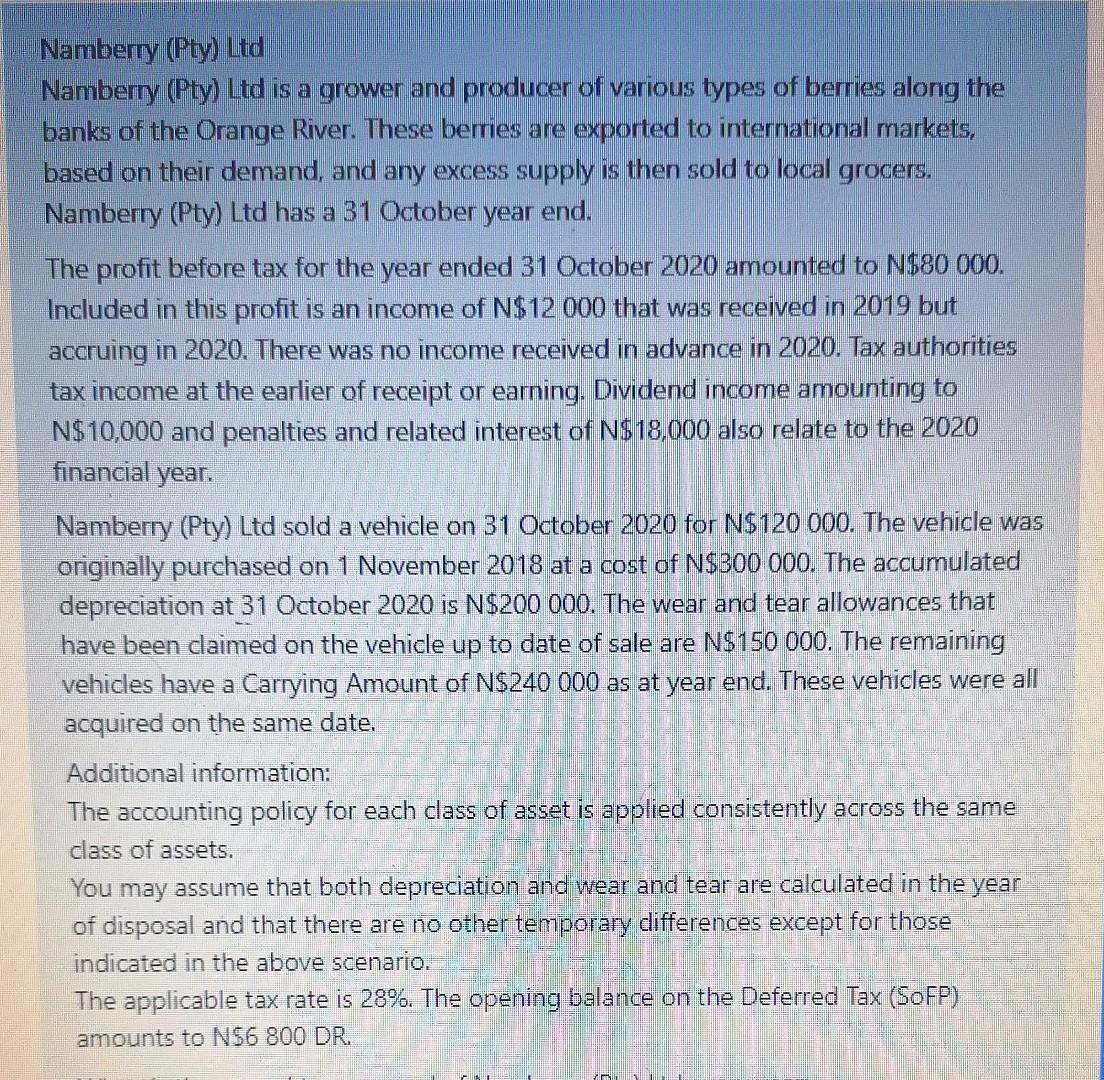

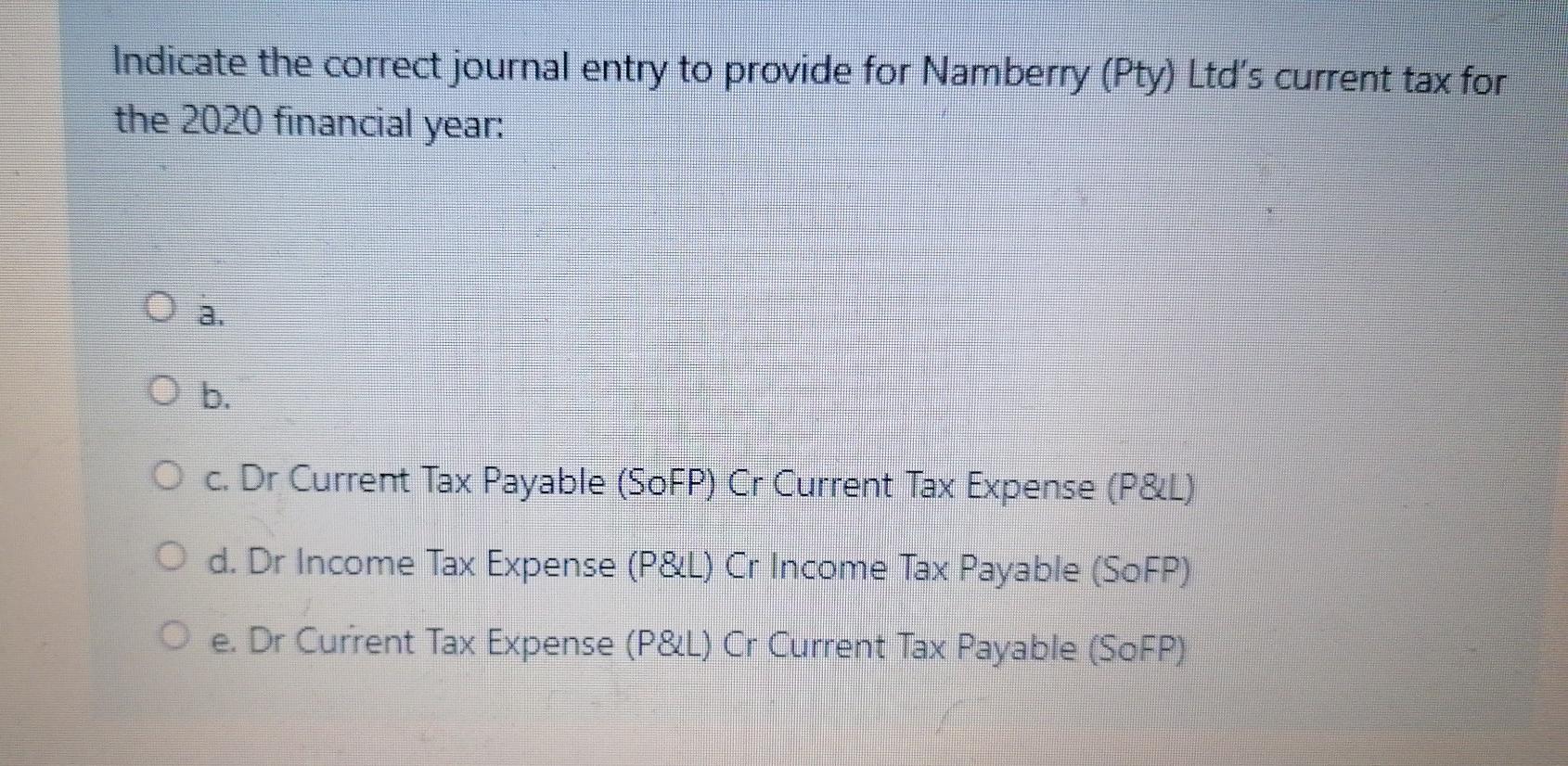

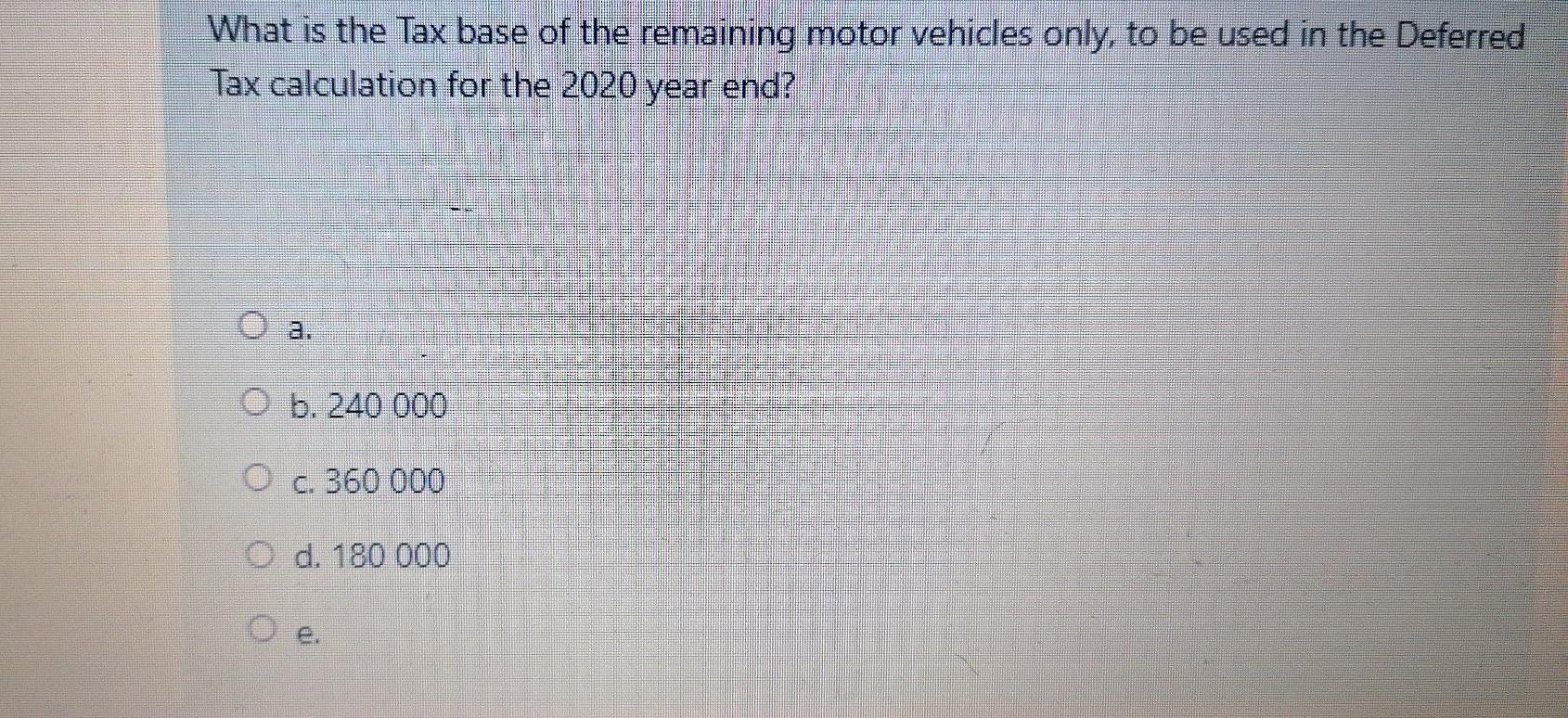

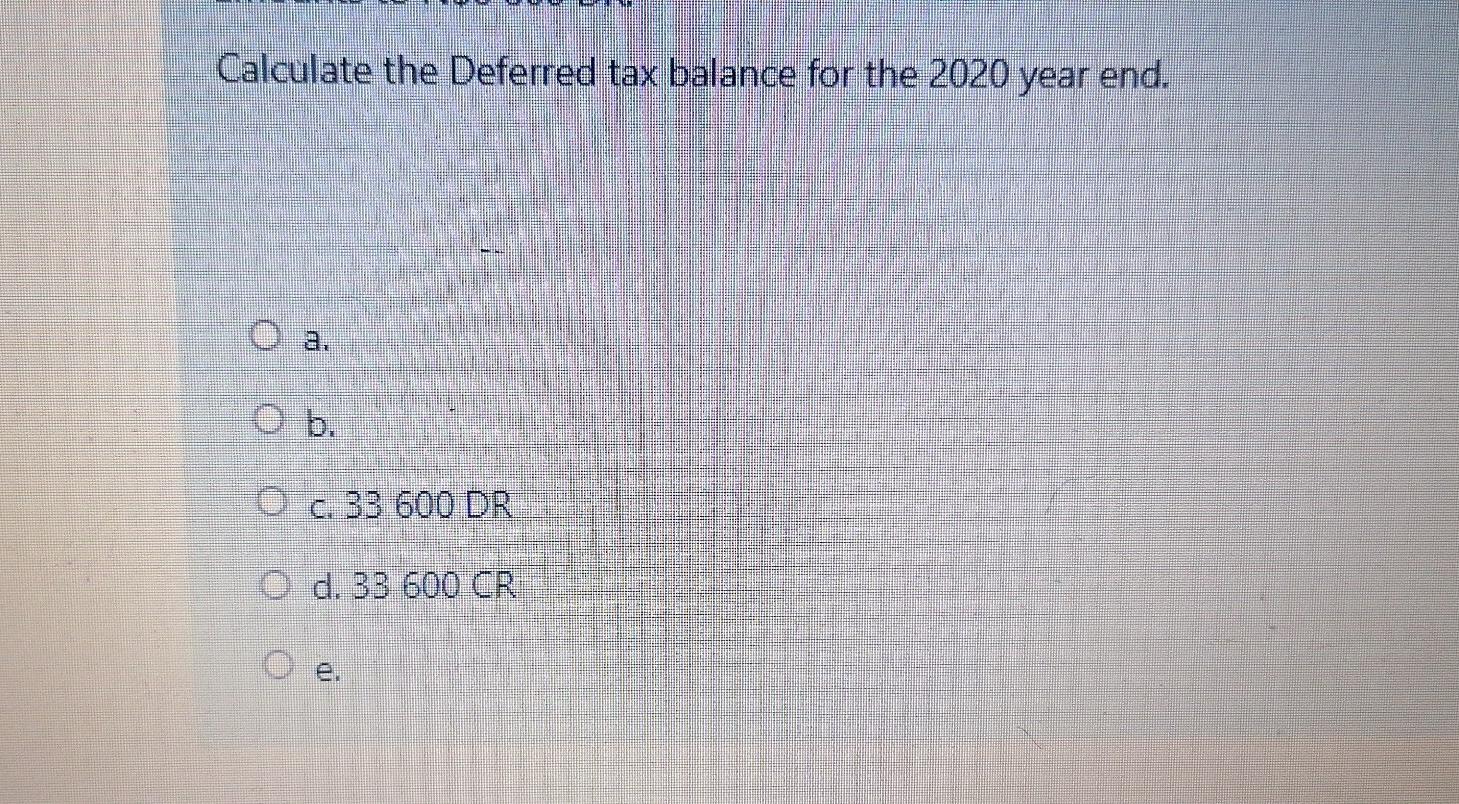

Namberry (Pty) Ltd Namberry (Pty) Ltd is a grower and producer of various types of berries along the banks of the Orange River. These berries are exported to international markets, based on their demand, and any excess supply is then sold to local grocers. Nambery (Pty) Ltd has a 31 October year end. The profit before tax for the year ended 31 October 2020 amounted to N$80 000. Included in this profit is an income of N$12 000 that was received in 2019 but accruing in 2020. There was no income received in advance in 2020. Tax authorities tax income at the earlier of receipt or earning. Dividend income amounting to N$10,000 and penalties and related interest of N$18,000 also relate to the 2020 financial year. Namberry (Pty) Ltd sold a vehicle on 31 October 2020 for N$120 000. The vehicle was originally purchased on 1 November 2018 at a cost of N$300 000. The accumulated depreciation at 31 October 2020 is N$200 000. The wear and tear allowances that have been claimed on the vehicle up to date of sale are N$150 000. The remaining vehicles have a Carrying Amount of N$240 000 as at year end. These vehicles were all acquired on the same date. Additional information: The accounting policy for each class of asset is applied consistently across the same class of assets. You may assume that both depreciation and wear and tear are calculated in the year of disposal and that there are no other temporary differences except for those indicated in the above scenario. The applicable tax rate is 28%. The opening balance on the Deferred Tax (SoFP) amounts to N$6 800 DR. Indicate the correct journal entry to provide for Namberry (Pty) Ltd's current tax for the 2020 financial year: ob. O c. Dr Current Tax Payable (SoFP) Cr Current Tax Expense (P&L) O d. Dr Income Tax Expense (P&L) Cr Income Tax Payable (SoFP) Oe. Dr Current Tax Expense (P&L) Cr Current Tax Payable (SoFP) What is the Tax base of the remaining motor vehicles only, to be used in the Deferred Tax calculation for the 2020 year end? O b. 240 000 O c. 360 000 O d. 180 000 Calculate the Deferred tax balance for the 2020 year end. O a. O c. 33 600 DR O d. 33 600 CR eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started