Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Orange Computer decides to sell a new line of foldable smartphones. The phones will sell for $965 per unit with variable cost of $487 per

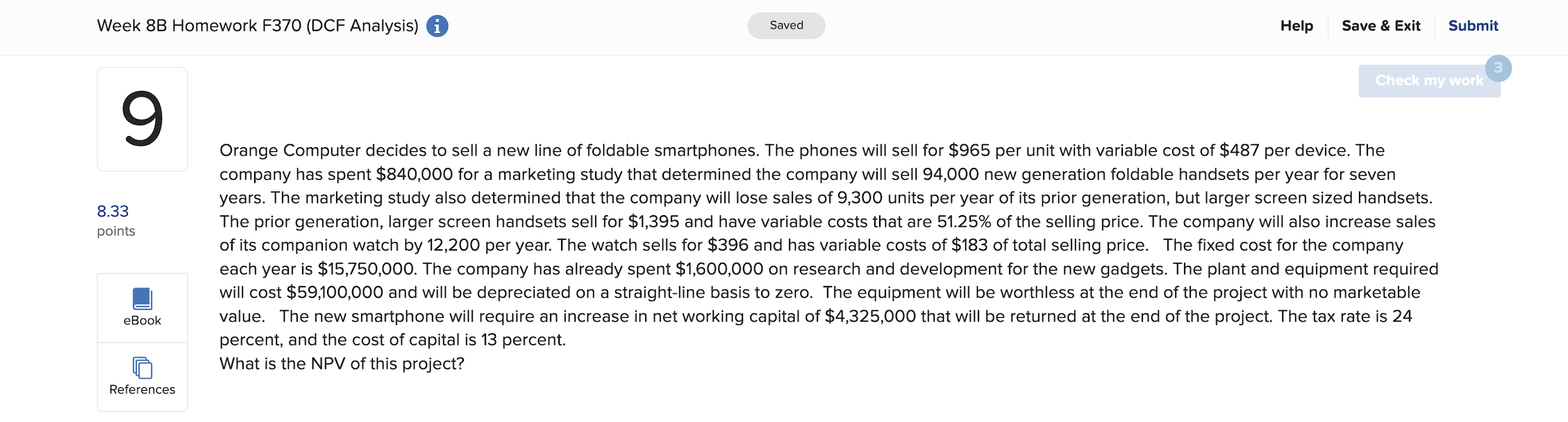

Orange Computer decides to sell a new line of foldable smartphones. The phones will sell for $965 per unit with variable cost of $487 per device. The company has spent $840,000 for a marketing study that determined the company will sell 94,000 new generation foldable handsets per year for seven years. The marketing study also determined that the company will lose sales of 9,300 units per year of its prior generation, but larger screen sized handsets. The prior generation, larger screen handsets sell for $1,395 and have variable costs that are 51.25% of the selling price. The company will also increase sales of its companion watch by 12,200 per year. The watch sells for $396 and has variable costs of $183 of total selling price. The fixed cost for the company each year is $15,750,000. The company has already spent $1,600,000 on research and development for the new gadgets. The plant and equipment required will cost $59,100,000 and will be depreciated on a straight-line basis to zero. The equipment will be worthless at the end of the project with no marketable value. The new smartphone will require an increase in net working capital of $4,325,000 that will be returned at the end of the project. The tax rate is 24 percent, and the cost of capital is 13 percent. What is the NPV of this project

Orange Computer decides to sell a new line of foldable smartphones. The phones will sell for $965 per unit with variable cost of $487 per device. The company has spent $840,000 for a marketing study that determined the company will sell 94,000 new generation foldable handsets per year for seven years. The marketing study also determined that the company will lose sales of 9,300 units per year of its prior generation, but larger screen sized handsets. The prior generation, larger screen handsets sell for $1,395 and have variable costs that are 51.25% of the selling price. The company will also increase sales of its companion watch by 12,200 per year. The watch sells for $396 and has variable costs of $183 of total selling price. The fixed cost for the company each year is $15,750,000. The company has already spent $1,600,000 on research and development for the new gadgets. The plant and equipment required will cost $59,100,000 and will be depreciated on a straight-line basis to zero. The equipment will be worthless at the end of the project with no marketable value. The new smartphone will require an increase in net working capital of $4,325,000 that will be returned at the end of the project. The tax rate is 24 percent, and the cost of capital is 13 percent. What is the NPV of this project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started