Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what are the answers of these questions? If the ______of a bond equals the investment horizon, the investor is immunized against interest rate risk. Yield

what are the answers of these questions?

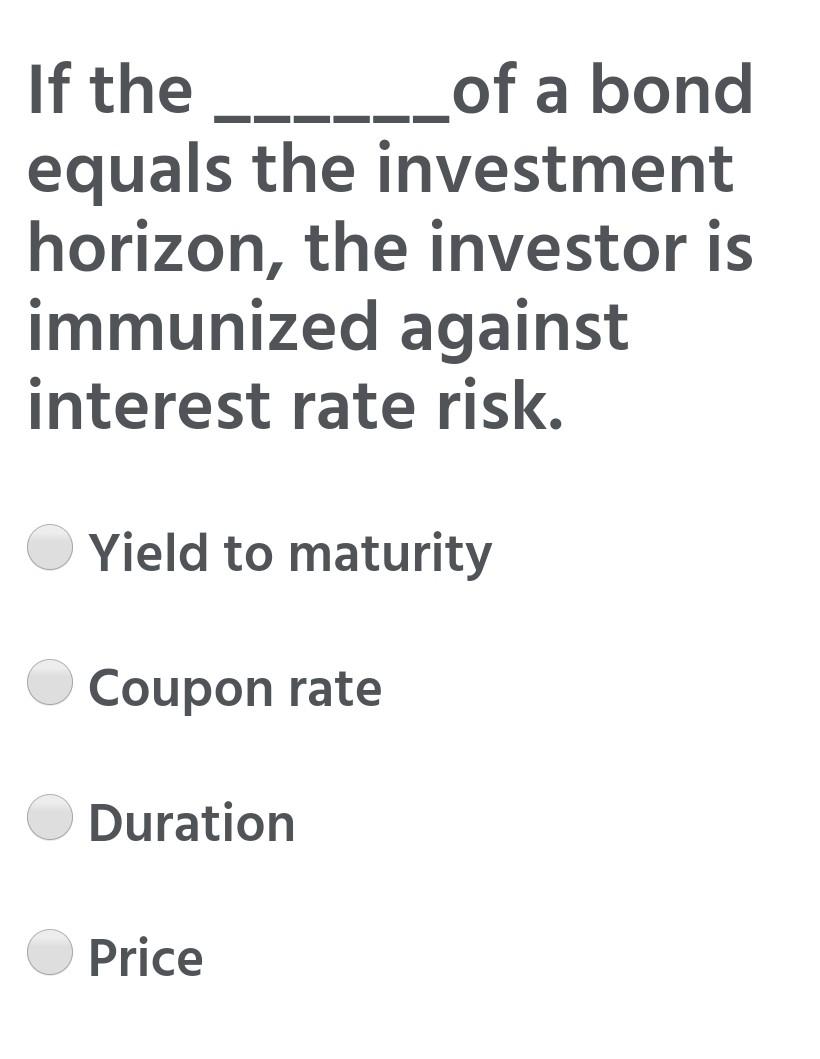

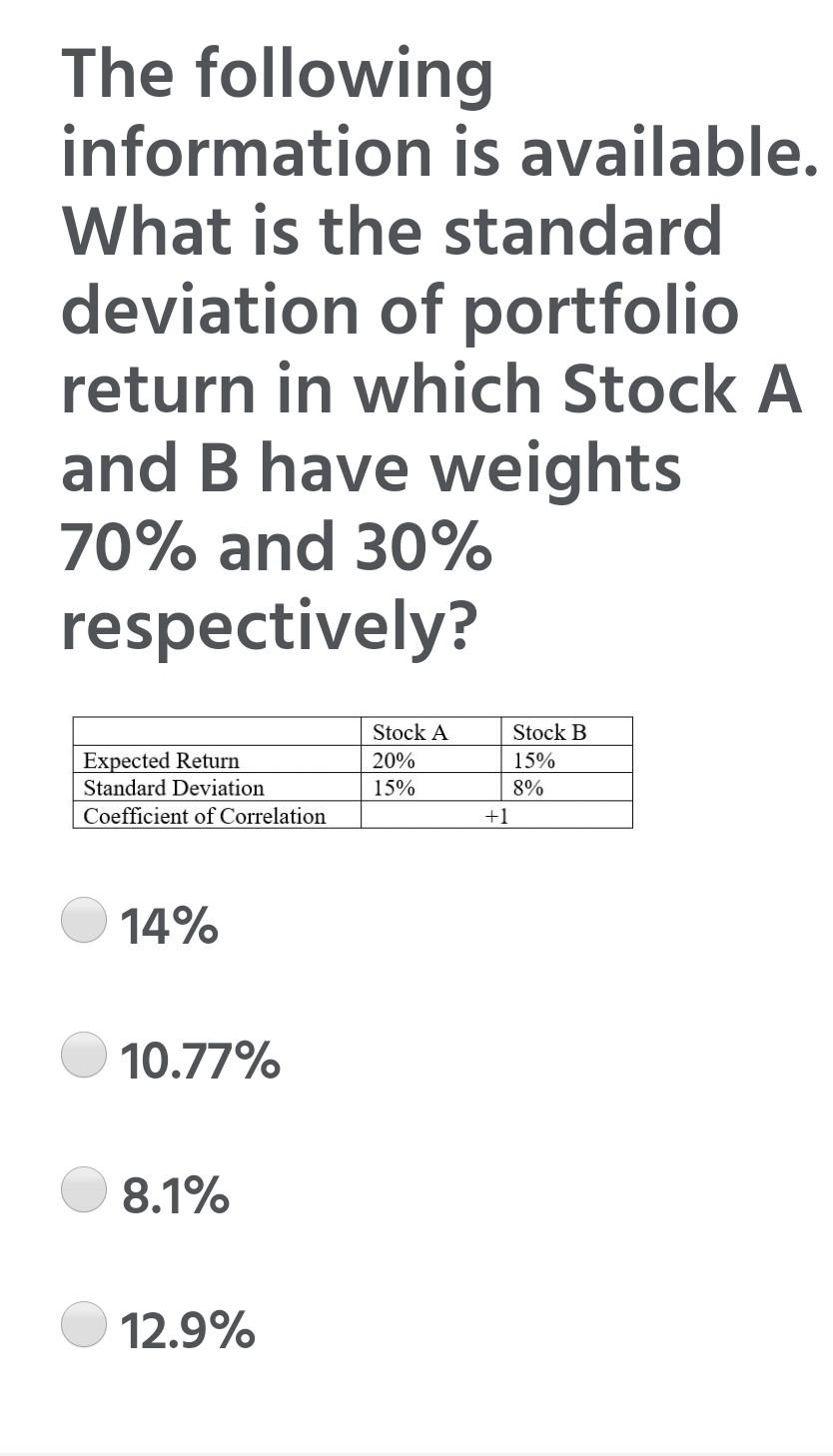

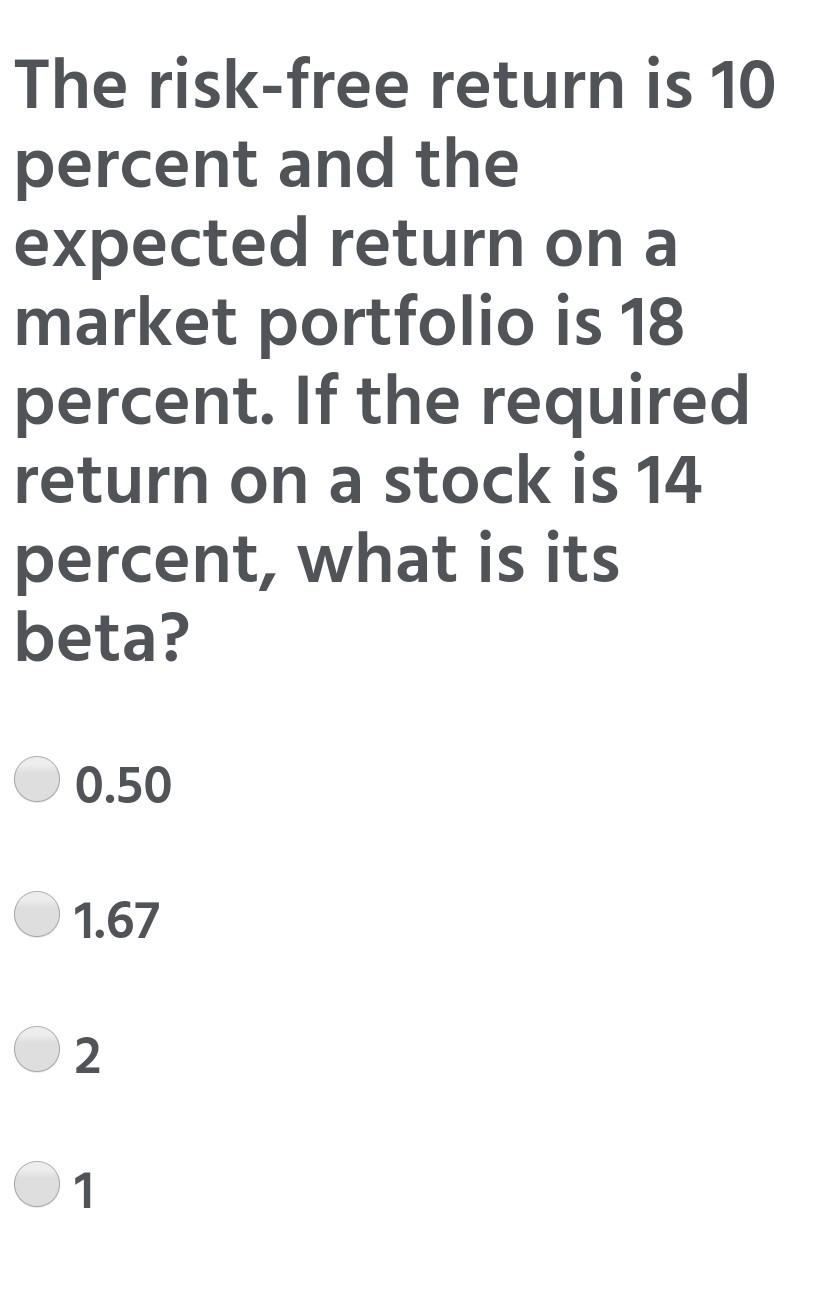

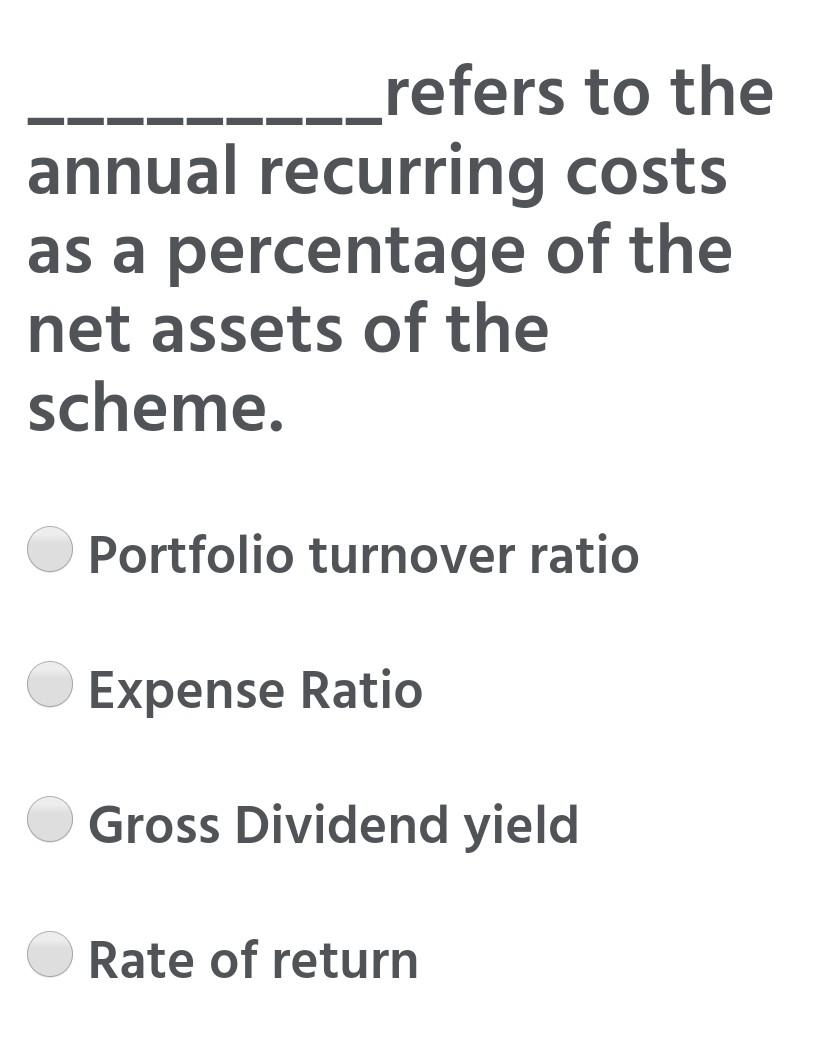

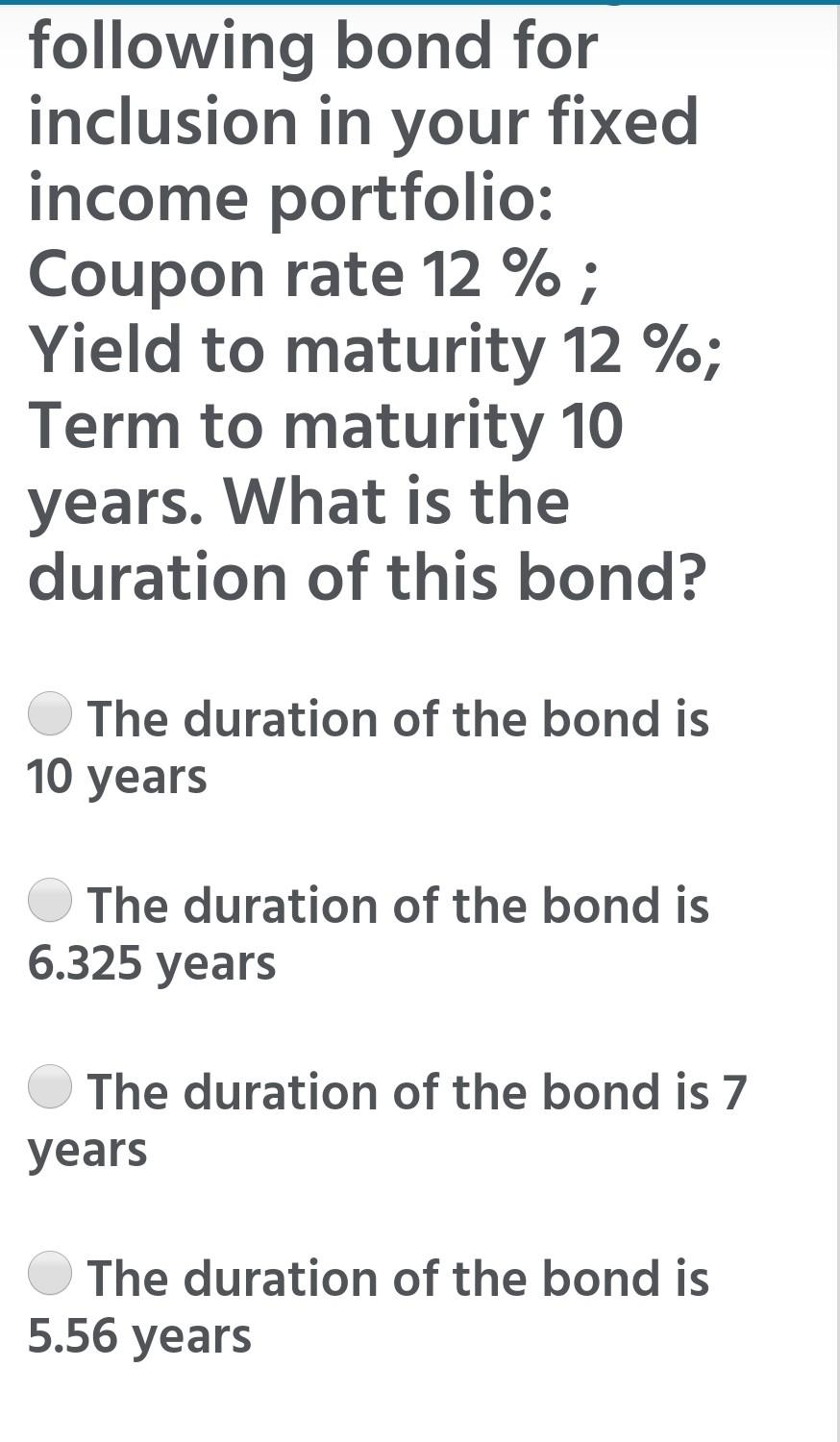

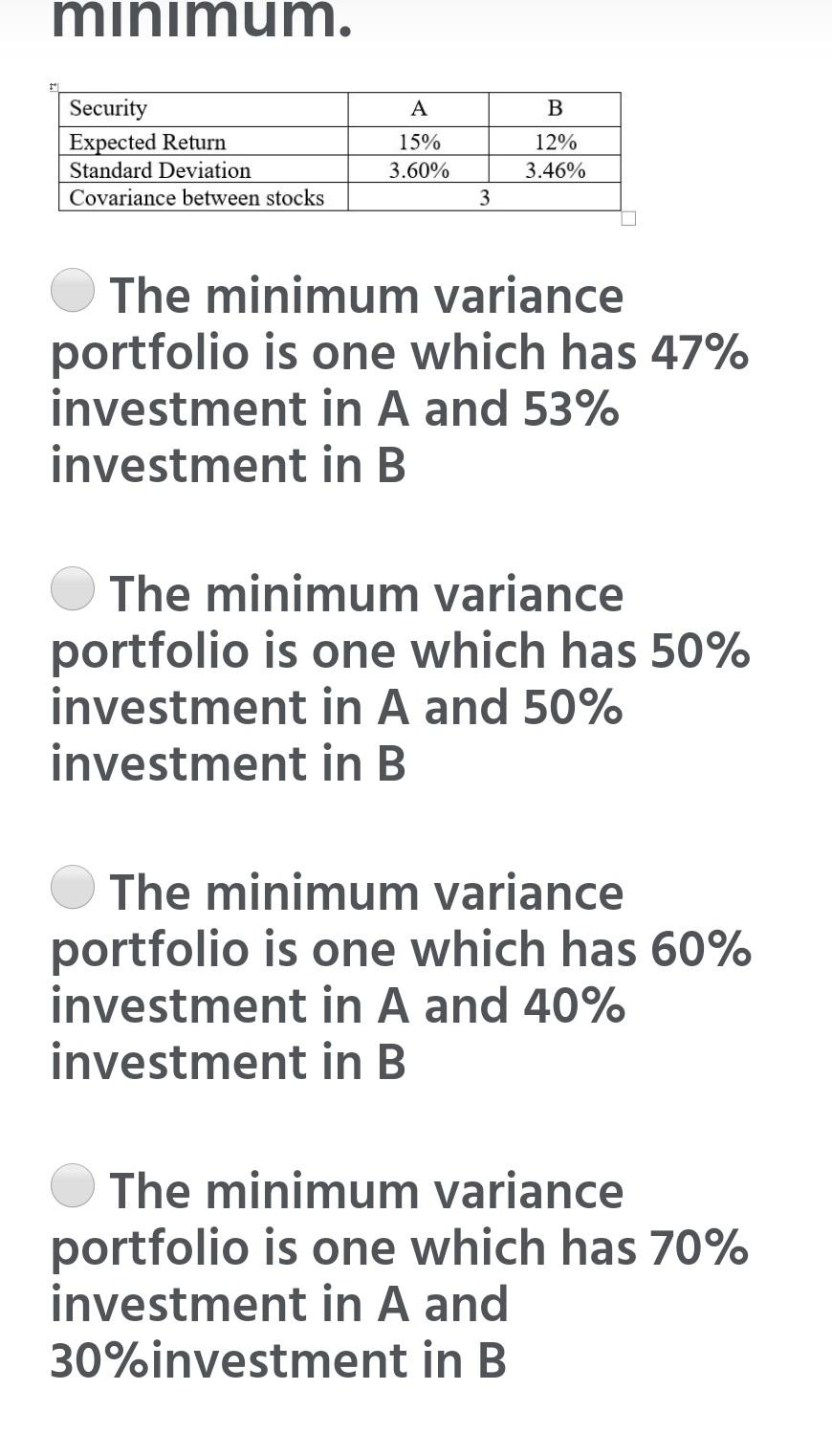

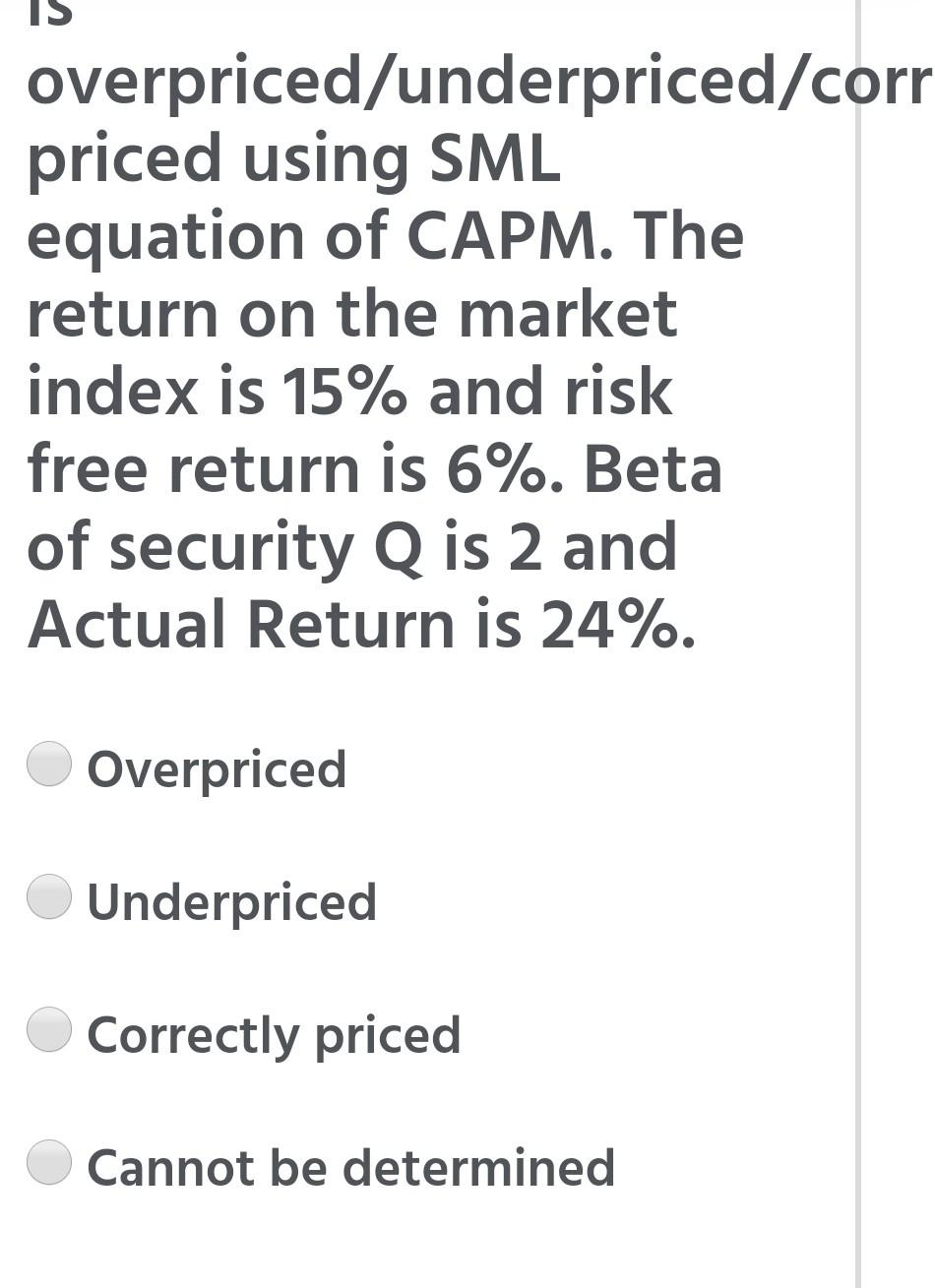

If the ______of a bond equals the investment horizon, the investor is immunized against interest rate risk. Yield to maturity Coupon rate Duration Price The following information is available. What is the standard deviation of portfolio return in which Stock A and B have weights 70% and 30% respectively? Expected Return Standard Deviation Coefficient of Correlation Stock A 20% 15% Stock B 15% 8% +1 14% 10.77% 8.1% 12.9% The risk-free return is 10 percent and the expected return on a market portfolio is 18 percent. If the required return on a stock is 14 percent, what is its beta? 0.50 1.67 2 1 refers to the annual recurring costs as a percentage of the net assets of the scheme. Portfolio turnover ratio Expense Ratio Gross Dividend yield Rate of return following bond for inclusion in your fixed income portfolio: Coupon rate 12 %; Yield to maturity 12 %; Term to maturity 10 years. What is the duration of this bond? The duration of the bond is 10 years The duration of the bond is 6.325 years The duration of the bond is 7 years The duration of the bond is 5.56 years minimum. A B Security Expected Return Standard Deviation Covariance between stocks 15% 3.60% 12% 3.46% 3 The minimum variance portfolio is one which has 47% investment in A and 53% investment in B The minimum variance portfolio is one which has 50% investment in A and 50% investment in B The minimum variance portfolio is one which has 60% investment in A and 40% investment in B The minimum variance portfolio is one which has 70% investment in A and 30%investment in B overpriced/underpriced/corr priced using SML equation of CAPM. The return on the market index is 15% and risk free return is 6%. Beta of security Q is 2 and Actual Return is 24%. Overpriced Underpriced Correctly priced Cannot be determinedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started