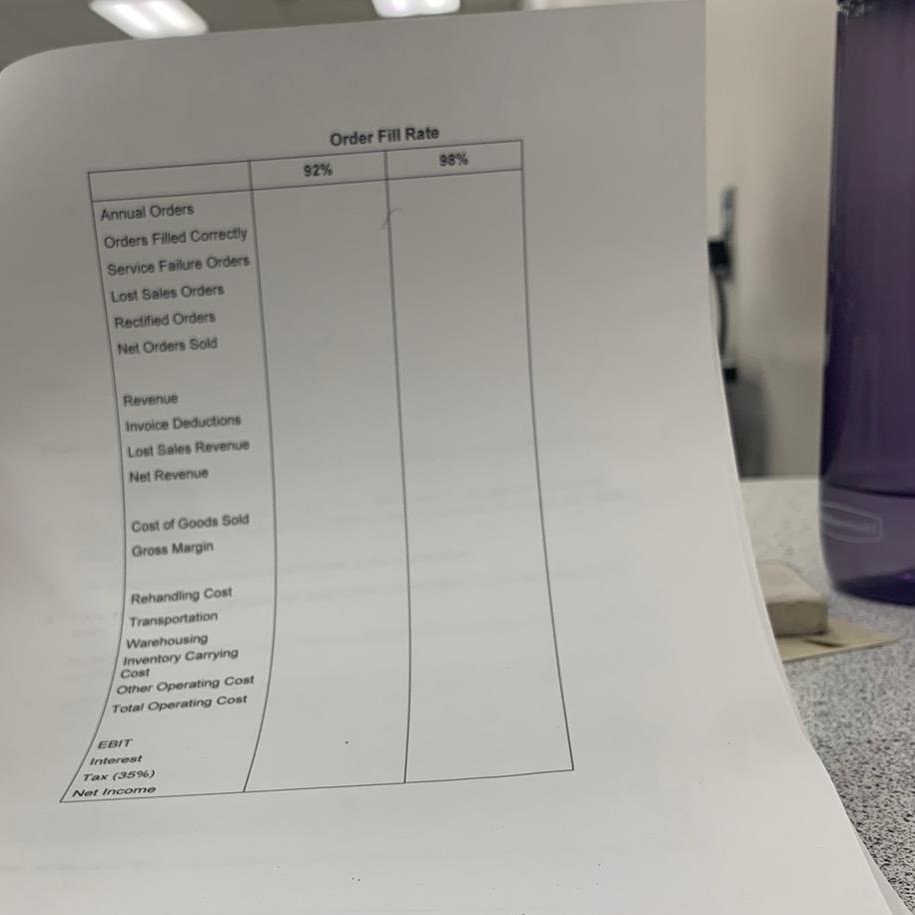

Order Fill Rate 92%% 98% Annual Orders Orders Filled Correctly Service Failure Orders Lost Sales Orders Rectified Orders Net Orders Sold Revenue Invoice Deductions Lost Sales Revenue Net Revenue Cost of Goods Sold Gross Margin Rehandling Cost Transportation Warehousing Inventory Carrying Cost Other Operating Cost Total Operating Cost EBIT Interest Tax (3596) Net IncomeColleen Starky never thought she would be able to sell paper products to consumers on the Internet. However, after five years in business Paper2Go.com has reached $75 million in revenue. Paper2Go specializes in shipping paper-related products to consumers, including diapers, paper towels, and facial tissue from numerous suppliers. Because these items have a low margin, Colleen knows she needs to control costs and at the same time have high service levels. Paper2Go receives 500,000 orders annually with an average revenue per order of $150 and an average profit per order of $90. Paper2Go's current order fill rate is 92 percent. Colleen estimates that of the orders not filled correctly or completely, 15 percent of the customers cancel their orders and 85 percent will accept a reshipment of the correct/unfilled items. This rehandling costs Paper2Go $15 per order and is only applicable on the reshipped orders. In an effort to retain customers, Paper2Go reduces the invoice value of rehandled orders by $30. Paper2Go pays $2.500,000 for transportation, both inbound to and outbound from its warehouses. Its warehousing costs are $1,950,000 annually. Paper2Go has $40 million of debt at an annual interest rate of 12 percent. Other operating costs are $1 million per year and Paper2Go maintains $100,000 in cash at all times. Paper2Go has an average inventory of $6.7 million. This level of inventory is necessary to help fill consumer orders correctly the first time. The inventory carrying cost rate is 30 percent of the average inventory value per year. Its accounts receivable averages $350,000 per year. Paper2Go owns three warehouses that are valued in total at $85.7 million. The net worth of Paper2Go is $45 million. Colleen has decided that a 92 percent order fill rate is not acceptable in the market and lost customers and rehandled orders are negatively affecting profits. She has decided to invest $1 million in a new stock locator system for the warehouses, increase inventories by 10 percent and increase the on-time delivery of inbound shipments by contracting with a new carrier. This carrier upgrade will increase total transportation costs by 10 percent. Colleen hopes these changes will increase the order fill rate to 98 percent. Paper2Go faces a current tax rate of 35%. (20 pts.) You are the logistics analyst at Paper2Go.com and have been asked to do the following: a. Calculate the financial impact of increasing order fill rates to 98 percent from 92 percent. (Complete the table below.) b. Calculate asset turnover, return on assets (ROA), inventory turns, and return on equity (ROE) for both the old system and the modified system. Do you think it is worth investing in the new system