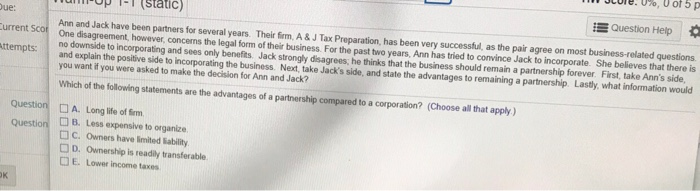

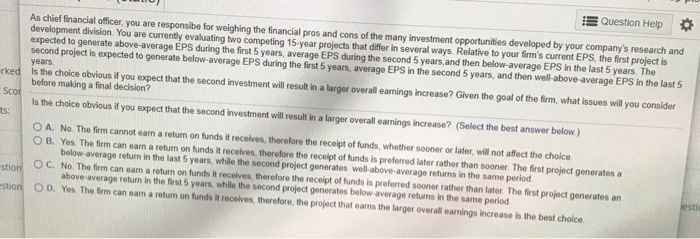

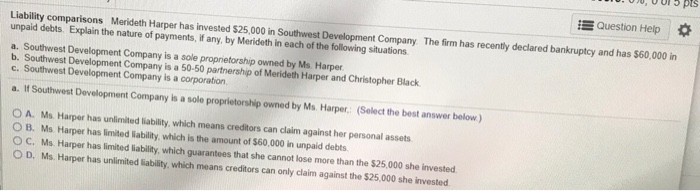

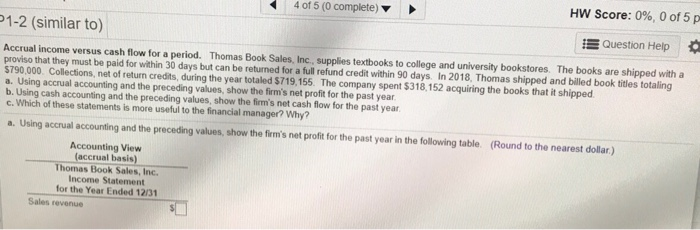

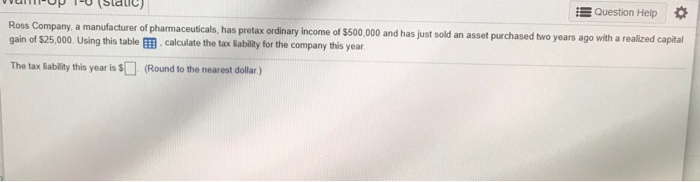

ore. 076, 00t 5 p p (static) i Question Hep * ue: urrent Sco ttempts: Ann and Jack have been partners for several years. Their fim, A & J Tax Preparation, has been very successful, as the pair agree on most business-related questions e disagreement, however, concerns the legal form of their business. For the past two years. Ann has tried to convince Jack to incorporate. She beleves that there is ees, he thinks that the business should remain a partnership forever. First, take Ann's side, the positive side to incorporating the business. Next, take Jack's side, and state the advantages to remaining a partnership Lasly, what information would no downside to incorporating and sees only benefits. Jack strongly disagr and ex you want if you were asked to make the decision for Ann and Jack? of the following statements are the advantages of a partnership compared to a corporation? (Choose all that apply) A, Long life offim Question n B. Less expensive to organize. C. Owners have limited Sability D D. Ownership is readily transferable E. Lower income taxes OK Question Help * As chief financial officer, you are responsibe for weighing the financial pros and cons of the many investment opportunities developed by your company's research and development division. You are currently evaluating two competing 15-year projects that differ in several ways. Relative to your firm's current EPS, the first project is expected to generate above-average EPS during the first 5 years, average EPS during the second 5 years,and then below-average EPS in the last 5 years. The years second project is expected to generate below-average EPS during the first 5 years, average EPS in the second 5 years, and then well-above-average EPS in the last 5 rked is the choice obvious i you expect that the second investment will eslit i a larger overalil carnings increase? Given the goal of the frm, what issues willyou consider before making a final decision? is the choice obvious if you expect that the second Investment will i lrer overall anings increase? (Select the best answer below) ts: No The firm cannot earn a return on funds it receives, therefore the receipt of funds, whether sooner or later, wnot affect the choice. below-average return in the last 5 years, while the second project generates well-above-average returns in the same period above-average return in the frst 5 years, while the second project generates below-average returns in the same period 0 A. O B. Yes. The frm can earn a return on funds it recelves, therefore the receipt of funds is preferred later rather than sooner. The first project generates a c. No The firm can earn a return on funds t receives therefore the receipt of funds is preferred sooner rather than late. The OD. Yes. The fim can ean a retun on funds iR recelves, therefore, the project that earns the larger overall earnings increase is the best choice rst project generates an stion Question Help * per has invested $25,000 in Southwest Development Company The firm has recently declared bankruptcy and has $60,000 in unpaid debts. Explain the nature of payments, if any, by Merideth in each of the following situations a. Southwest Development Company is a sole proprietorship owned by Ms. Harper b. Southwest Development Company is a 50-50 partnership of Merideth Harper and Christopher Black a If Southwest Development Company is a sole proprietorship owned by Ms Harper. (Selecthe best answer below) O A. Mo Harper has unlimited liability, which means creditors can dlaim against her personal assets O B. Ms Harper has limited liability, which is the amount of $60,000 in unpaid debts O C. Ms Harper has limited liability, which guarantees that she cannot lose more than the $25,000 she invested O D. Ms Harper has unlimted sability wWhich means credtors can only caim against he $25,00 she invested 4 015 (0 complete) HW Score: 0%, 0 of 5 p 1-2 (similar to) E Question Help Accrual income versus cash flow for a period. Thomas Book Sales, Inc., supplies textbooks to college and university bookstores. The books are shipped with a proviso that they must be paid for within 30 days but can be returned for a full refund credit within 90 days In 2018, Thomas shipped and billed book titles totaling $790,000 Collections, net of return credits, during the year totaled $719,155. The company spent $318,152 acquiring the books that it shipped a. Using accrual accounting and the preceding values, show the firm's net profit for the past year b. Using cash accounting and the preceding values, show the firm's net cash flow for the past year c. Which of these statements is more useful to the financial manager? Why? a. Using accrual accounting and the preceding values, show the firm's net profit for the past year in the following table. (Round to the nearest dollar.) Accounting View (acerual Thomas Book Sales, Inc Income Statement for the Year Ended 12/31 Sales revenue i Question Help * has just sold an asset purchased two years ago with a realized capital OP T- (slaic Ross Company, a manufacturer of pharmaceuticals, has pretax ordinary income of 5000 and has just sold an asset purchased two gain of $25,000. Using this table E calculate the tax Babilly for the company this y The tax iability this year is s(Round to the nearest dollar.)