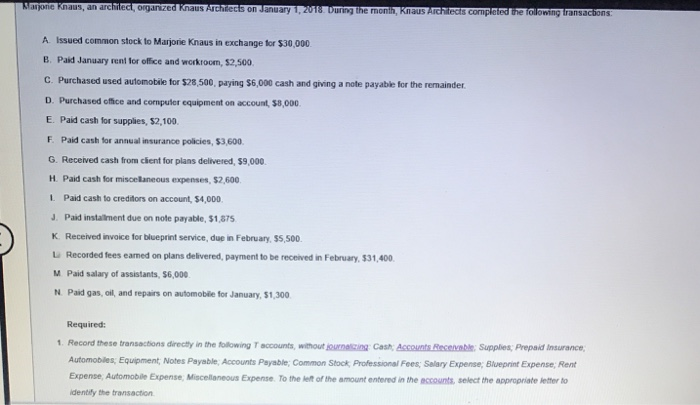

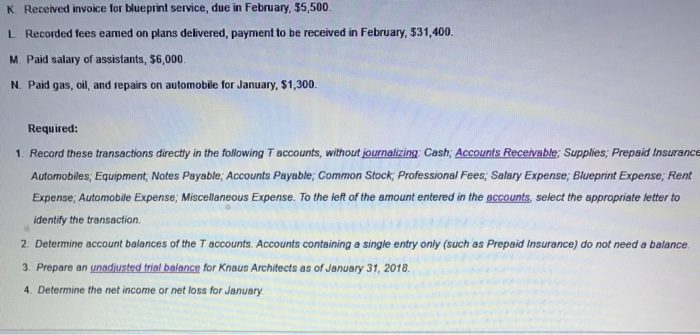

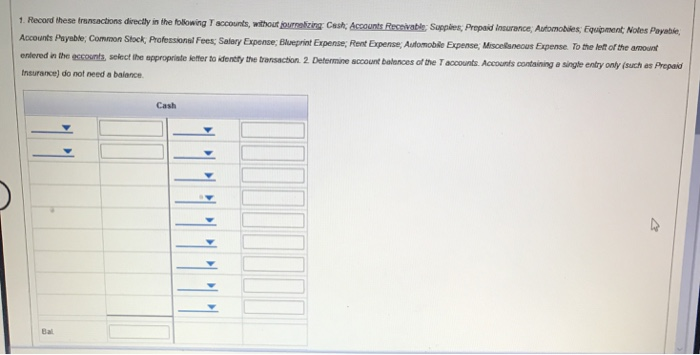

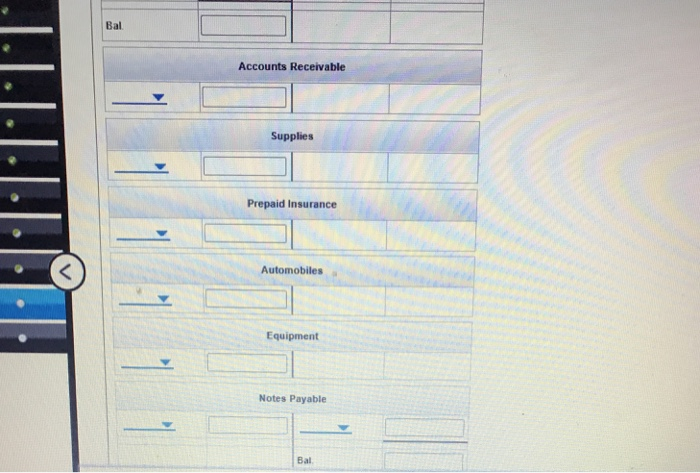

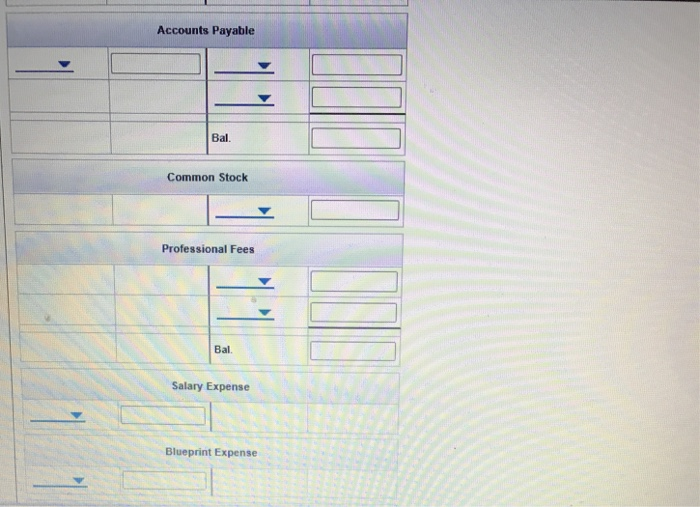

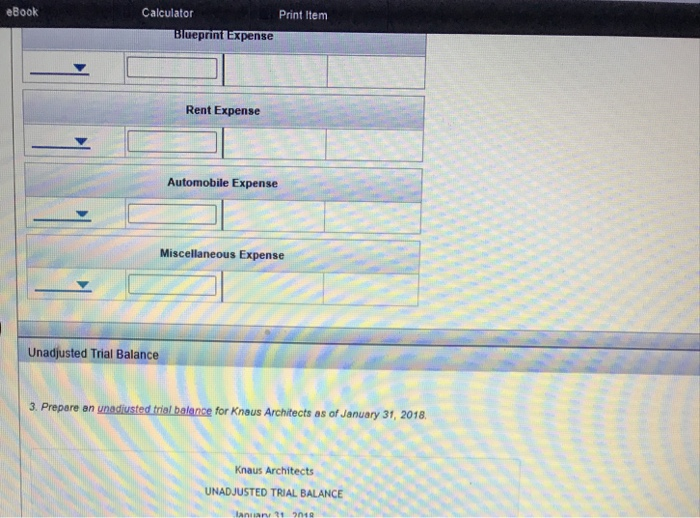

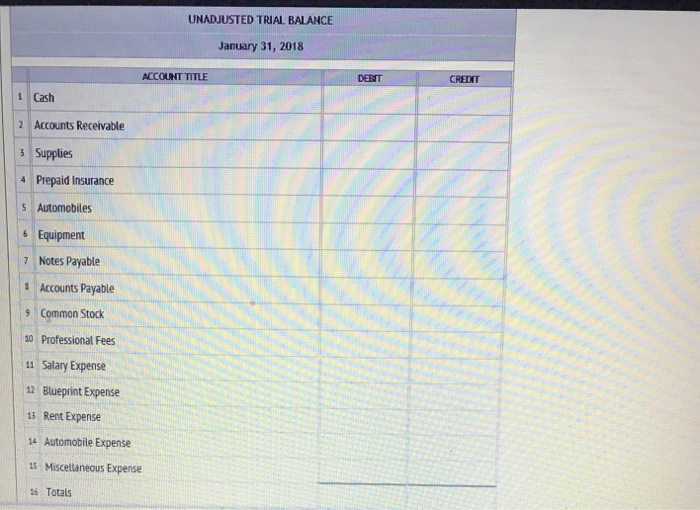

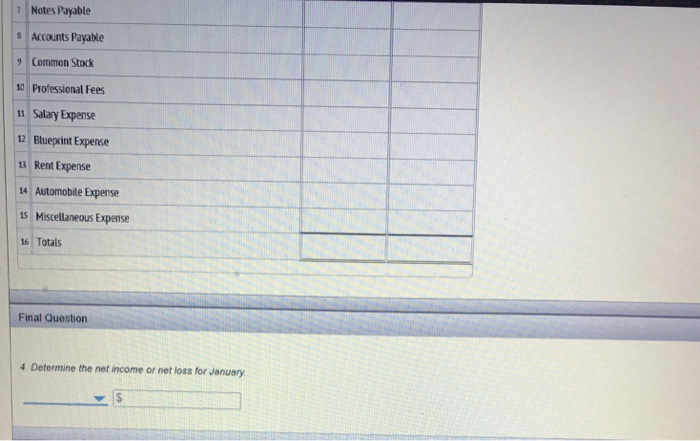

organzed Knaus Archrects on January 1, 2018 Duing the month, Knaus Architects completed the following transactions A Issued common stock to Marjorie Knaus in exchange for $30,000 B. Paid January rent for office and workroom, $2,500 C Purchased used automobile for $28,500, paying $6,000 cash and gi ng a note payable for the remainder D. Purchased ofice and cormputer equipment on account, $8,000 E. Paid cash for supplies, $2,100 F. Paid cash for annual insurance policies, $3,600 G. Received cash from clent for plans delivered, $9,000 H. Paid cash for miscelaneous expenses, $2,600 1. Paid cash to creditors on account, $4,000 J. Paid instalment due on note payable, $1,875 K. Received invoice for blueprint service, due in February, SS,500 L Recorded fees earmed on plans delivered, payment to be received in February, $31,40o M Paid salary of assistants, $6,000 N Paid gas, oil, and repairs on automobile for January, $1,300 Required: 1 Record these transactions directly in the following T accounts, without journeszing Cash, Accounts Recenmble: Supplies; Prepaid Insurance Automobiles, Equipment, Notes Payable, Accounts Payable Common Stock Professional Fees: Selary Expense; Blueprint Expense, Rent Expense, Automobile Expense, Miscelleneous Expense. To the lelt of the amount entered in the eccounts, select the appropriate letter o dentily the transaction K. Received invoice for blueprint service, due in February, $5,500 L Recorded fees eamed on plans delivered, payment to be received in February, $31,400. M. Paid salary of assistants, $6,000 N. Paid gas, oil, and repairs on automobile for January, $1,300 Required 1. Record these transactions directy in the following T accounts, without journalizing Cash, Accounts Receivable; Supplies; Prepaid Insurance Automobiles; Equipment, Notes Payable; Accounts Payable; Common Stock, Professional Fees; Salary Expense,; Blueprint Expense; Rent Expense; Automobile Expense; Miscellaneous Expense. To the left of the amount entered in the sccounts, select the appropriate letter to identify the transaction. 2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance 3. Prepare an unadjusted trial balance for Knaus Architects as of January 31, 2018. 4. Determine the net income or net loss for January Bal Accounts Receivable Supplies Prepaid Insurance Automobiles a Equipment Notes Payable Bal eBook Calculator Print Item Rent Expense Automobile Expense Miscellaneous Expense Unadjusted Trial Balance 3. Prepare an unadiusted triel balance for Knaus Architects as of January 31, 2018. Knaus Architects UNADJUSTED TRIAL BALANCE UNADJUSTED TRIAL BALANCE January 31, 2018 ACCOUNT TITLE DEENT CREDIT 1 Cash 2 Accounts Receivable 3 Supplies Prepaid Insurance S Automobiles 6 Equipment 7 Notes Payable 8 Accounts Payable 9 Common Stock 10 Professional Fees 11 Salary Expense 12 Blueprint Expense 13 Rent Expense 14 Automobile Expense 15 Miscellaneous Expense 16 Totals