Question

Original problem and it's answer (background, supporting information): Middleton Classics, a chain of exclusive furniture stores, is considering renting space in a new shopping mall.

Original problem and it's answer (background, supporting information):

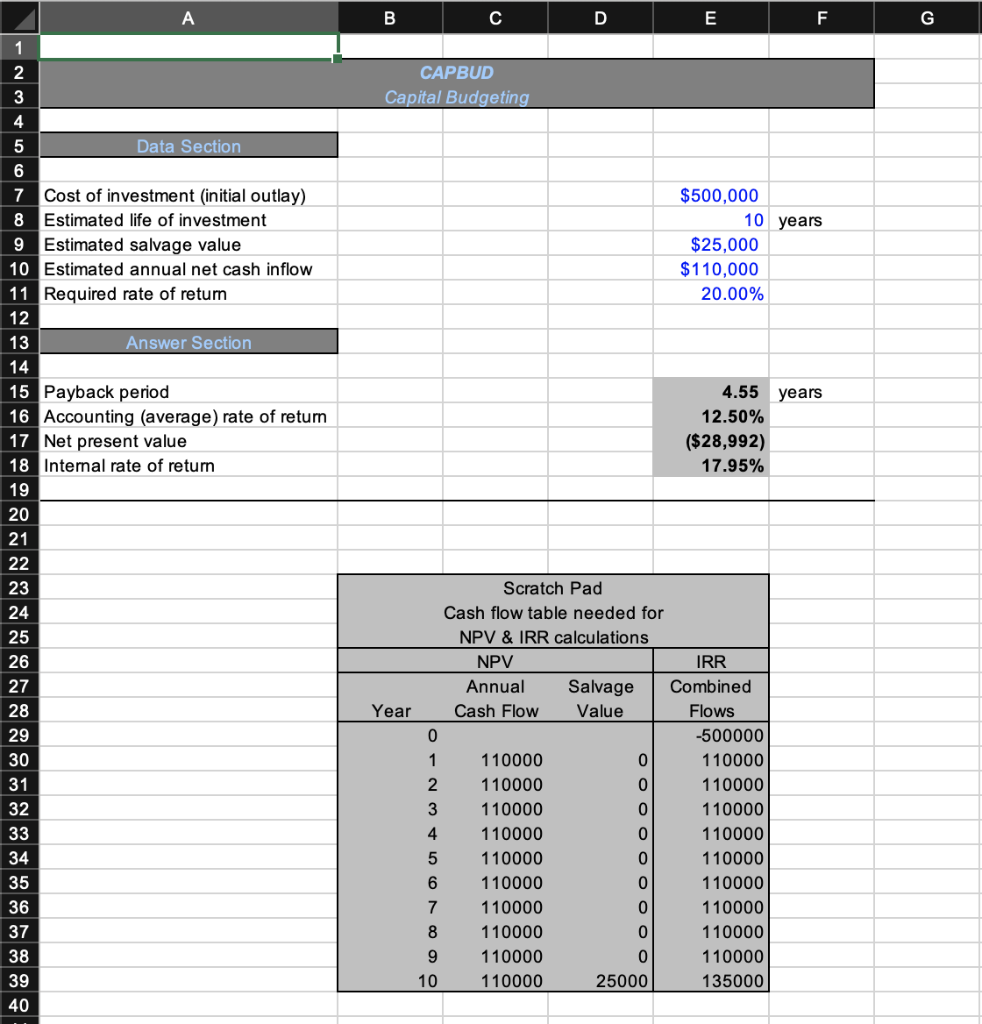

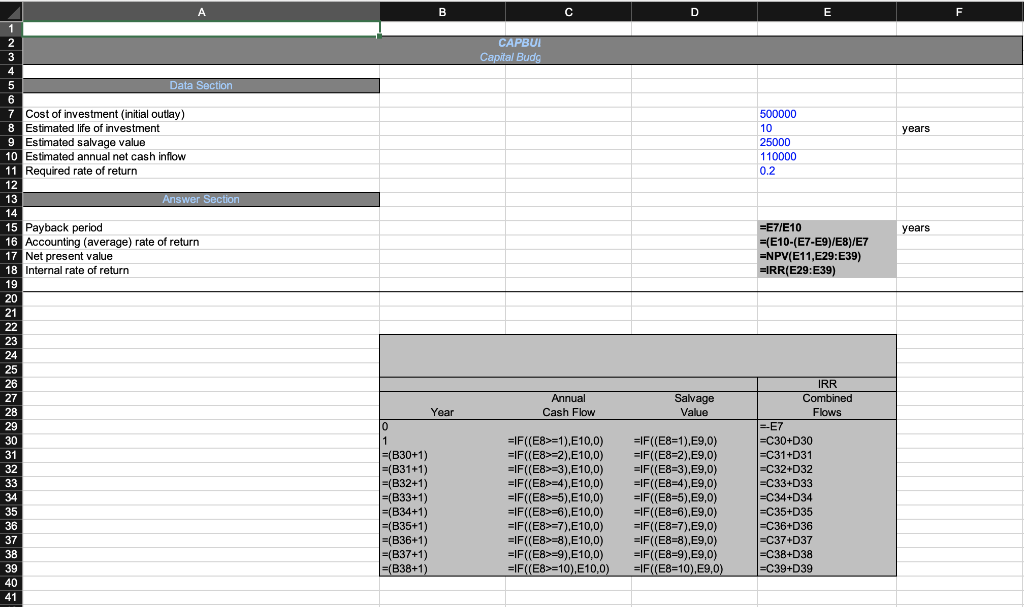

Middleton Classics, a chain of exclusive furniture stores, is considering renting space in a new shopping mall. It is anticipated that this rental will require an investment in fixtures and equipment costing $500,000, with an estimated salvage value of $25,000 at the end of its useful life in ten years. The new store is expected to generate an annual net cash flow of $110,000. The owner desires a 20% annual return on investment and wants a payback period of less than four years. Ignore the impact of taxes. Enter the formulas in excel:

Where I'm currently at and need help with (the follow-up question I need help with):

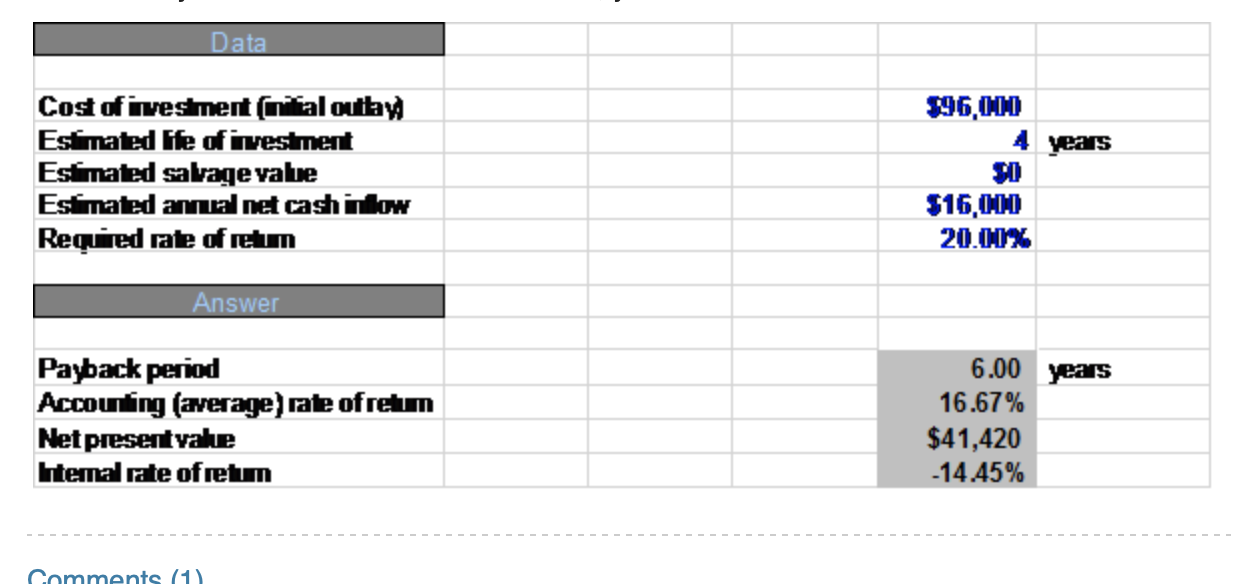

Middleton Classics is also considering to introduce a computerized interior design service. The company will have to spend $74,000 for equipment, $6,000 for installation, and $16,000 for testing. The equipment will have no salvage value at the end of four years. Estimated annual results for the project are:

| Service Fees | $106,000 | |

| Expenses other than depreciation | $66,000 | |

| Depreciation (straight line) | 24,000 | 90,000 |

| Net Income | $16,000 | |

Enter the new information in the data section of the excel worksheet. Please show the formulas you use.

Apparently this is the correct answer is below, but I'm not sure how they got it. I get -8.33% for Accounting (average) rate of return and ($45,484) for Net present value because of the formulas in place from the original question. How do I get this answer, if it's the correct one? Please show formulas as well.

B D E F G 1 2 3 4 5 CAPBUD Capital Budgeting Data Section $500,000 10 years $25,000 $110,000 20.00% 4.55 years 12.50% ($28,992) 17.95% 7 Cost of investment (initial outlay) 8 Estimated life of investment 9 Estimated salvage value 10 Estimated annual net cash inflow 11 Required rate of return 12 13 Answer Section 14 15 Payback period 16 Accounting (average) rate of return 17 Net present value 18 Internal rate of retur 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Scratch Pad Cash flow table needed for NPV & IRR calculations NPV IRR Annual Salvage Combined Year Cash Flow Value Flows 0 -500000 1 110000 0 110000 2 110000 0 110000 3 110000 0 110000 4 110000 0 110000 5 110000 0 110000 6 110000 0 110000 7 110000 0 110000 8 110000 0 110000 9 110000 0 110000 10 110000 25000 135000 A B D E F CAPBUI Capital Budg years 500000 10 25000 110000 0.2 years =E7/E10 =(E10-(E7-E9)/E8)/E7 =NPV(E11, E29:E39) EIRR(E29:E39) 2 3 4 5 Data Section 6 Cost of investment initial outlay) 8 Estimated life of investment 9 Estimated salvage value 10 Estimated annual net cash inflow 11 Required rate of return 12 13 Answer Section 14 15 Payback period 16 Accounting (average) rate of return 17 Net present value 18 Internal rate of return 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 Annual Cash Flow Salvage Value Year 0 1 =(B30+1) =(B31+1) 1=(B32+1) =(B33+1) =(B34+1) =(B35+1) =(B36+1) =(B37+1) =(B38+1) =IF((E8>=1),E10,0) =IF((E8>=2).E10,0) =IF((E8>=3),E10,0) =IF ((E8>=4),E10,0) =IF((E8>=5),E10,0) =IF((E8>=6).E10,0) =IF((E8>=7),E10,0) =IF((E8>=8),E10,0) =IF((E8>=9),E10,0) =IF((E8>=10), E10,0) =IF((E8=1),E9,0) =IF((E8=2),E9,0) =IF((E8=3),E9,0) =IF((E8=4),E9,0) =IF((E8=5),E9,0) =IF((E8=6),E9,0) =IF((E8=7),E9,0) =IF((E8=8),E9,0) =IF((E8=9),E9,0) =IF((E8=10), E9,0) IRR Combined Flows -E7 =C30+D30 =C31+D31 =C32+D32 =C33+D33 =C34+D34 =C35+D35 =C36+D36 =C374037 =C38+D38 =C39+D39 Data $96,000 4 years Cost of investment (ritalouttay Estimated life of investment Estimated savage vale Estimated amanet cash intow Required rate of retum $16.000 20.00% Answer Payback period Accounting (average rate of retum Net presentyale Intemal rate ofretum 6.00 years 16.67% $41,420 -14.45% Comments (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started