Answered step by step

Verified Expert Solution

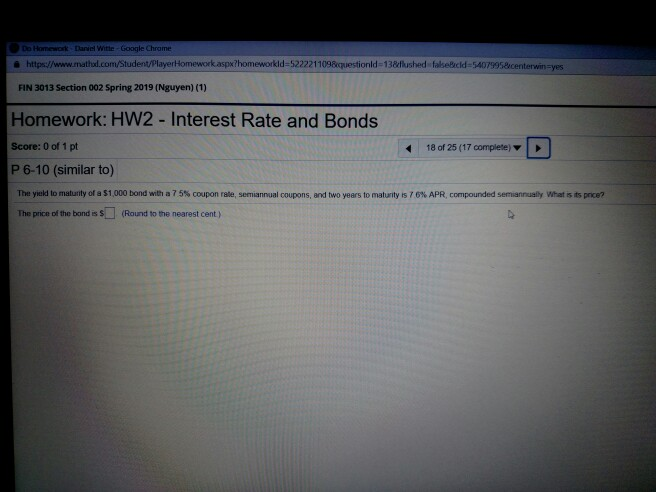

Question

1 Approved Answer

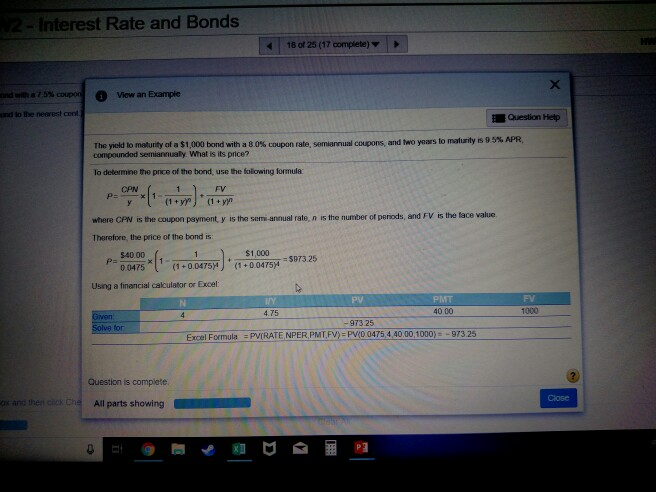

Original problem This is the explanation on how to work the problem but I don't understand how they get the value for the CPN or

Original problem

This is the explanation on how to work the problem but I don't understand how they get the value for the CPN or the I/y

if someone could please show/explain this to me I would really appreciate it. thank you.

o Homework Dariel Witte Google Chrame e https://www.mathod.com/Student/PlayerHomework aspx?homeworkld-522221109questionld-13&flushed falseBbcld-54079958icenterwin-yes FIN 3013 Section 002 Spring 2019 (Nguyen) (1) Homework: HW2 Interest Rate and Bonds Score: 0 of 1 pt P 6-10 (similar to) The yeld tomat rity of a s 1,000 bond with a 7 5% coupon ra e, sem annual coupons, and two years to maturity is 7 6% APR, compounded sem anna y whats ts por? The price of the bond is s Round to the nearest cent) 418 of 25 (17 complete) , 2-Interest Rate and Bonds 418 of 25 (17 complete) ond with a t5% copo View an Example nd lo the neerest cont Question Help They d to maturity of a 1 000 ondwitha l 0% coupun rate, sem annual capons, compounded semiannualy. What is its price? and two years to maturity is 95% APR. To determine the price of the bond, use the following formula FV where CPN is the coupon payment, y is the sami-annual rate, n is the number of periods, and FV is the lace value Tharefore, the price of the bond is 000T 0758) 890097 10/3.2 $1,000873 25 (1+00475)4 540.00 !' (1 + 0.0475)) Using a financial calculator or Excel: I/Y 4.75 PMT 40 00 FV 1000 PV 973 25 PVIRATE NPER PMIFV)- PV 0 0475 4,40 001000)-973 25 Excel Formula Question is complete. Close ox and then cl he All parts showingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started