Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oriole Company sponsors a defined benefit pension plan for its employees. The following data relate to the Your answer is correct. Determine the amounts of

Oriole Company sponsors a defined benefit pension plan for its employees. The following data relate to the Your answer is correct.

Determine the amounts of the components of pension expense that should be recognized by the company

in Enter amounts that reduce pension expense with either a negative sign preceding the number eg or

parenthesis eg

Components of Pension Expense

Interest on Projected Benefit Obligation

Expected Return on Plan Assets

Amortization of Prior Service Cost

Pension Expense

$

$

eTextbook and Media Your answer is correct.

Prepare the journal entry to record pension expense and the employer's contribution to the pension trustee in

Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required,

select No entry" for the account titles and enter for the amounts. List all debit entries before credit entries.

Account Titles and Explanation

Debit

Credit

Pension Expense

Pension AssetLiability

Other Comprehensive Income PSC Indicate the amounts that would be reported on the income statement for the year

ORIOLE COMPANY

Income Statement Partial

For the Year Ended December

Other Comprehensive Income GL

$

Accumulated Other Comprehensive Income GL

$

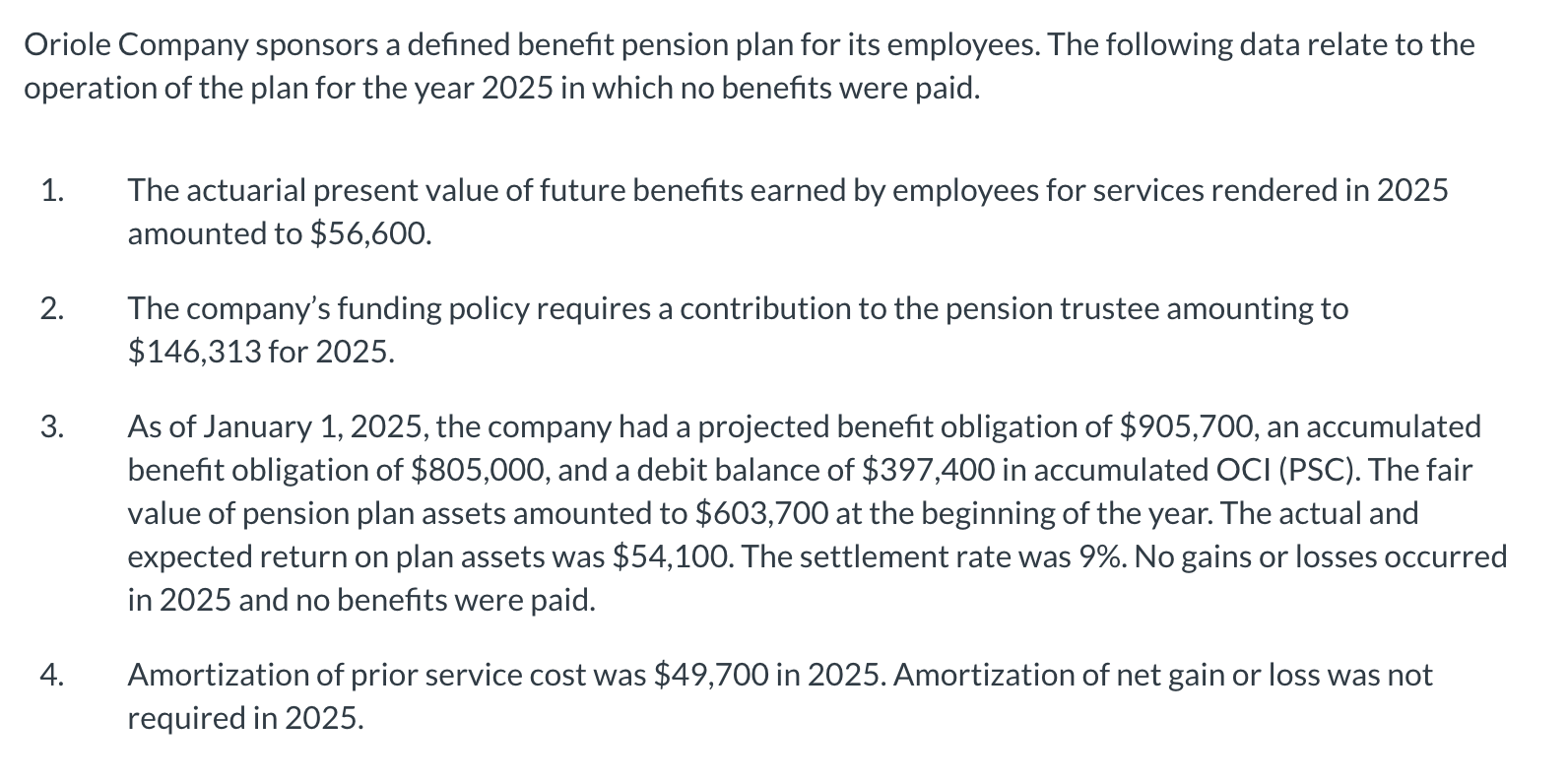

operation of the plan for the year in which no benefits were paid.

The actuarial present value of future benefits earned by employees for services rendered in

amounted to $

The company's funding policy requires a contribution to the pension trustee amounting to

$ for

As of January the company had a projected benefit obligation of $ an accumulated

benefit obligation of $ and a debit balance of $ in accumulated OCI PSC The fair

value of pension plan assets amounted to $ at the beginning of the year. The actual and

expected return on plan assets was $ The settlement rate was No gains or losses occurred

in and no benefits were paid.

Amortization of prior service cost was $ in Amortization of net gain or loss was not

required in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started