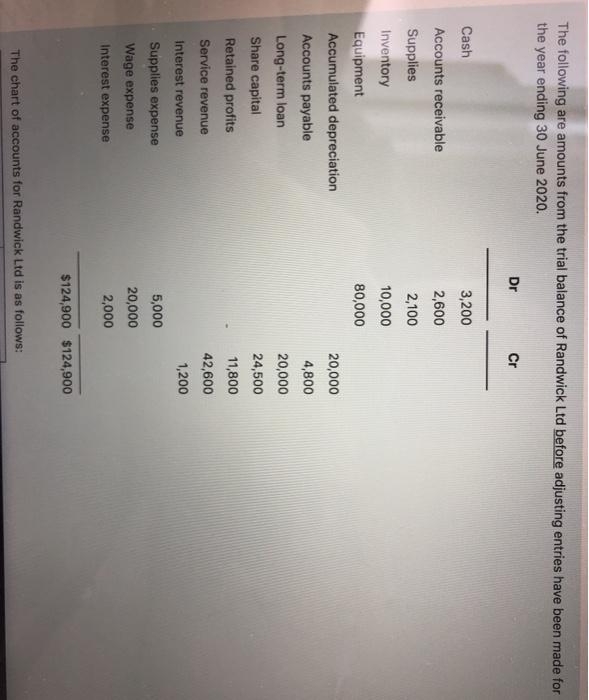

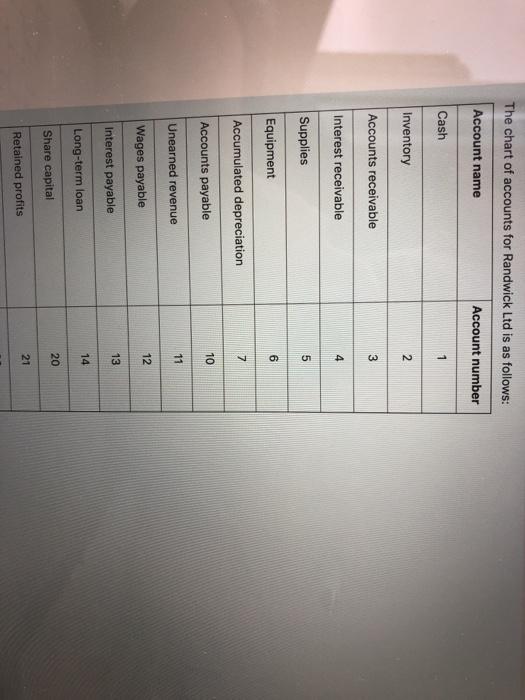

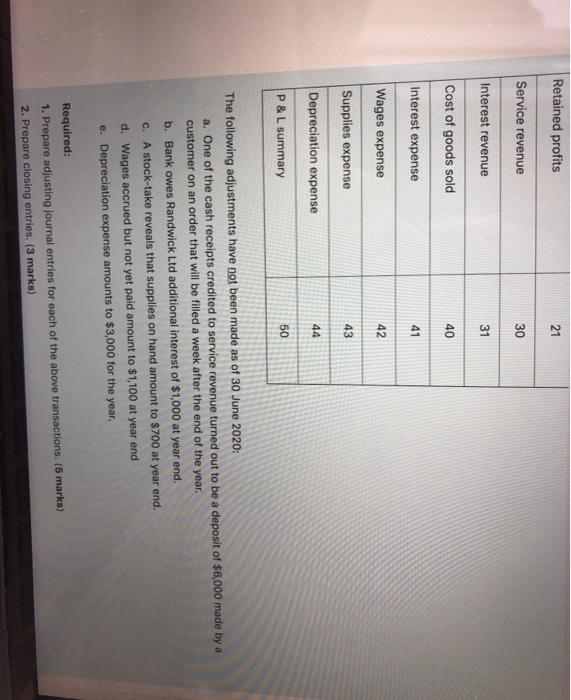

The following are amounts from the trial balance of Randwick Ltd before adjusting entries have been made for the year ending 30 June 2020. Dr Cr 3,200 2,600 2,100 10,000 80,000 20,000 4,800 Cash Accounts receivable Supplies Inventory Equipment Accumulated depreciation Accounts payable Long-term loan Share capital Retained profits Service revenue Interest revenue Supplies expense Wage expense Interest expense 20,000 24,500 11,800 42,600 1,200 5,000 20,000 2,000 $124,900 $124,900 The chart of accounts for Randwick Ltd is as follows: The chart of accounts for Randwick Ltd is as follows: Account name Account number Cash 1 Inventory 2 Accounts receivable 3 Interest receivable 4 Supplies 5 6 Equipment 7 Accumulated depreciation 10 Accounts payable 11 Unearned revenue 12 Wages payable 13 Interest payable 14 Long-term loan 20 Share capital 21 Retained profits Retained profits 21 Service revenue 30 Interest revenue 31 Cost of goods sold 40 Interest expense 41 Wages expense 42 Supplies expense 43 Depreciation expense 44 P & L summary 50 The following adjustments have not been made as of 30 June 2020: a. One of the cash receipts credited to service revenue turned out to be a deposit of $6,000 made by a customer on an order that will be filled a week after the end of the year. b. Bank owes Randwick Ltd additional interest of $1,000 at year end. c. A stock-take reveals that supplies on hand amount to $700 at year end. d. Wages accrued but not yet paid amount to $1,100 at year end e. Depreciation expense amounts to $3,000 for the year. Required: 1. Prepare adjusting journal entries for each of the above transactions. (5 marks) 2. Prepare closing entries. (3 marks) The following adjustments have not been made as of 30 June 2020: a. One of the cash receipts credited to service revenue turned out to be a deposit of $6,000 made b customer on an order that will be filled a week after the end of the year. b. Bank owes Randwick Ltd additional interest of $1,000 at year end. c. A stock-take reveals that supplies on hand amount to $700 at year end. d. Wages accrued but not yet paid amount to $1,100 at year end e. Depreciation expense amounts to $3,000 for the year. Required: 1. Prepare adjusting journal entries for each of the above transactions. (5 marks) 2. Prepare closing entries. (3 marks) 3. Prepare Randwick Ltd's balance sheet at 30 June 2020. (9 marks) Font family Font size Paragraph