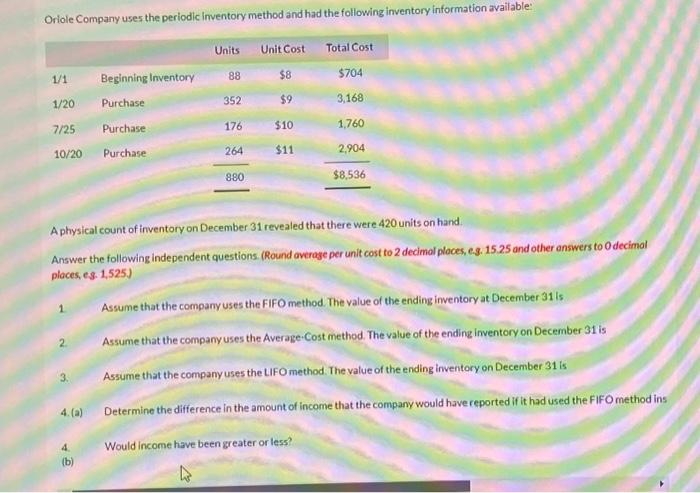

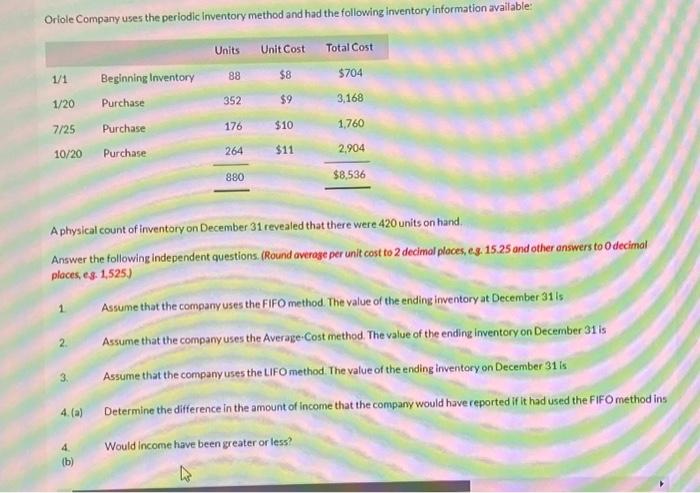

Oriole Company uses the periodic inventory method and had the following inventory information available: 1/1 1/20 7/25 10/20 1. 2. 3. 4. (a) Beginning Inventory Purchase Purchase 4. (b) Purchase Units 88 352 176 264 880 A physical count of inventory on December 31 revealed that there were 420 units on hand. Answer the following independent questions. (Round average per unit cost to 2 decimal places, e.g. 15.25 and other answers to O decimal places, e.g. 1,525.) Unit Cost $8 $9 $10 $11 Total Cost $704 3,168 1,760 2,904 $8,536 Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is Assume that the company uses the Average-Cost method. The value of the ending inventory on December 31 is Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is Would income have been greater or less? Determine the difference in the amount of income that the company would have reported if it had used the FIFO method ins

Oriole Company uses the periodic inventory method and had the following inventory information available: A physical count of inventory on December 31 revealed that there were 420 units on hand. Answer the following independent questions. (Round average per unit cost to 2 decimal ploces, e. 3.15 .25 and other answers to 0 decimal places, es. 1,525) 1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is 2. Assume that the company uses the Average. Cost method. The value of the ending inventory on December 31 is 3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is 4. (a) Determine the difference in the amount of income that the company would have reported if it had used the FIFO method ins 4. Would income have been greater or less? (b) Oriole Company uses the periodic inventory method and had the following inventory information available: A physical count of inventory on December 31 revealed that there were 420 units on hand. Answer the following independent questions. (Round averaze per unit cost to 2 decimal places, e. 3.15 .25 and other answers to 0 decimal ploces, es. 1,525) 1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is 2. Assume that the company uses the Average. Cost method. The value of the ending inventory on December 31 is 3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is 4. (a) Determine the difference in the amount of income that the company would have reported if it had used the FIFO method ins 4. Would income have been greater or less? (b) Oriole Company uses the periodic inventory method and had the following inventory information available: A physical count of inventory on December 31 revealed that there were 420 units on hand. Answer the following independent questions. (Round average per unit cost to 2 decimal ploces, e. 3.15 .25 and other answers to 0 decimal places, es. 1,525) 1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is 2. Assume that the company uses the Average. Cost method. The value of the ending inventory on December 31 is 3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is 4. (a) Determine the difference in the amount of income that the company would have reported if it had used the FIFO method ins 4. Would income have been greater or less? (b) Oriole Company uses the periodic inventory method and had the following inventory information available: A physical count of inventory on December 31 revealed that there were 420 units on hand. Answer the following independent questions. (Round averaze per unit cost to 2 decimal places, e. 3.15 .25 and other answers to 0 decimal ploces, es. 1,525) 1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is 2. Assume that the company uses the Average. Cost method. The value of the ending inventory on December 31 is 3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is 4. (a) Determine the difference in the amount of income that the company would have reported if it had used the FIFO method ins 4. Would income have been greater or less? (b)