XYZ Ltd is preparing budget for the first four (4) months of the year 2020. The company manufactures and sell one product. The selling

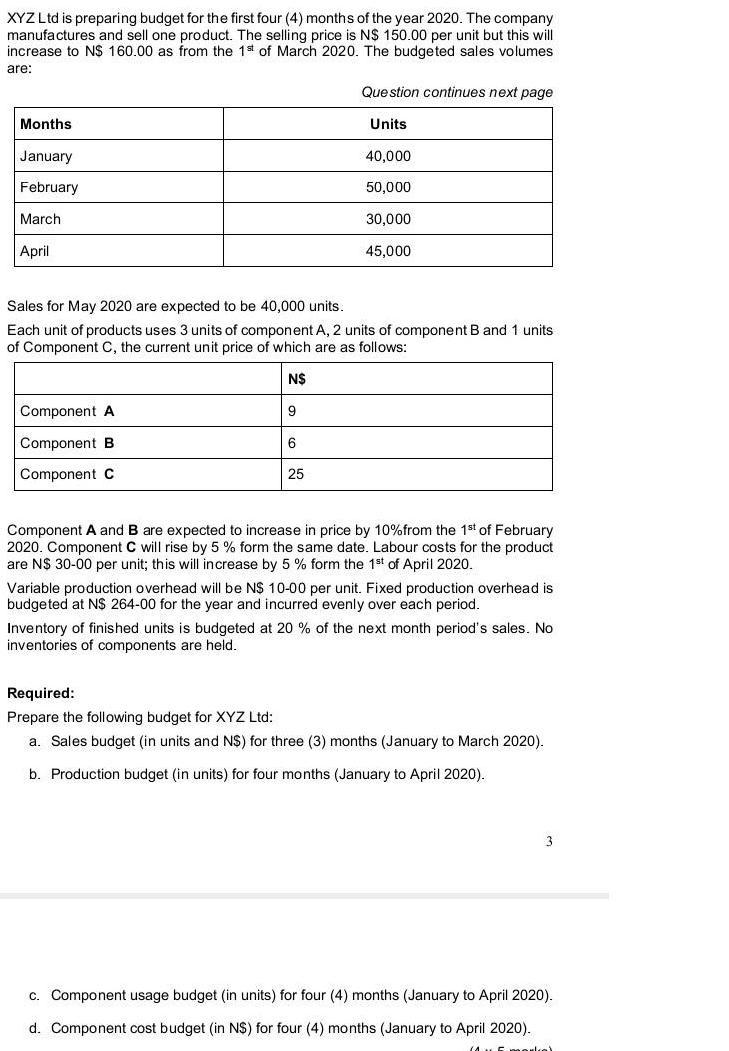

XYZ Ltd is preparing budget for the first four (4) months of the year 2020. The company manufactures and sell one product. The selling price is N$ 150.00 per unit but this will increase to N$ 160.00 as from the 1st of March 2020. The budgeted sales volumes are: Months January February March April Sales for May 2020 are expected to be 40,000 units. Each unit of products uses 3 units of component A, 2 units of component B and 1 units of Component C, the current unit price of which are as follows: N$ Component A Component B Component C 9 6 Question continues next page Units 40,000 50,000 30,000 45,000 25 Component A and B are expected to increase in price by 10% from the 1st of February 2020. Component C will rise by 5 % form the same date. Labour costs for the product are N$ 30-00 per unit; this will increase by 5 % form the 1st of April 2020. Variable production overhead will be N$ 10-00 per unit. Fixed production overhead is budgeted at N$ 264-00 for the year and incurred evenly over each period. Inventory of finished units is budgeted at 20 % of the next month period's sales. No inventories of components are held. Required: Prepare the following budget for XYZ Ltd: a. Sales budget (in units and N$) for three (3) months (January to March 2020). b. Production budget (in units) for four months (January to April 2020). 3 c. Component usage budget (in units) for four (4) months (January to April 2020). d. Component cost budget (in N$) for four (4) months (January to April 2020). (45 marka)

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Hello Student I hope you find this answer helpful Wishing you the best of luck in ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started