Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oshawa discovered years ago that many existing clients frequent certain recreational and sporting clubs. To encourage contacts with potential clients, employees have their choice among

Oshawa discovered years ago that many existing clients frequent certain recreational and sporting clubs. To encourage contacts with potential clients, employees have their choice among five such clubs. Since Madison enjoys squash, he chose a free membership at a local squash club. The annual membership is $895. 9. Oshawa reimbursed Madison for 80% of the $22,000 (5348,000 - 5326,000) loss that he experienced on the sale of his Red Deer home. 10. Madison had $39,000 for a down payment on his new Ottawa home. Since he had no previous work experience, the banks were reluctant to provide him a mortgage at favourable terms. His employer stepped in and agreed to give him an interest-free housing loan of $191,000 beginning on December 1, 2022. The loan requires annual payments of $8,000 due at the end of November beginning in 2023. The loan is required to be paid if Madison dies, sells the home, or terminates his employment. Assume that the prescribed interest rates for such benefits are 2% in each of the first two quarters of 2022 and 1% in the third and fourth quarters. 11. Oshawa instituted a stock option plan for its employees in 2021. The plan eligibility requires three months of service. Employees are permitted to acquire a limited number of option shares at 20% below their FMV on either May 1 or November 1 each year. The company hires valuators to determine the FMV on those dates. Madison acquires 200 shares on November 1, 2022. for $13,200. Low on cash and wanting to buy Jordyn a nice wedding ring, he is forced to sell 80 of the shares. He sells them on December 16, 2022, for $8,880 12. Oshawa has an arrangement with a local dealership to lease a minimum number of new automobiles each year at favourable rates. Madison receives his leased automobile on May 1, 2022. It has 162 kilometres on it when it is received. The odometer reads 19,414 kilometres on December 31, 2022. Madison estimates that he drove 5.198 kilometres for personal use, including drives to and from home to the office, and 14,054 for employment purposes. Oshawa pays monthly lease payments (including HST) of $435. The cost of gas, oil, insurance, repairs and maintenance, and other charges total $2,195 for 2022. Oshawa requires each employee provided with an automobile to pay $75 each month for the personal use of the automobile, which is withheld directly from their pay. 13. Madison prepared a separate room in his apartment to be used exclusively for a home office. He used the office space between June 1 and November 30, 2022. A home office was not ready in his newly purchased home until February 2023. The apartment office space together with common areas is calculated as 100 square feet. The total apartment space is 1,176 square feet. Home office-related costs are as follows. Monthly Rent Monthly Phone Line Charge (April to November) Employment-Related Long Distance Calls (June to November) Total Electricity Charge (March 16 to November 30) Property Insurance (March 16 to November 30) Paint For Apartment Office Furniture Computer Purchase 975 37 76 850 205 248 1,348 1,744 128 Stationery And Office Supplies Purchased 14. Madison received an allowance of $220 per month for six months to cover the costs of maintaining an office in his home.

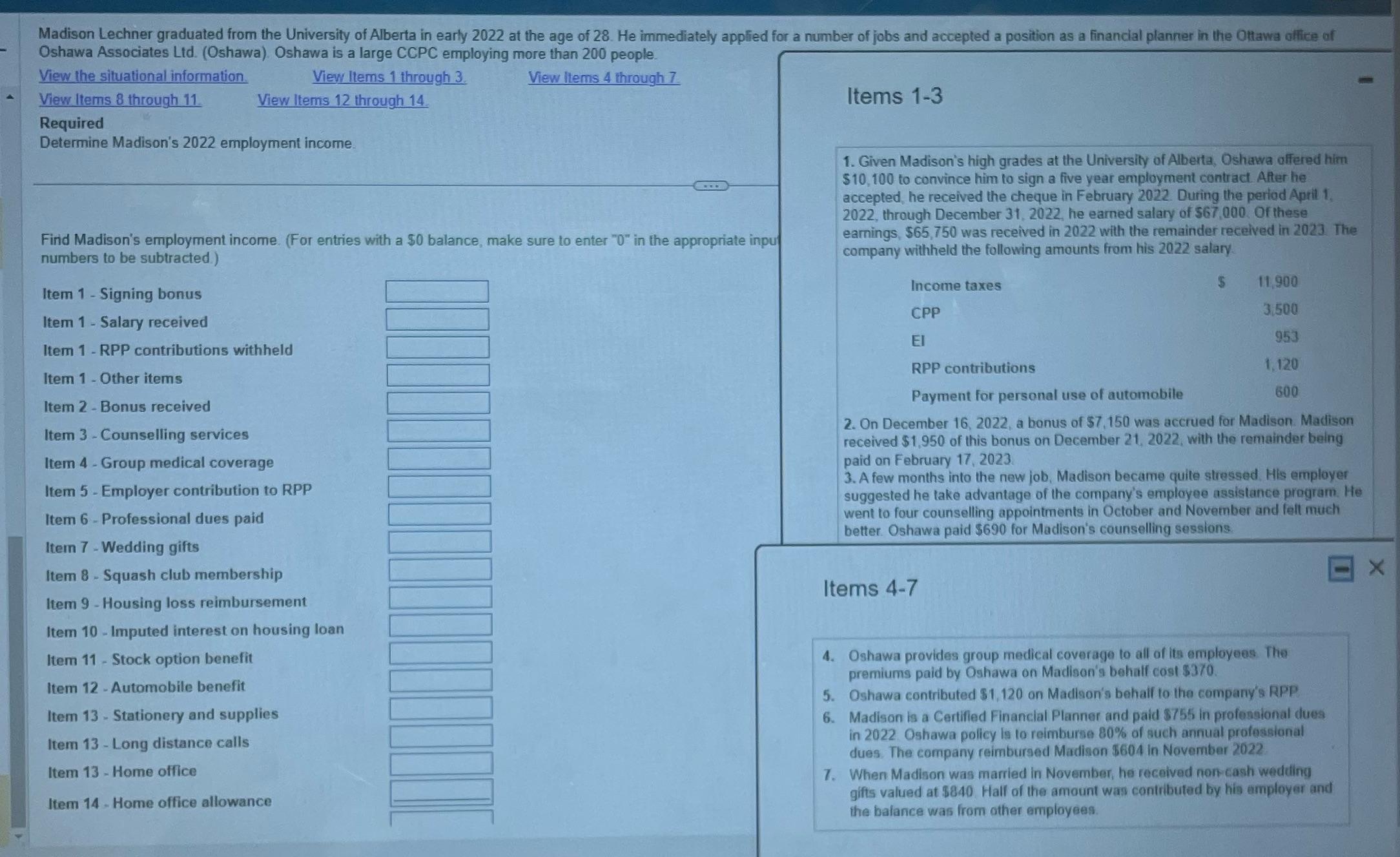

Madison Lechner graduated from the University of Alberta in early 2022 at the age of 28. He immediately applied for a number of jobs and accepted a position as a financial planner in the Ottawa office of Oshawa Associates Ltd. (Oshawa). Oshawa is a large CCPC employing more than 200 people. View Items 4 through 7 View the situational information. View Items 1 through 3. View Items 8 through 11. Required View Items 12 through 14. Items 1-3 Determine Madison's 2022 employment income Find Madison's employment income. (For entries with a $0 balance, make sure to enter "0" in the appropriate input numbers to be subtracted.) Item 1 - Signing bonus Item 1 - Salary received Item 1 - RPP contributions withheld Item 1 - Other items Item 2 - Bonus received Item 3 - Counselling services Item 4 - Group medical coverage Item 5 - Employer contribution to RPP Item 6 - Professional dues paid Item 7 - Wedding gifts Item 8 - Squash club membership Item 9 - Housing loss reimbursement Item 10 - Imputed interest on housing loan Item 11 - Stock option benefit Item 12- Automobile benefit Item 13 Stationery and supplies Item 13 - Long distance calls Item 13 - Home office Item 14 - Home office allowance 1. Given Madison's high grades at the University of Alberta, Oshawa offered him $10,100 to convince him to sign a five year employment contract. After he accepted, he received the cheque in February 2022. During the period April 1, 2022, through December 31, 2022, he earned salary of $67,000. Of these earnings, $65,750 was received in 2022 with the remainder received in 2023 The company withheld the following amounts from his 2022 salary Income taxes CPP $ 11,900 3,500 953 1,120 600 RPP contributions Payment for personal use of automobile 2. On December 16, 2022, a bonus of $7,150 was accrued for Madison. Madison received $1,950 of this bonus on December 21, 2022, with the remainder being paid on February 17, 2023 3. A few months into the new job, Madison became quite stressed. His employer suggested he take advantage of the company's employee assistance program. He went to four counselling appointments in October and November and felt much better. Oshawa paid $690 for Madison's counselling sessions Items 4-7 4. Oshawa provides group medical coverage to all of its employees. The premiums paid by Oshawa on Madison's behalf cost $370. 5. Oshawa contributed $1,120 on Madison's behalf to the company's RPP 6. Madison is a Certified Financial Planner and paid $755 in professional dues in 2022 Oshawa policy is to reimburse 80% of such annual professional dues. The company reimbursed Madison $604 in November 2022 7. When Madison was married in November, he received non-cash wedding gifts valued at $840. Half of the amount was contributed by his employer and the balance was from other employees.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To assess the tax implications for Madison we need to analyze each item mentioned in the description based on Canadian tax laws Heres a breakdown of e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started