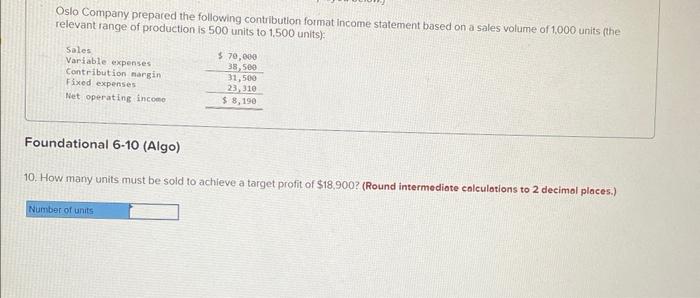

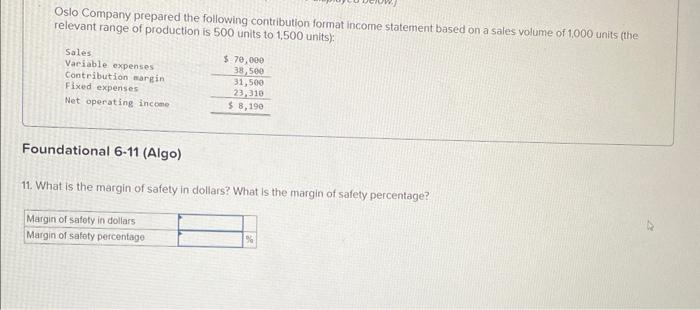

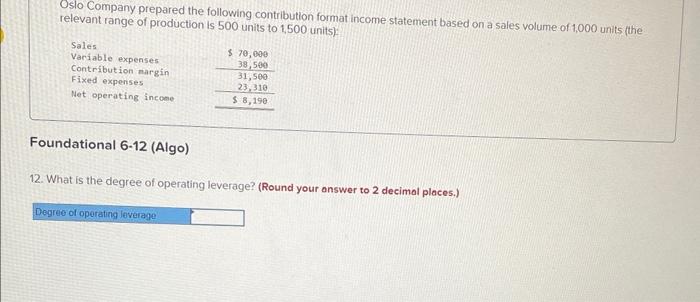

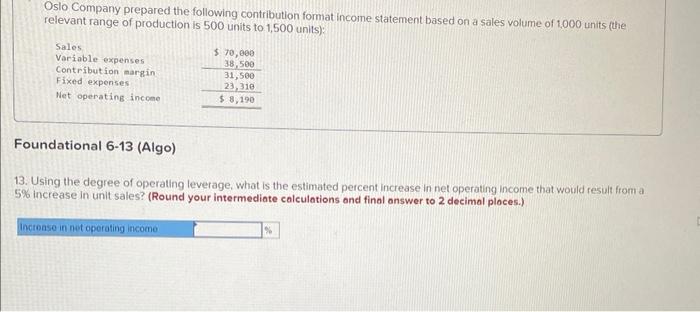

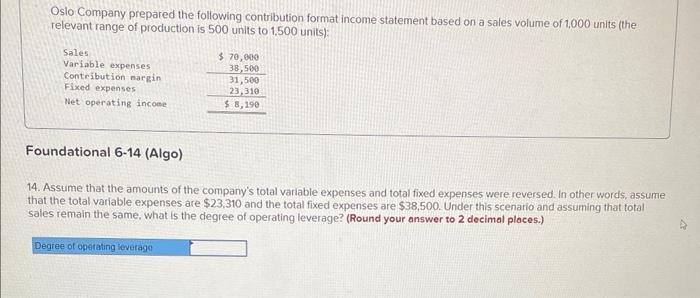

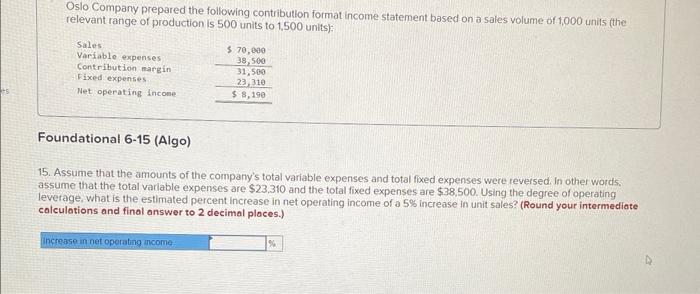

Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Foundational 6-10 (Algo) 10. How many units must be sold to achieve a target profit of $18,900 ? (Round intermediate calculotions to 2 decimol places.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Foundational 6-11 (Algo) 11. What is the margin of safety in dollars? What is the margin of safety percentage? Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Foundational 6-12 (Algo) 12. What is the degree of operating leverage? (Round your onswer to 2 decimal places.) Oslo Company prepared the following contribution fomat income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Foundational 6-13 (Algo) 13. Using the degree of operating leverage, what is the estimated percent increase in net operating income that would result from a 5% increase in unit sales? (Round your intermediate calculations and finol answer to 2 decimal ploces.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Foundational 6-14 (Algo) 14. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $23,310 and the total fixed expenses are $38,500. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.) Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the. relevant range of production is 500 units to 1,500 units): Foundational 6-15 (Algo) 15. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words. assume that the total varlable expenses are $23,310 and the total fixed expenses are $38.500. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 5% increase in unit sales? (Round your intermediate calculations and final answer to 2 decimal ploces.)