Question

Stan purchases machinery costing $180,000 for use in his business in 2020. The machinery is 7-year MACRS property and has an ADS life of 12

Stan purchases machinery costing $180,000 for use in his business in 2020. The machinery is 7-year MACRS property and has an ADS life of 12 years.

Refer to the MACRS Depreciation Tables to answer the following questions.

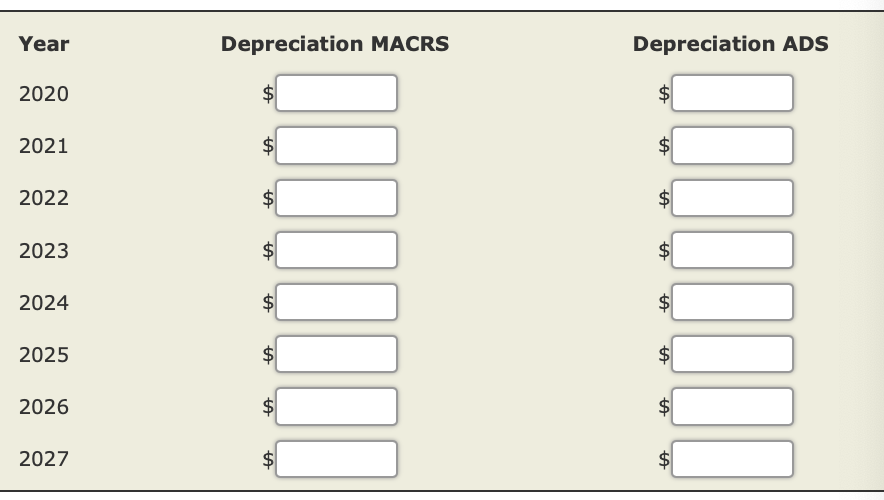

Complete a depreciation schedule using the regular MACRS method and ADS (straight-line method) depreciation assuming that Stan does not make a Section 179 election and elects not to claim bonus depreciation. Round depreciation percentages to two decimal places. Round your final answers to the nearest dollar.

For ADS, use mid-year convention. For MACRS, adjust the amount of depreciation in 2027 (the last year) so that total depreciation equals $180,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started