Answered step by step

Verified Expert Solution

Question

1 Approved Answer

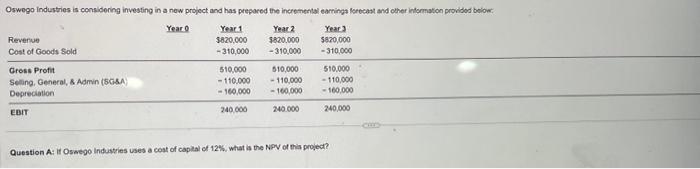

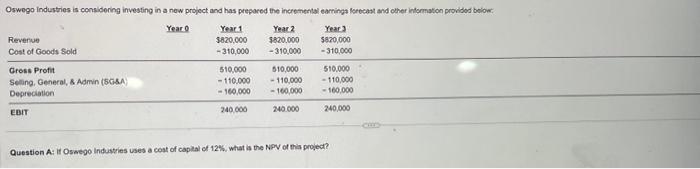

Oswego Industries is considering investing in a new project and has prepared the incremental earnings forecast and other information provided below: Year 1 $820,000 -

Oswego Industries is considering investing in a new project and has prepared the incremental earnings forecast and other information provided below: Year 1 $820,000 - 310,000 Year 3 $820,000 - 310,000 Revenue Cost of Goods Sold Gross Profit Selling, General, & Admin (SG&A) Depreciation EBIT Year 0 510,000 - 110,000 - 160,000 240,000 Year 2 $820,000 - 310,000 510,000 - 110,000 - 160,000 240,000 510,000 - 110,000 - 160,000 240,000 Question A: If Oswego Industries uses a cost of capital of 12%, what is the NPV of this project?

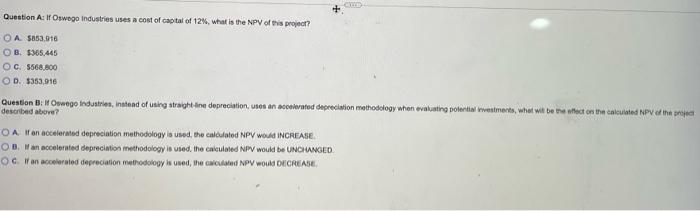

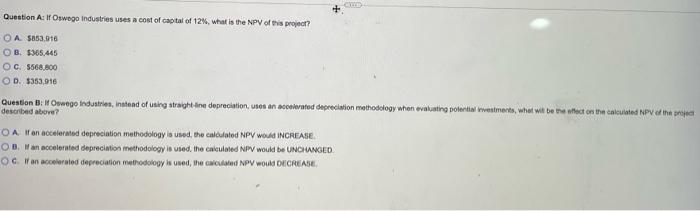

Question A: if Osaego Industries uses a cost of capilal of 12%, what is the NPV of this project? Question A: If Orwogo industries uses a cost of caotal of 12%, what is the NPV of this propect? A. 5853.9+6 B. 5965.445 C. 5568.800 D. $353.916 descrbed atesere A. If an accelermed depreciation methodology is used, the caloulatod NPV wold inCrEAse. 8. If an accelerated degrecimtion methodolog is used. the cakulaled NPV would be UNCiungeD C. If an acolerated depreciation methodology is used, the carculahed NPV would OECREASt: Question A: if Osaego Industries uses a cost of capilal of 12%, what is the NPV of this project? Question A: If Orwogo industries uses a cost of caotal of 12%, what is the NPV of this propect? A. 5853.9+6 B. 5965.445 C. 5568.800 D. $353.916 descrbed atesere A. If an accelermed depreciation methodology is used, the caloulatod NPV wold inCrEAse. 8. If an accelerated degrecimtion methodolog is used. the cakulaled NPV would be UNCiungeD C. If an acolerated depreciation methodology is used, the carculahed NPV would OECREASt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started