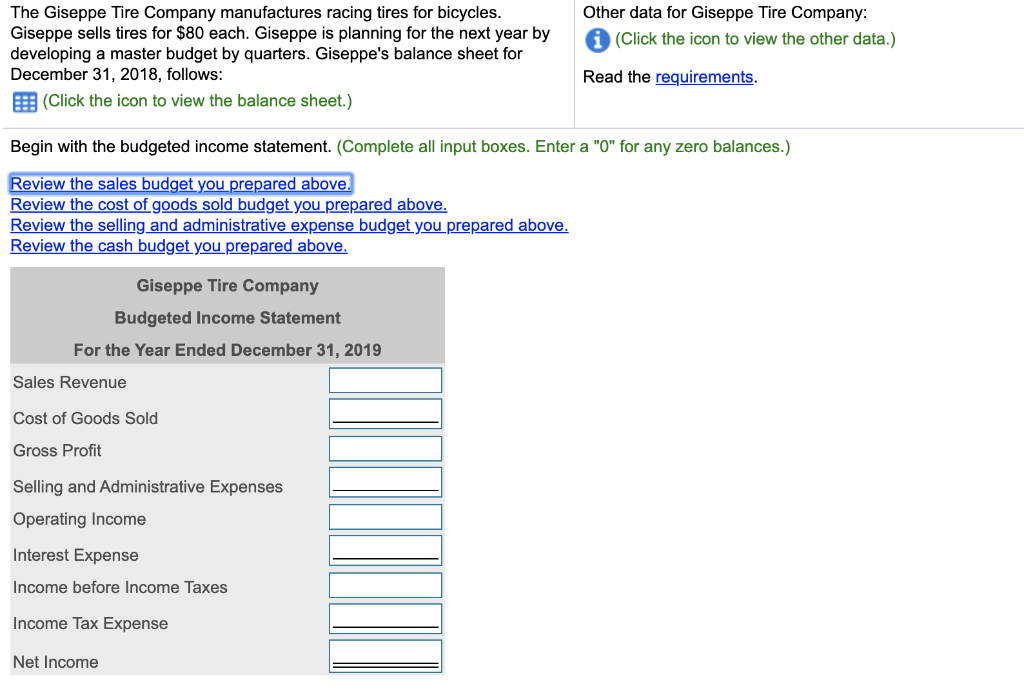

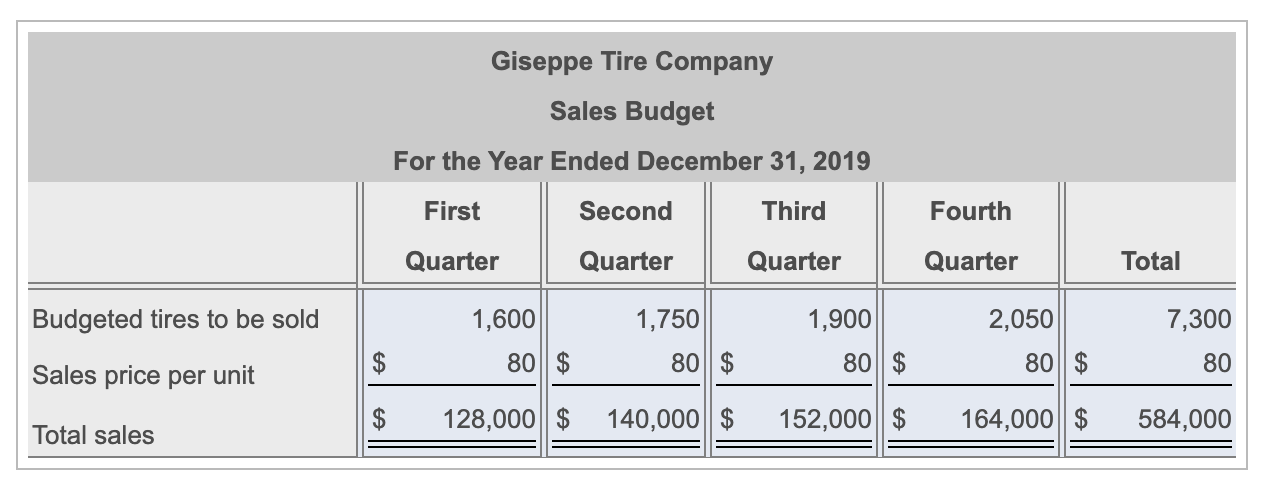

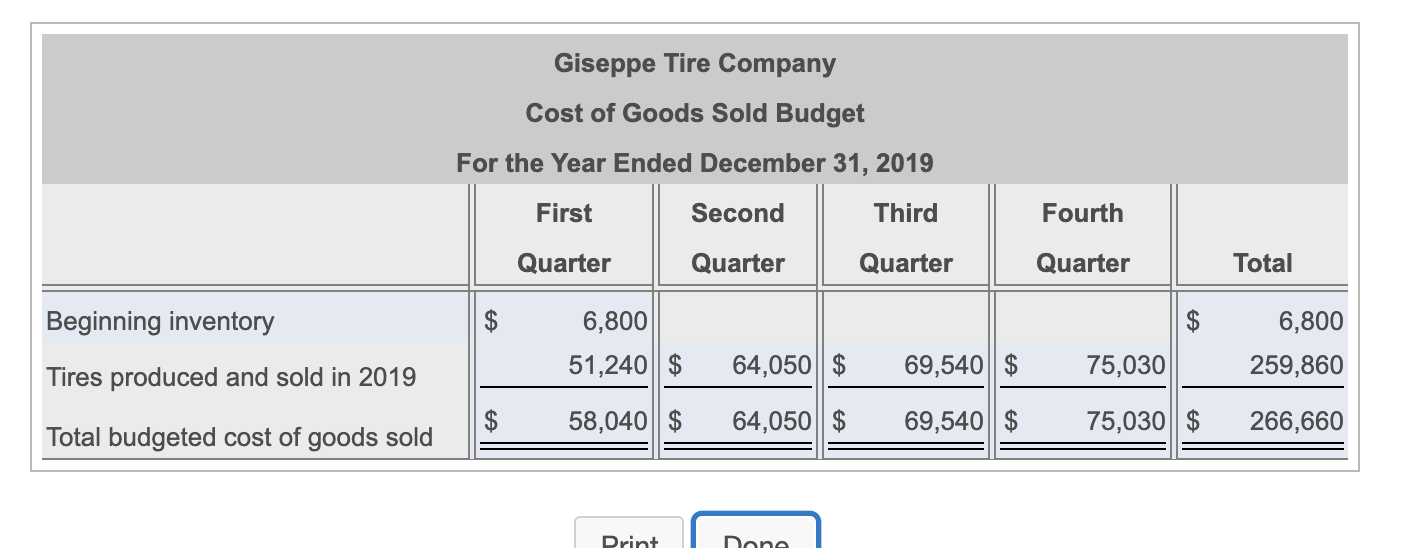

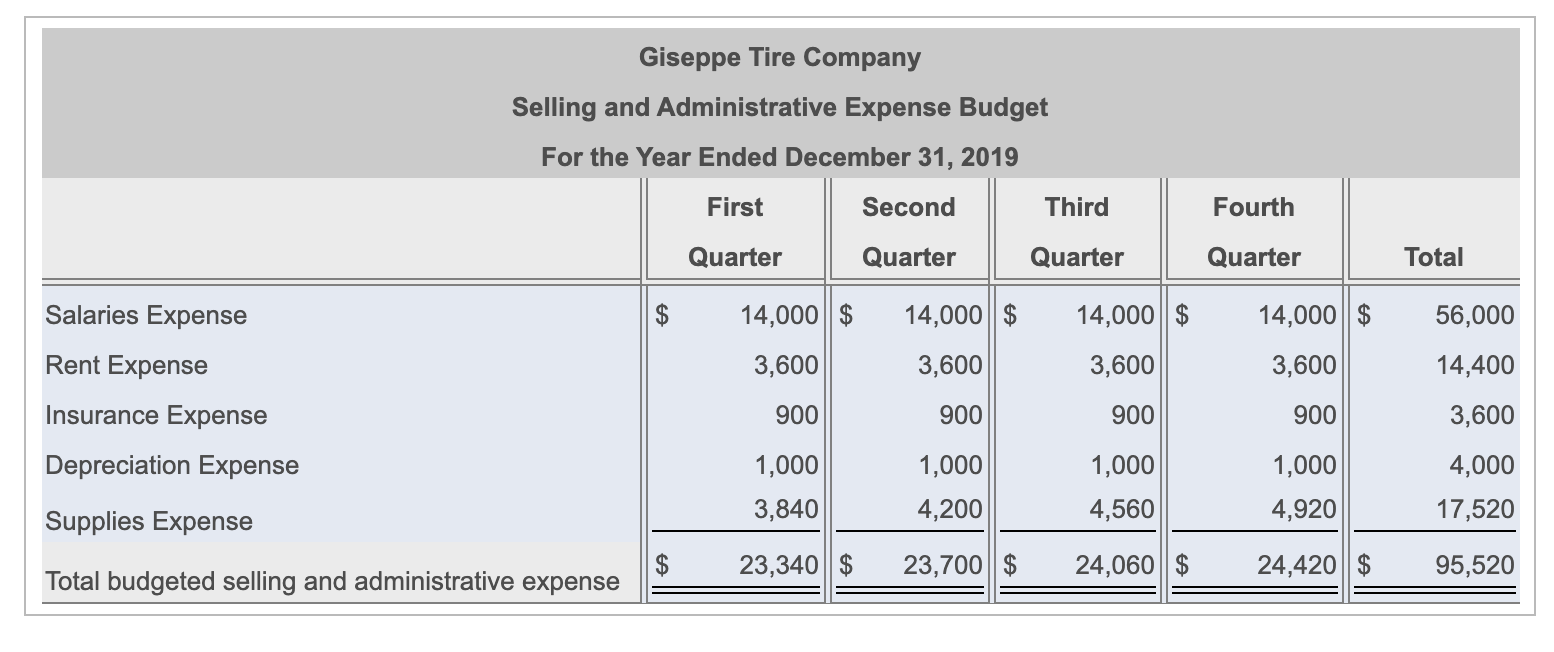

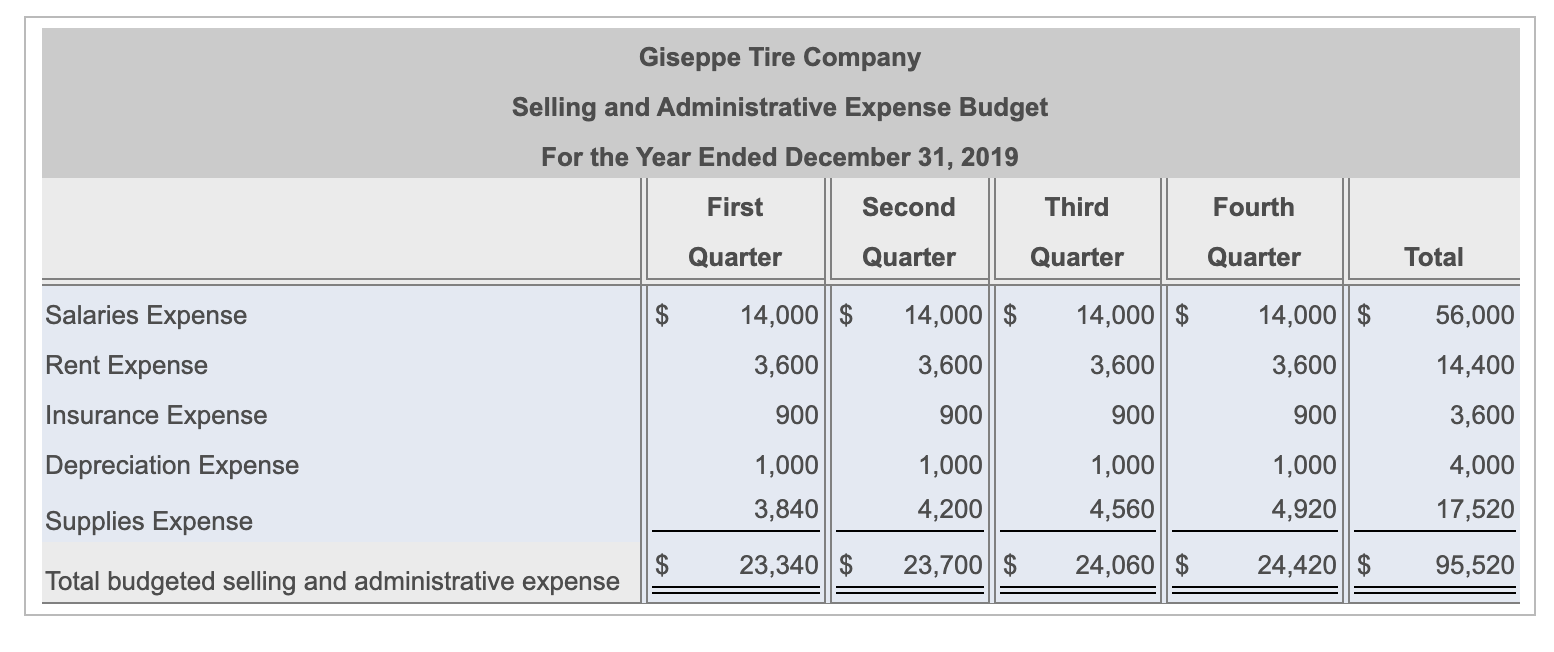

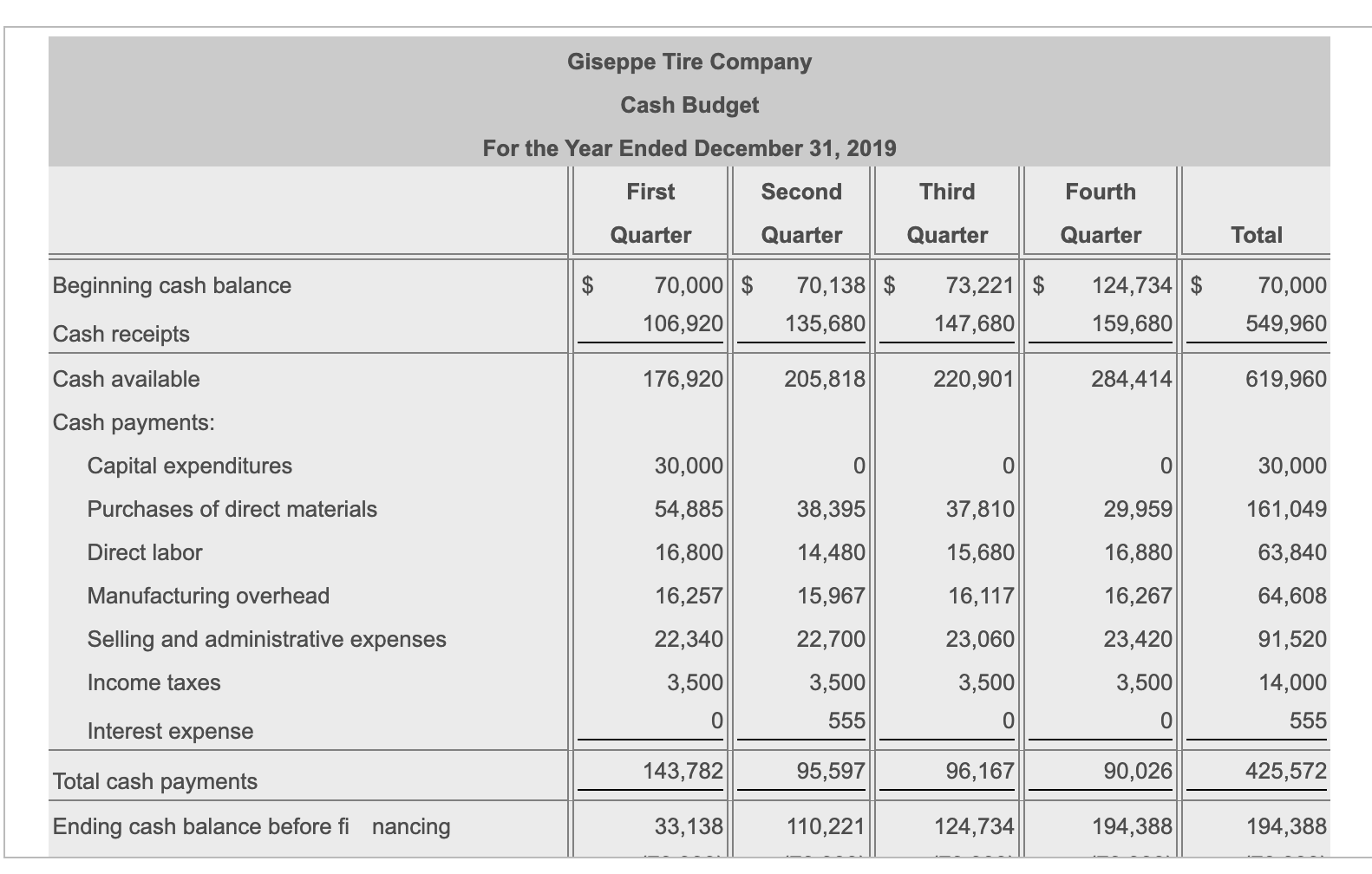

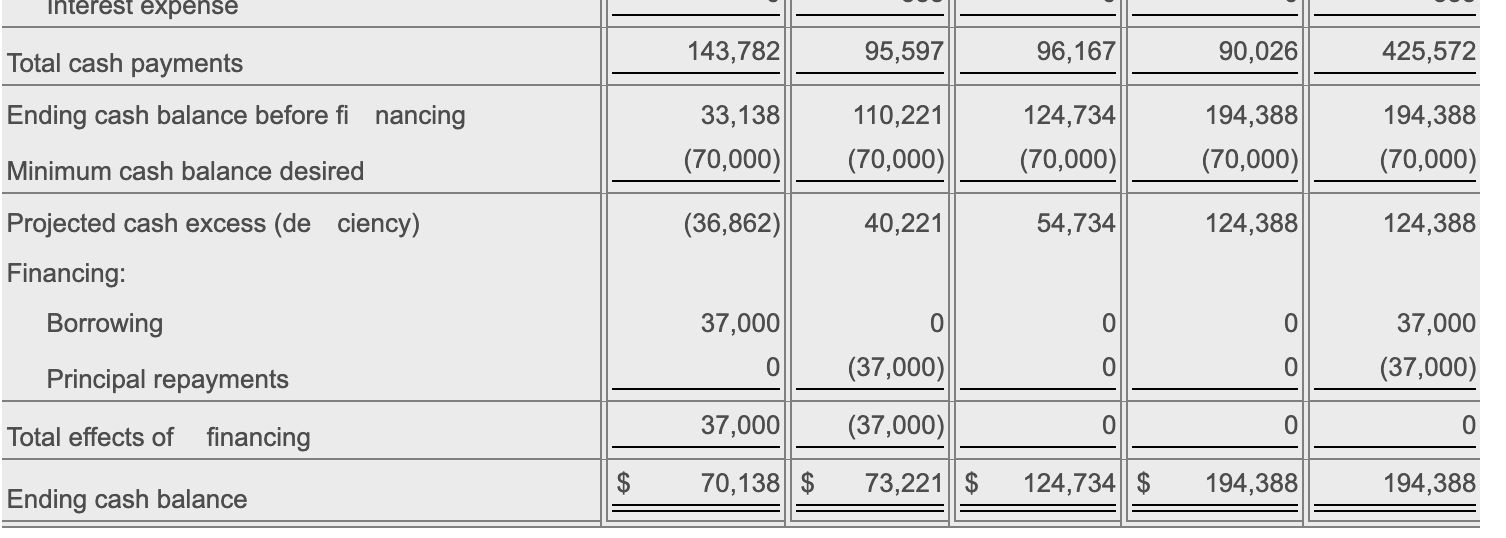

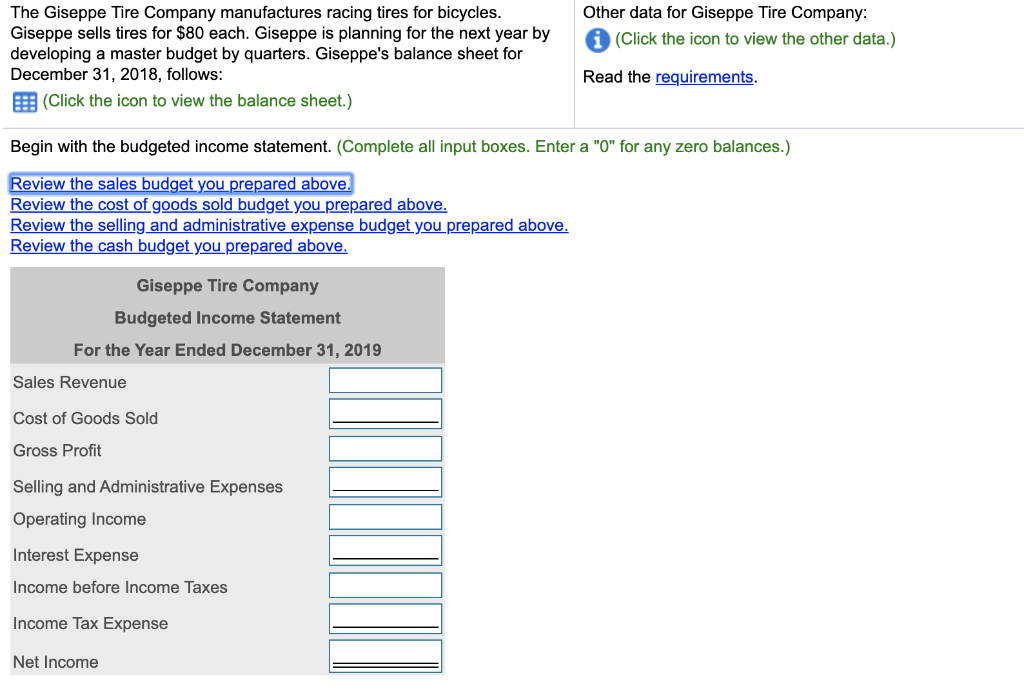

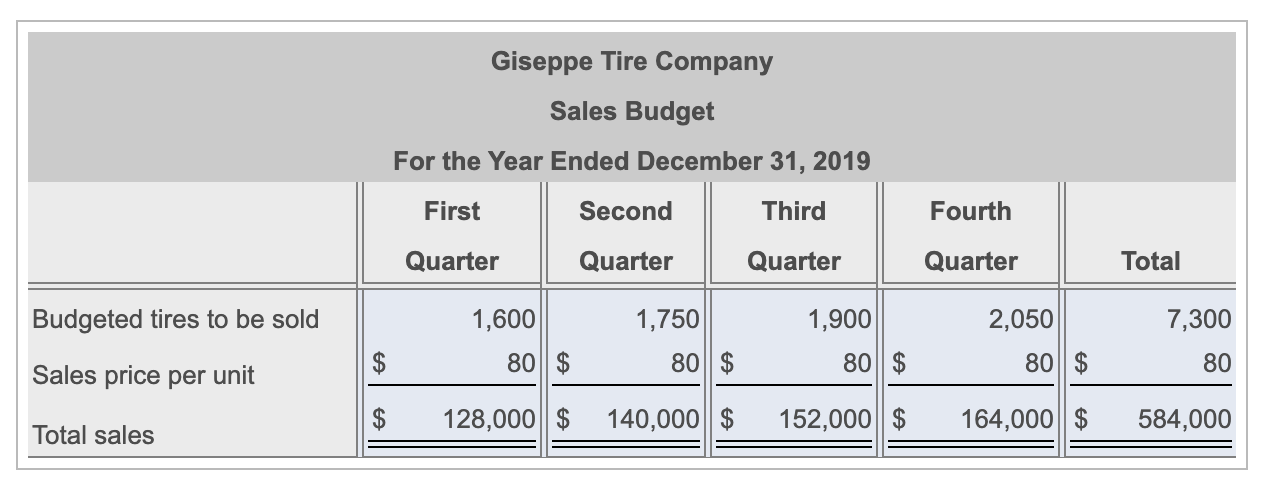

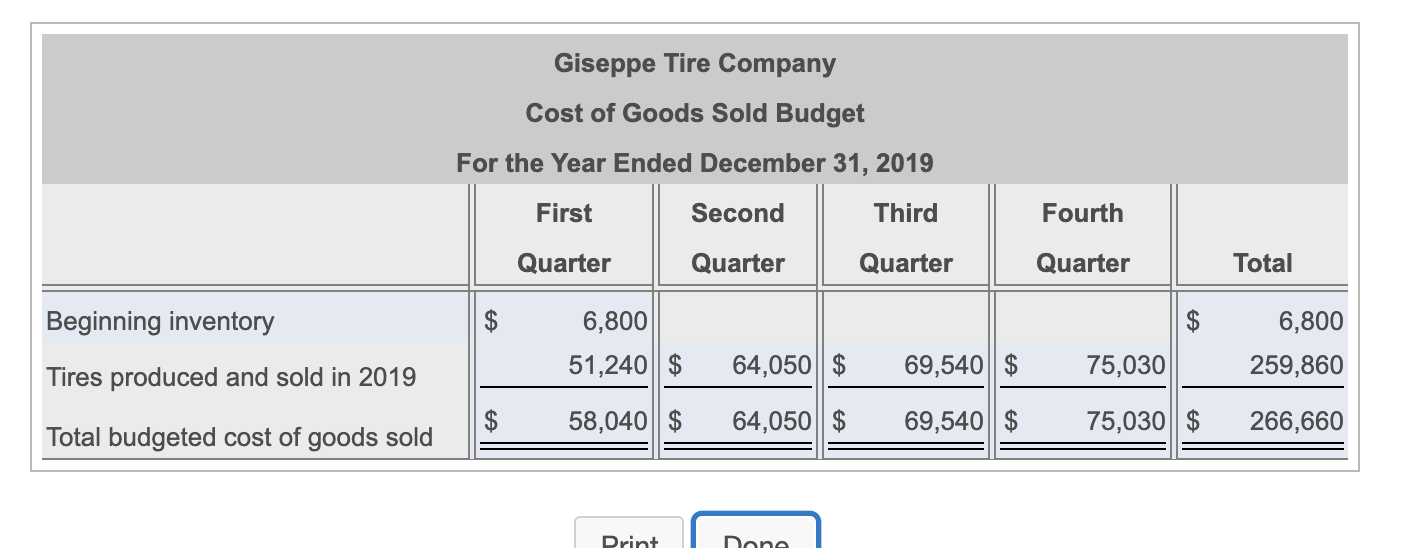

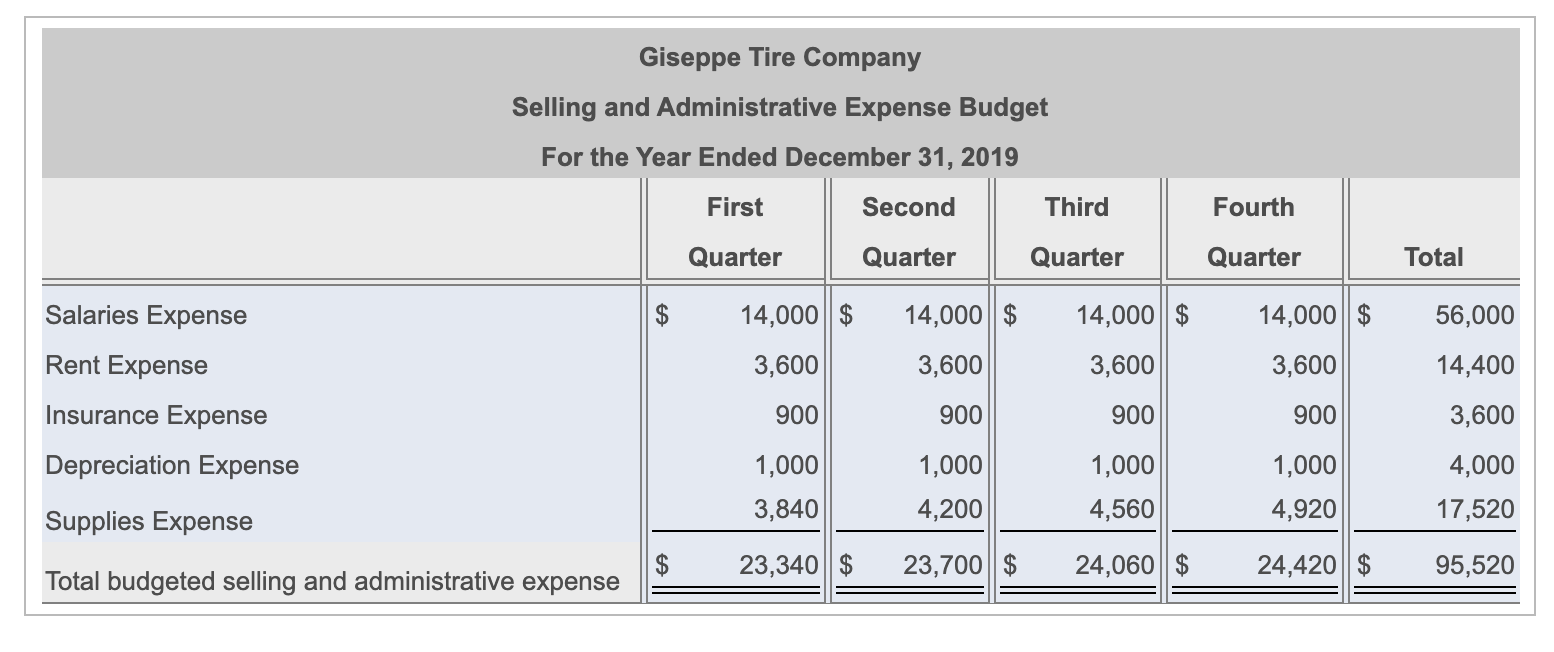

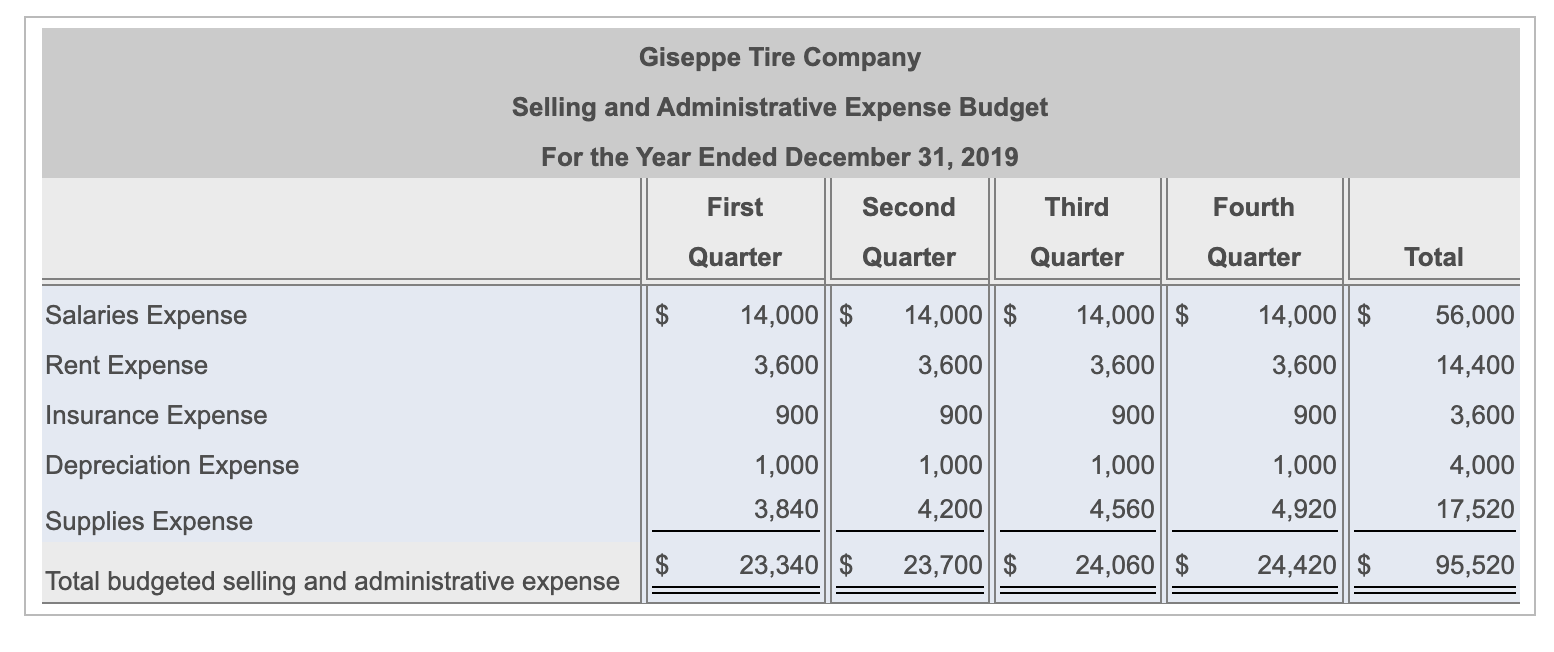

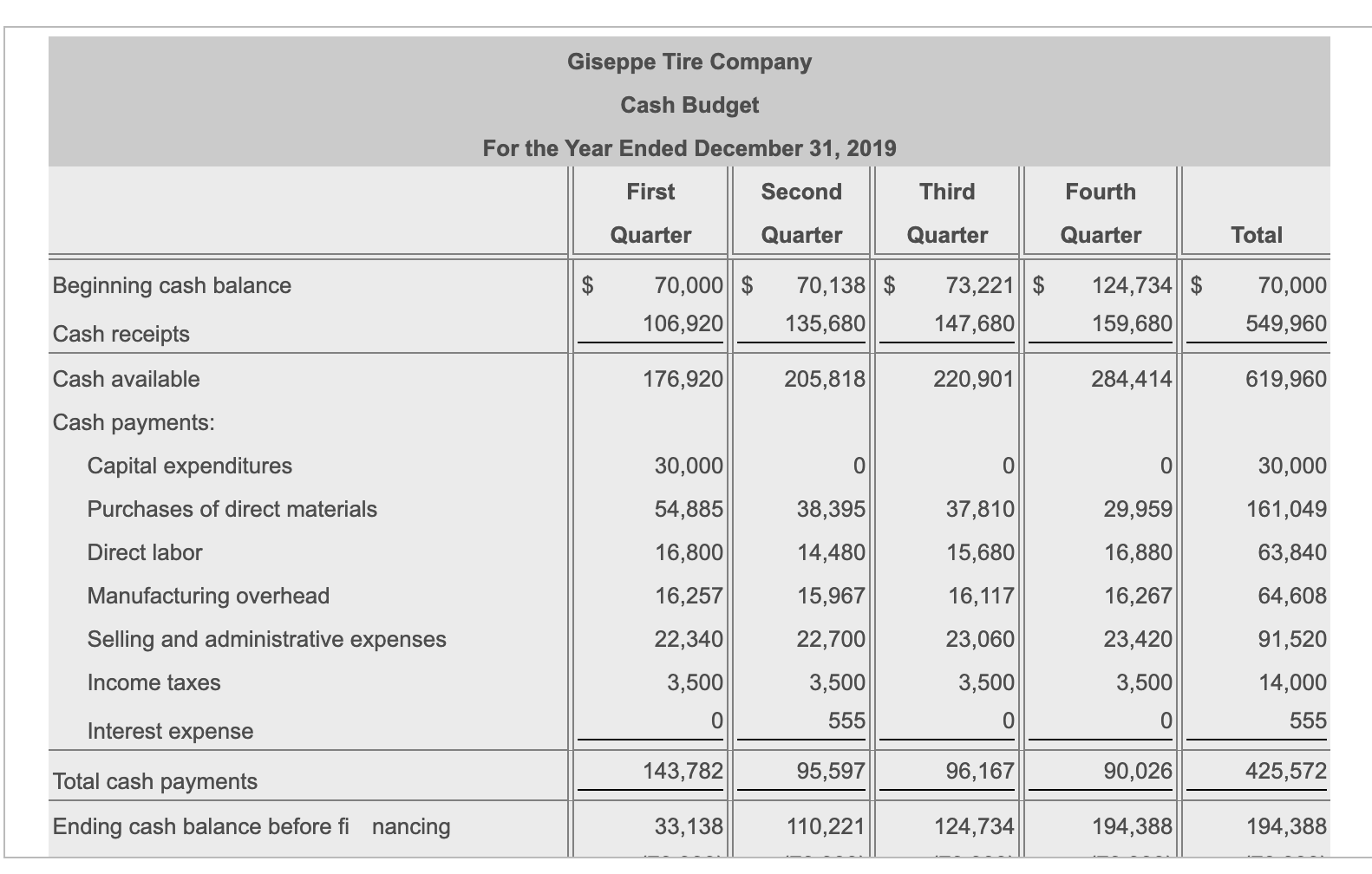

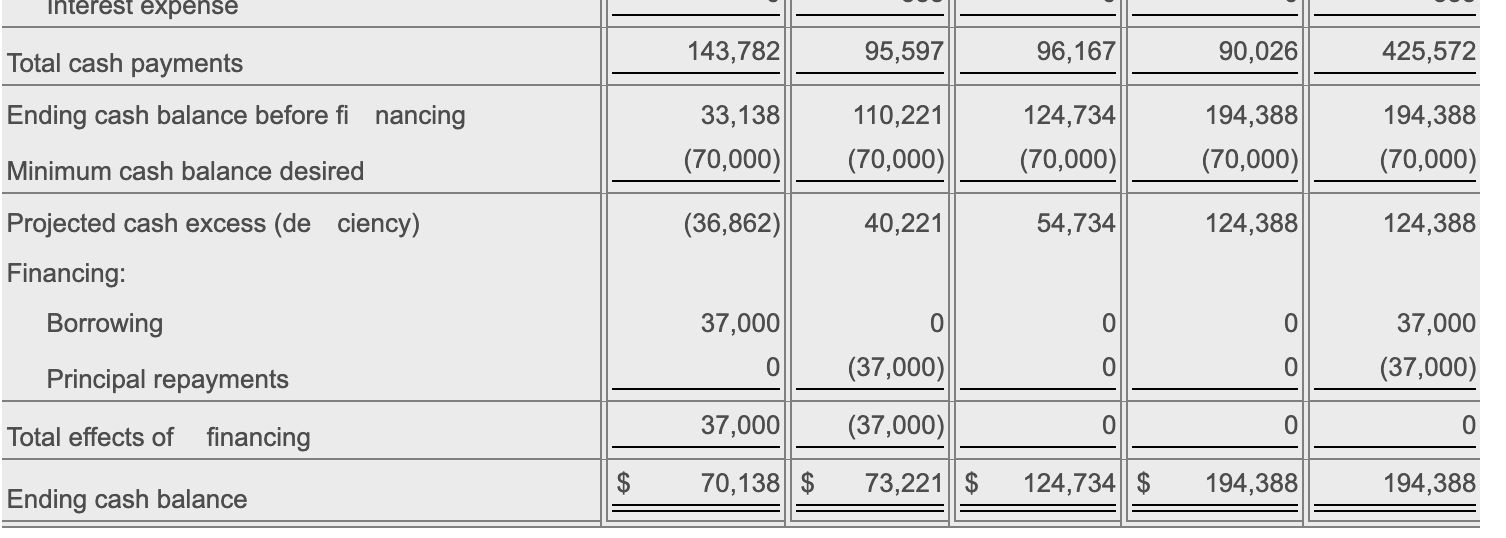

Other data for Giseppe Tire Company: (Click the icon to view the other data.) The Giseppe Tire Company manufactures racing tires for bicycles. Giseppe sells tires for $80 each. Giseppe is planning for the next year by developing a master budget by quarters. Giseppe's balance sheet for December 31, 2018, follows: (Click the icon to view the balance sheet.) Read the requirements. Begin with the budgeted income statement. (Complete all input boxes. Enter a "0" for any zero balances.) Review the sales budget you prepared above. Review the cost of goods sold budget you prepared above. Review the selling and administrative expense budget you prepared above. Review the cash budget you prepared above. Giseppe Tire Company Budgeted Income Statement For the Year Ended December 31, 2019 Sales Revenue Gross Profit Selling and Administrative Expenses Operating Income Interest Expense Income before Income Taxes Income Tax Expense Net Income Giseppe Tire Company Sales Budget For the Year Ended December 31, 2019 First Third Fourth Quarter Quarter Quarter Total Budgeted tires to be sold 7,300 Sales price per unit | $ $ 800 $ 128,000 $ 800 $ 140,000 $ 1,900 800 $ 152,000 $ 2,050 800 $ 164,000 $ 584,000 Total sales Giseppe Tire Company Cost of Goods Sold Budget For the Year Ended December 31, 2019 First Second Third Fourth Quarter Quarter Quarter Quarter Total Beginning inventory Tires produced and sold in 2019 6,800 51,240||$ 58,040||$ 64,050 $ 64,050||$ 69,540 $ 69,540 $ $ 75,030 75,030|| $ 6,800 259,860 266,660 $ Total budgeted cost of goods sold Print one Giseppe Tire Company Selling and Administrative Expense Budget For the Year Ended December 31, 2019 First Second Third Fourth Quarter Quarter Quarter Quarter Total 14,000 $ 56,000 14,000 $ 3,600 3,600 14,400 Salaries Expense Rent Expense Insurance Expense Depreciation Expense 14,000||$ 3,600 900 1,000 3,840 14,000 $ 3,600 900 1,000 4,560 900 1,000 4,200 1,000 4,920 3,600 4,000 17,520 Supplies Expense 23,340 23,700|$ 24,060|| 24,420 95,520 Total budgeted selling and administrative expense Giseppe Tire Company Selling and Administrative Expense Budget For the Year Ended December 31, 2019 First Second Third Quarter Quarter Quarter Quarter Total 14,000 $ 56,000 14,000 $ 3,600 3,600 14,400 Salaries Expense Rent Expense Insurance Expense Depreciation Expense 14,000||$ 3,600 900 1,000 3,840 900 14,000 $ 3,600 900 1,000 4,560 900 1,000 4,200 1,000 4,920 3,600 4,000 17,520 Supplies Expense 23,340 23,700|$ 24,060|| 24,420 95,520 Total budgeted selling and administrative expense Giseppe Tire Company Cash Budget For the Year Ended December 31, 2019 First Second Third Quarter Quarter Quarter Fourth Quarter Total Beginning cash balance 70,000 $ 106,920 70,138 $ 135,680 73,221 $ 147,680 124,734 $ 159,680 70,000 549,960 Cash receipts Cash available 176,920 205,818 220,901 284,414 619,960 Cash payments: Capital expenditures Purchases of direct materials Direct labor 30,000 54,885 16,800 16,257 22,340 3,500 38,395 14,480 15,967 22,700 Manufacturing overhead Selling and administrative expenses 37,810 15,680 16,117 23,060 3,500 29,959 16,880 16,267 23,420 3,500 30,000 161,049 63,840 64,608 91,520 14,000 555 Income taxes 3,500 555 Interest expense 143,782 95,597 96,167 90,026 425,572 Total cash payments Ending cash balance before financing 33,138 110,221 124,734 194,388 194,388 Giseppe Tire Company Cash Budget For the Year Ended December 31, 2019 First Second Third Quarter Quarter Quarter Fourth Quarter Total Beginning cash balance 70,000 $ 106,920 70,138 $ 135,680 73,221 $ 147,680 124,734 $ 159,680 70,000 549,960 Cash receipts Cash available 176,920 205,818 220,901 284,414 619,960 Cash payments: Capital expenditures Purchases of direct materials Direct labor 30,000 54,885 16,800 16,257 22,340 3,500 38,395 14,480 15,967 22,700 Manufacturing overhead Selling and administrative expenses 37,810 15,680 16,117 23,060 3,500 29,959 16,880 16,267 23,420 3,500 30,000 161,049 63,840 64,608 91,520 14,000 555 Income taxes 3,500 555 Interest expense 143,782 95,597 96,167 90,026 425,572 Total cash payments Ending cash balance before financing 33,138 110,221 124,734 194,388 194,388 Thterest expense Total cash payments 143,782 95,597 96,167 90,026 425,572 Ending cash balance before financing 33,138 (70,000) (36,862) 110,221 (70,000) 124,734 (70,000) 194,388 (70,000) 194,388 (70,000) Minimum cash balance desired 40,221 54,734 124,388 124,388 Projected cash excess (de ciency) Financing: Borrowing 37,000 37,000 (37,000) Principal repayments (37,000) Total effects of financing 37,000 (37,000) 70,138||$ 73,221 $ 124,734 $ 194,388 194,388 Ending cash balance