Answered step by step

Verified Expert Solution

Question

1 Approved Answer

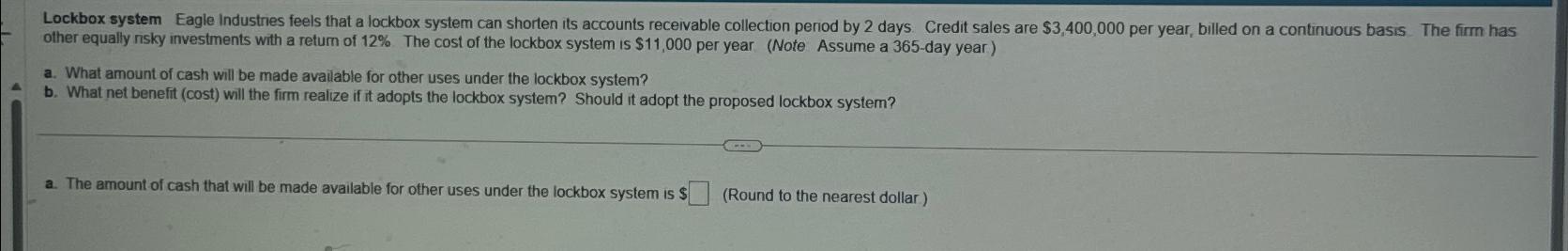

other equally risky investments with a retum of 12% . The cost of the lockbox system is $11,000 per year (Note Assume a 365-day year)

other equally risky investments with a retum of

12%. The cost of the lockbox system is

$11,000per year (Note Assume a 365-day year)\ a. What amount of cash will be made available for other uses under the lockbox system?\ b. What net benefit (cost) will the firm realize if it adopts the lockbox system? Should it adopt the proposed lockbox system?\ a. The amount of cash that will be made available for other uses under the lockbox system is

$(Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started