Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Other Information (2021 Adjusting Journal Entry Details) A) RCI uses the aging method for estimating bad debts for the year. The accounts receivable balance is

Other Information (2021 Adjusting Journal Entry Details)

A) RCI uses the aging method for estimating bad debts for the year. The accounts receivable balance is to be aged as follows: (1) $96,000 @ 1-30 days old 2.5% uncollectible, (2) $46,200 @ 31-90 days old 8% uncollectible, (3) $19,000 more than 90 days old 30% uncollectible. These amounts already include any sales returns, allowance and discounts that occurred.

B. The tax rate for RCI is 25%

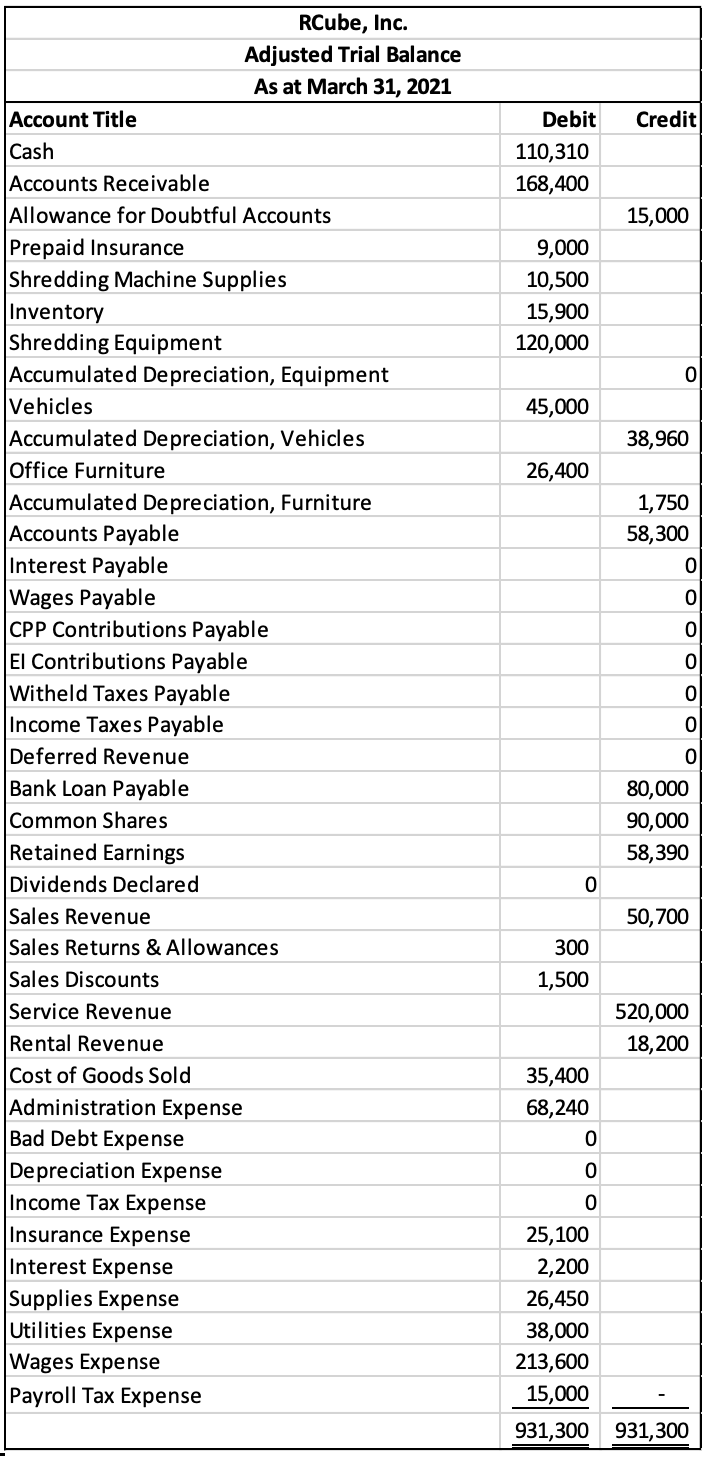

Credit Debit 110,310 168,400 15,000 9,000 10,500 15,900 120,000 45,000 38,960 26,400 1,750 58,300 RCube, Inc. Adjusted Trial Balance As at March 31, 2021 Account Title Cash Accounts Receivable Allowance for Doubtful Accounts Prepaid Insurance Shredding Machine Supplies Inventory Shredding Equipment Accumulated Depreciation, Equipment Vehicles Accumulated Depreciation, Vehicles Office Furniture Accumulated Depreciation, Furniture Accounts Payable Interest Payable Wages Payable CPP Contributions Payable El Contributions Payable Witheld Taxes Payable Income Taxes Payable Deferred Revenue Bank Loan Payable Common Shares Retained Earnings Dividends Declared Sales Revenue Sales Returns & Allowances Sales Discounts Service Revenue Rental Revenue Cost of Goods Sold Administration Expense Bad Debt Expense Depreciation Expense Income Tax Expense Insurance Expense Interest Expense Supplies Expense Utilities Expense Wages Expense Payroll Tax Expense 80,000 90,000 58,390 0 50,700 300 1,500 520,000 18,200 35,400 68,240 0 0 0 25,100 2,200 26,450 38,000 213,600 15,000 931,300 931,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started