Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Other information: Phila received an annuity of R Phila Siwela is a fashion buyer for Gucci Designs Ltd , a South African company and a

Other information:

Phila received an annuity of R Phila Siwela is a fashion buyer for Gucci Designs Ltd a South African company and a registered VAT vendor. She has been working for Gucci Designs Ltd for the last five years. She is a South African resident and lives in Hout Bay in Cape Town. Phila is age is married to Jimmy, age and they have two children that are schoolgoing. Phila and Jimmy are married out of community of property. She worked for Gucci Designs Ltd throughout the year of assessment ended February

The following information relates to Phila Chus employment at Gucci Designs Ltd for the year of assessment ending February : Phila receives a cash salary of R per month

She also received a performance bonus of R and a thirteenth cheque,

equivalent to one months cash salary. Phila was provided with exclusive use of a motor vehicle a motor car as defined for VAT purposes from February and in addition she also received a travel allowance of R per month on the same vehicle. It was purchased by Gucci Designs Ltd for Rexcluding VAT on February Gucci Designs Ltd also paid VAT of R when it purchased this motor vehicle. The motor vehicle was purchased with a full maintenance plan. Phila does not contribute towards the maintenance costs. All other costs in respect of the motor vehicle are borne by her employer. She is allowed to take the motor vehicle home each night and also has unlimited weekend use of it Phila travelled a total of kilometers in this motor vehicle up to February of which kilometers were travelled for business purposes as shown by her log book.

Phila is a member of her employers provident fund. Both her employer and she

contribute of her cash salary only to a provident fund. Phila contributed R per month towards a retirement annuity fund and Gucci Designs Ltd also contributed R per month. An amount of R relating to disallowed current retirement annuity fund contributions was carried forward from the year of assessment. She is also a beneficiary on her husband's medical aid fund. Contributions made to the medical aid by Jimmy for the entire year amounted to RR per month for Jimmy, Phila and their two children Jimmy paid R in qualifying medical expenses during the year of assessment. The medical aid refunded him an amount of R for the medical expenses that he paid. A reimbursive entertainment allowance was given to Phila as she is required to entertain clients on a regular basis. She was reimbursed for entertaining expenses actually incurred of R Gucci Designs Ltd requires Phila to be a member of Fashion Designers South Africa a professional body that maintains standards in fashion design. Her annual subscription amounted to R which was paid by Gucci Designs Ltd She also receives a cell phone allowance of R per month. Phila estimates that she uses her cell phone for business use. Her actual cell phone costs amounted to R Phila receives a subsistence allowance of R per night away from home due to local travel. Phila spent days away from home on local travel. The subsistence allowance is paid to Phila to cover the costs of meals and other incidental costs while away from home. Phila has kept an accurate record of her meals and incidental costs that she spent while away from home. The total amount of these costs amounted to R During September Gucci Designs Ltd settled a debt of R that Phila owed to a clothing store.

Gucci Designs Ltd has its own library and allows employees to take books home for private use. Phila made use of books from November to November which cost her employer Rincluding VAT and which had a market value of Rincluding VAT Gucci Designs Ltd granted each of Donnas two children a bursary. Donnas son,

Vernon, was granted a bursary of R towards his high school fees, while Donnas daughter, Suri, was granted a R bursary towards her junior school fees. Only children of employees qualify as beneficiaries of a bursary. The Commissioner regards this bursary scheme as a closed schemeOther information:

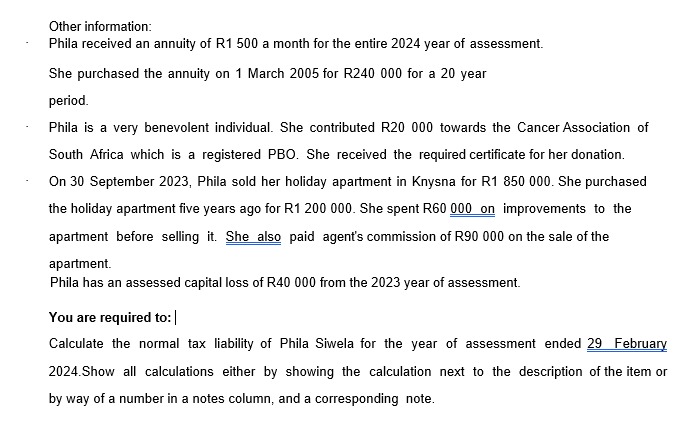

Phila received an annuity of R a month for the entire year of assessment.

She purchased the annuity on March for R for a year

period.

Phila is a very benevolent individual. She contributed R towards the Cancer Association of

South Africa which is a registered PBO. She received the required certificate for her donation.

On September Phila sold her holiday apartment in Knysna for R She purchased

apartment before selling it She also paid agent's commission of R on the sale of the

apartment.

Phila has an assessed capital loss of R from the year of assessment.SEE QUESTION ON EXTRACT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started