Question

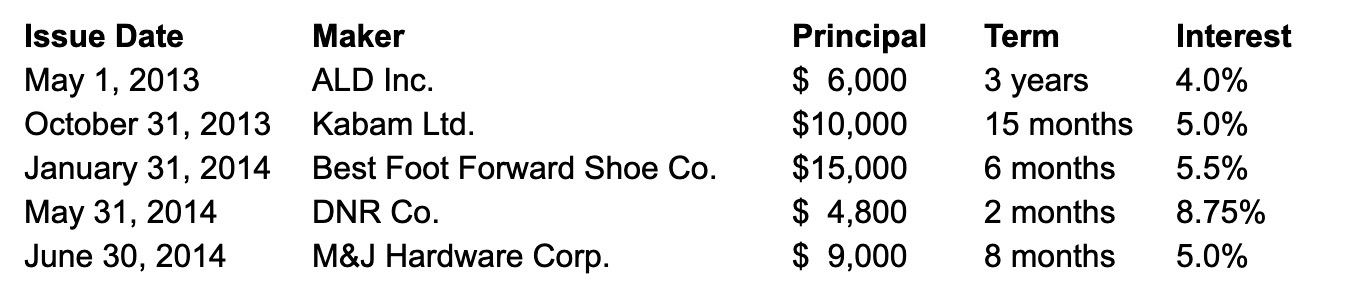

Ouellette Co. adjusts its books monthly. On June 30, 2014, notes receivable include the following: Interest is payable on the first day of each month

Ouellette Co. adjusts its books monthly. On June 30, 2014, notes receivable include the following:

Interest is payable on the first day of each month for notes with terms of one year or longer. Interest

is payable at maturity for notes with terms less than one year. In July, the following transactions were

completed:

July 1 Received payment of the interest due from ALD Inc.

2 Received payment of the interest due from Kabam Ltd.

31 Collected the full amount on the Best Foot Forward Shoe Co. note.

31 Received notice that the DNR Co. note has been dishonoured. Assume that DNR Co. is expected to pay in the future.

Instructions

Calculate the balance in the Interest Receivable and Notes Receivable accounts at June 30, 2014.

Record the July transactions and the July 31 adjusting entry for accrued interest receivable.

Enter the balances at July 1 in the receivables accounts. Post the entries to the receivables

Calculate the balances of the receivables accounts at July 31, 2014.

Record the journal entry on July 31 if DNR Co. were not expected to pay in the future.

IssueDateMay1,2013October31,2013January31,2014May31,2014June30,2014MakerALDInc.KabamLtd.BestFootForwardShoeCo.DNRCo.M&JHardwareCorp.Principal$6,000$10,000$15,000$4,800$9,000Term3years15months6months2months8monthsInterest4.0%5.0%5.5%8.75%5.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started