Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Our firm is considering the purchase of a new inventory management system, which is anticipated to cost $1,150,000. The system will be depreciated using the

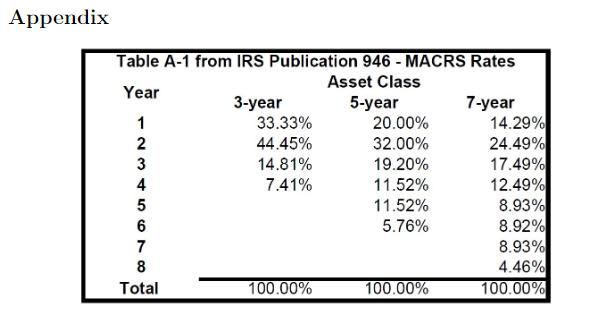

Our firm is considering the purchase of a new inventory management system, which is anticipated to cost $1,150,000. The system will be depreciated using the five year MACRS depreciation method (see the appendix). It is anticipated that the system will have a salvage value of $125,000 at the end of that time. You are expected to reduce inventory handling costs by $410,000 before taxes each year, and you will reduce working capital by $133,000 (one-time reduction) due to the increased inventory efficiencies.

Appendix Table A-1 from IRS Publication 946 - MACRS Rates Asset Class Year 5-year 1 2 3 4 56780 Total 3-year 33.33% 44.45% 14.81% 7.41% 100.00% 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 100.00% 7-year 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% 100.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Depreciations working Year 1 2 3 4 5 6 Depreciation rate 2000 3200 1900 1152 1152 576 Depreciation a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started