our professor is allowing us to make a double sided regular sized paper "cheat sheet" for an exam that can include anything you want from formulas to tips. Can someone please create one for me based on the information on this review sheet and keeping in mind the types of practice problems you see. please make it so someone who doesnt really understand the subject would still understand it and still be able to use it for help during the test. Thank you!! (Test is multiple choice)

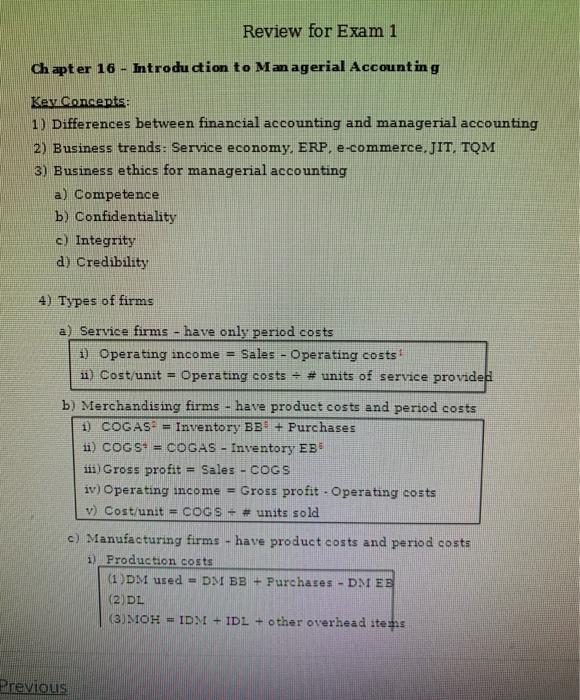

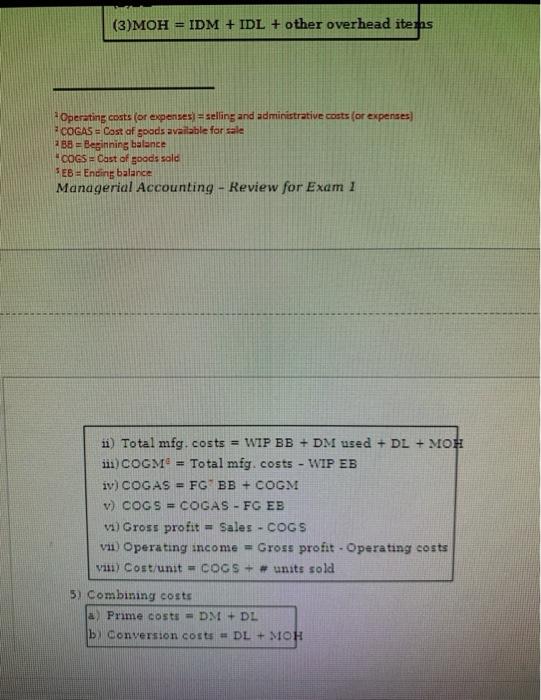

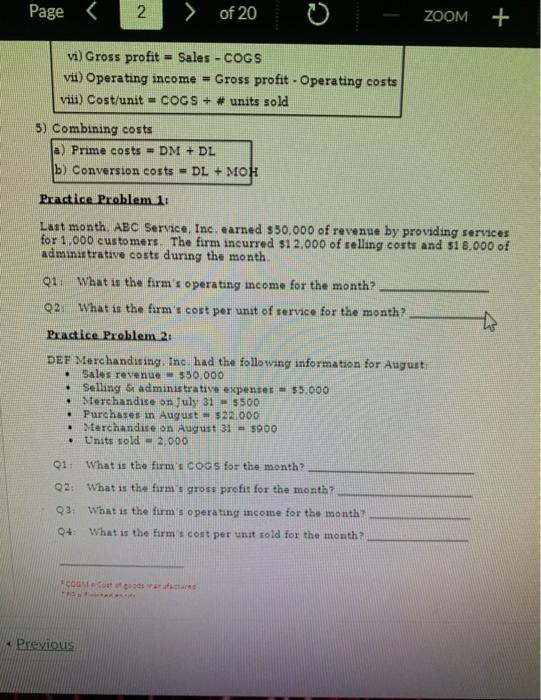

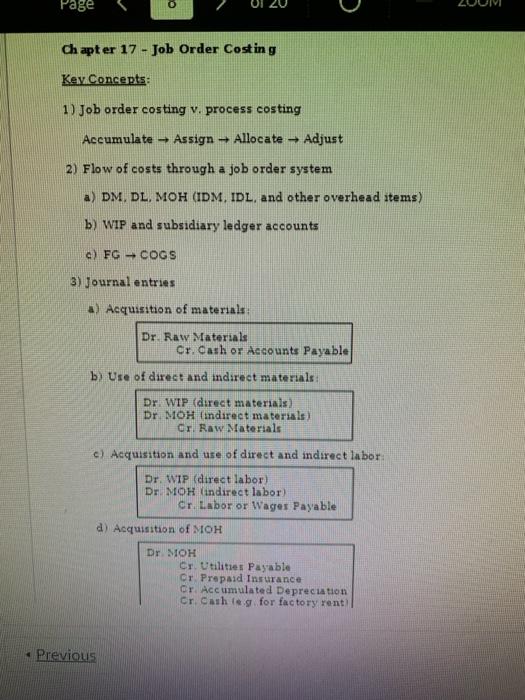

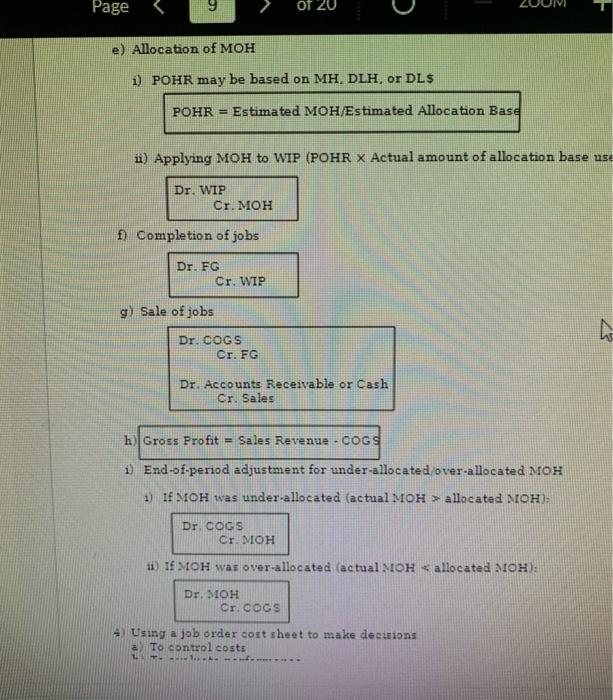

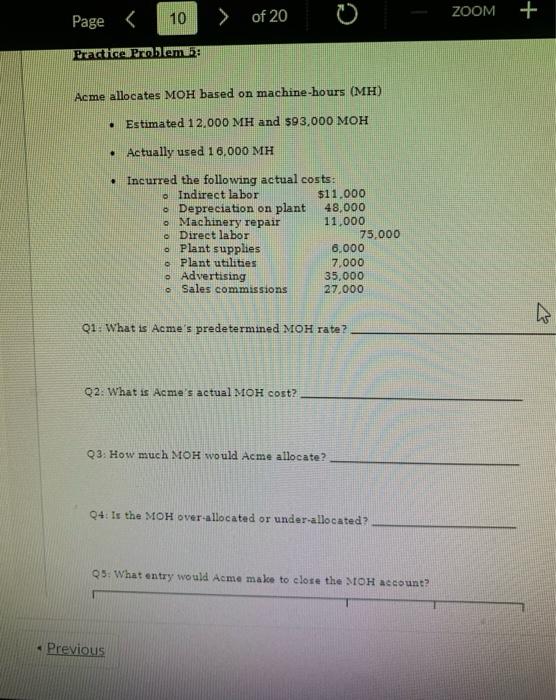

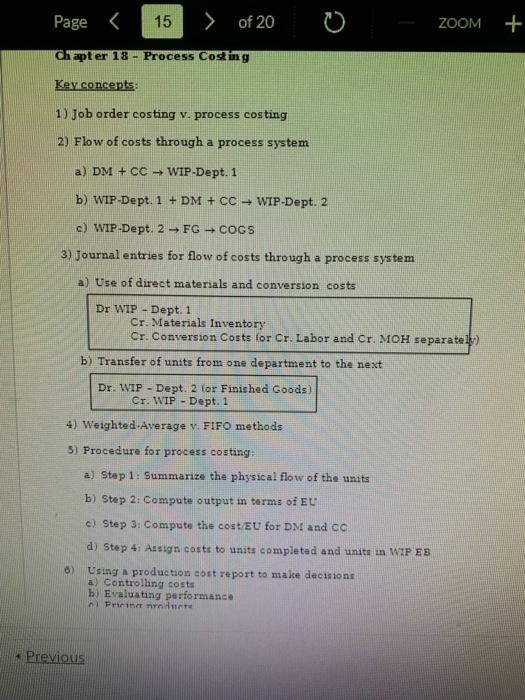

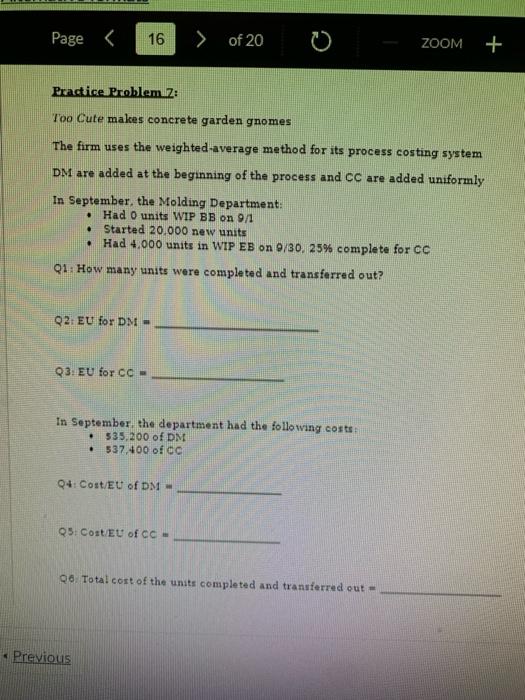

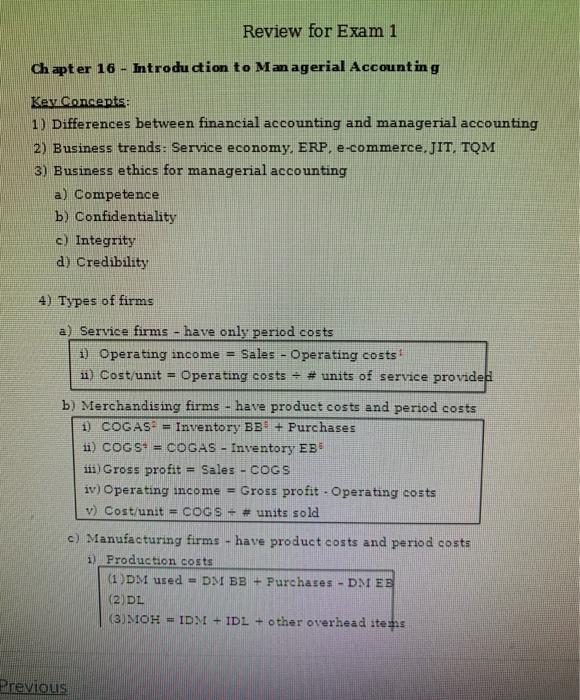

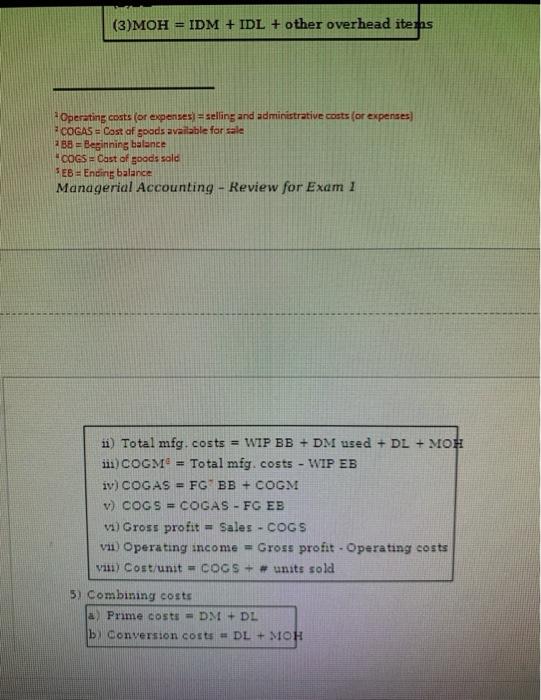

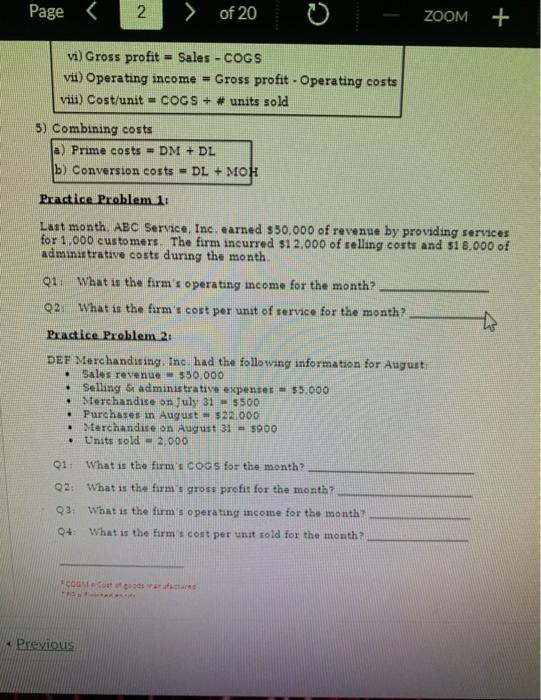

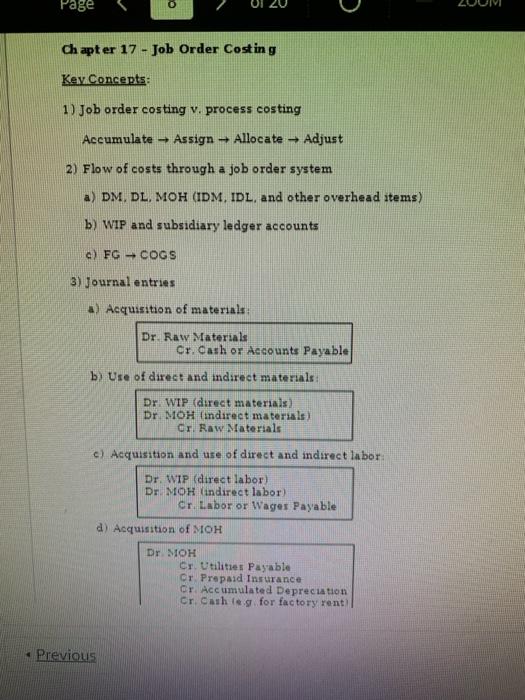

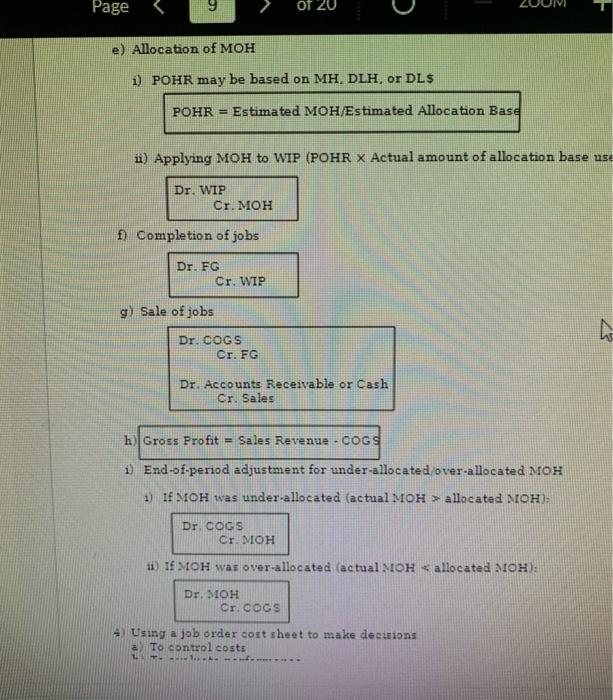

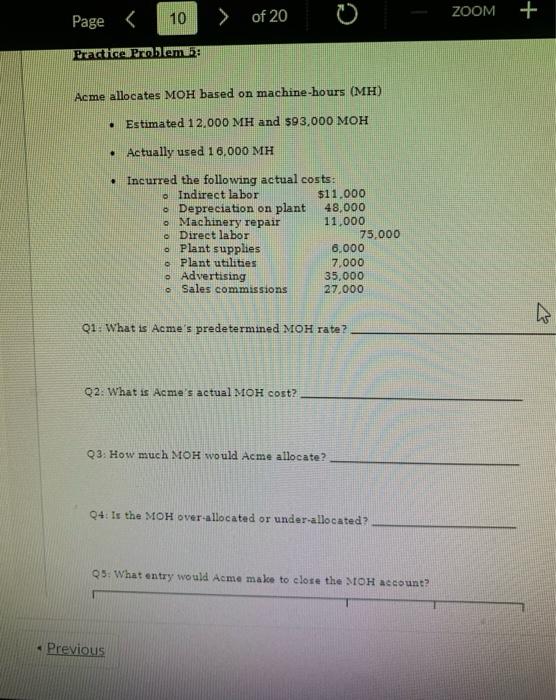

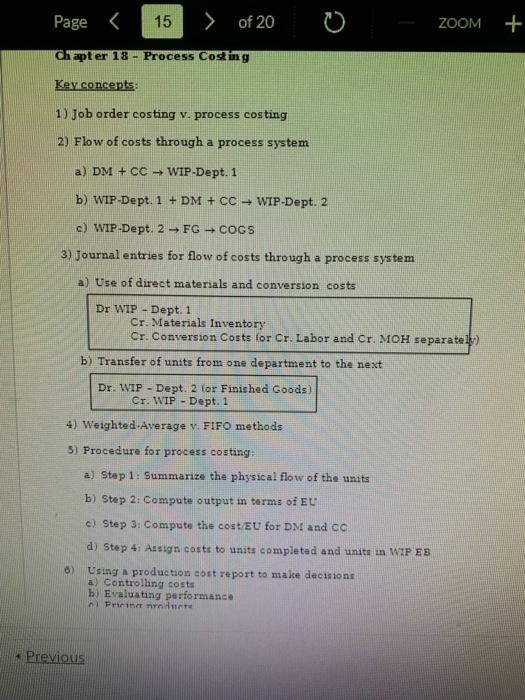

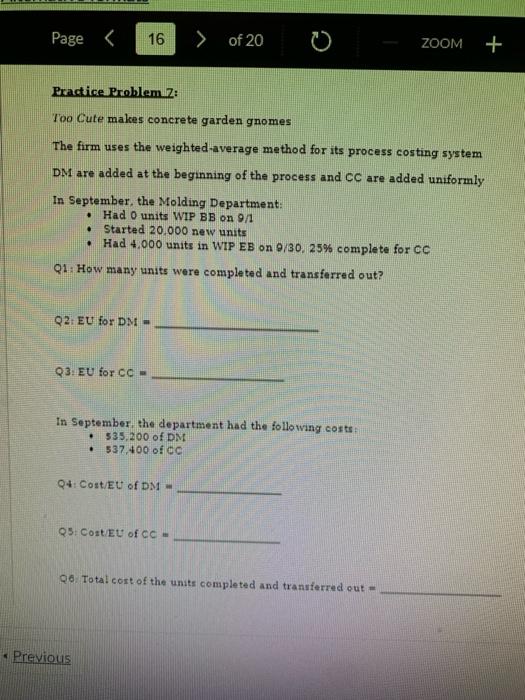

Ch apter 16 - Introduction to Managerial Accounting Key Cencepts: 1) Differences between financial accounting and managerial accounting 2) Business trends: Service economy, ERP, e-commerce,JIT, TQM 3) Business ethics for managerial accounting a) Competence b) Confidentiality c) Integrity d) Credibility 4) Types of firms a) Service firms - have only period costs 1) Operating income = Sales - Operating costs 1 ii) Cost/unit = Operating costs \# units of service provided b) Merchandising firms - have product costs and period costs 1) COGAS= Inventory BBt+ Purchases ii) cogS= COGAS - Inventory EB iii) Gross profit = Sales - CoGS iv) Operating income = Gross profit . Operating costs v) Cost/unit =COGS+# units sold c) Manufacturing firms - have product costs and period costs 1) Production costs (3) MOH =IDM+IDL+ other overhead iteps 2 Operating costs (or expenses) = selling and administrative costs (or expenses) 2 cocas = Cost of goods available for sale 2BA= Beginning balance COCS = Cast of goods sald SEB = Endins balance Managerial Accounting - Review for Exam I ii) Total mfgcosts= WIP BB +DM used +DL+MOH iii) COGMa= Total mfg. costs - WIP EB iv) COGAS=FGBB+COGM v) COCS= COGAS - FG EB v) Gross profit = Sales - COGS vi1) Operating income = Gross profit - Operating costs vin) Cost/unit =cocS+# units sold 5) Combining costs a) Prume costs =DM+DL b) Conversion costs =DL+MOH vi) Gross profit = Sales - COGS vii) Operating income = Gross profit. Operating costs vii) Cost/unit =cogs+# units sold 5) Combining costs a) Prime costs =DM+DL b) Conversion costs =DL+MOH Bractice Problem 1: Last month. ABC Service, Inc, arned $50,000 of revenue by providing services for 1,000 customers. The firm incurred $12,000 of relling costs and $18,000 of administrative costs during the month. Q1: What is the firm's operating income for the month? Q2. What is the frm's cost per unit of service for the month? Practice Problem 2: DEF Merchandiring, Inc. had the followng information for Augurt: - Sales revenue =$30,000 - Selling sa administrative expenter =$5,000 - Merchandire on july 31=$500 - Purchases in August =522,000 - Merchandise on August 31=5900 - Units sold =2,000 Q1: What is the firm a coos for the month? Q2: What is the firm is gross profit for the month? Q3. What is the furm s operating income for the month? Q4 What is the firm s cost per unit rold for the moath? Ch apter 17 - Job Order Costing Kev Concepts: 1) Job order costing v, process costing Accumulate Assign Allocate Adjust 2) Flow of costs through a job order system a) DM, DL, MOH (IDM, IDL, and other overhead items) b) WIP and subsidiary ledger accounts c) FGCOOS 3) journal entries a) Acquisition of materials: b) Use of direct and indirect materials: Dr. WIP (direct materials) Dr. MOH (indirect materials) Cr. Raw Materials c) Acquisition and use of direct and indirect labor: Dr. WIP (direct labor) Dr. MOH (indirect labor) Cr.tabor or Wager Payable d) Acquisition of MOH Dr. MOH Cx. Utilitien Payable Cr. Prepaid Insurance Cr. Accumulated Depreciation Cr. Cash ieg for factory rent) e) Allocation of MOH i) POHR may be based on MH, DLH, or DLS ii) Applying MOH to WIP (POHR Actual amount of allocation base us f) Completion of jobs g) Sale of jobs h) Gross Profit = Sales Revenue cos$ 1) End-of-period adjustment for under-allocated/over-allocated MOH 1) If MOH was under-allocated (actual MOH> allocated MOH ): ii) If MOH was over-allocated (actual MOH