Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Out of these numbers I am trying to find current assets. begin{tabular}{|c|c|c|c|c|} hline (3) Cash & Equivalents & 11,458,000> & 10,399,000> & 8,470,000= & 11,

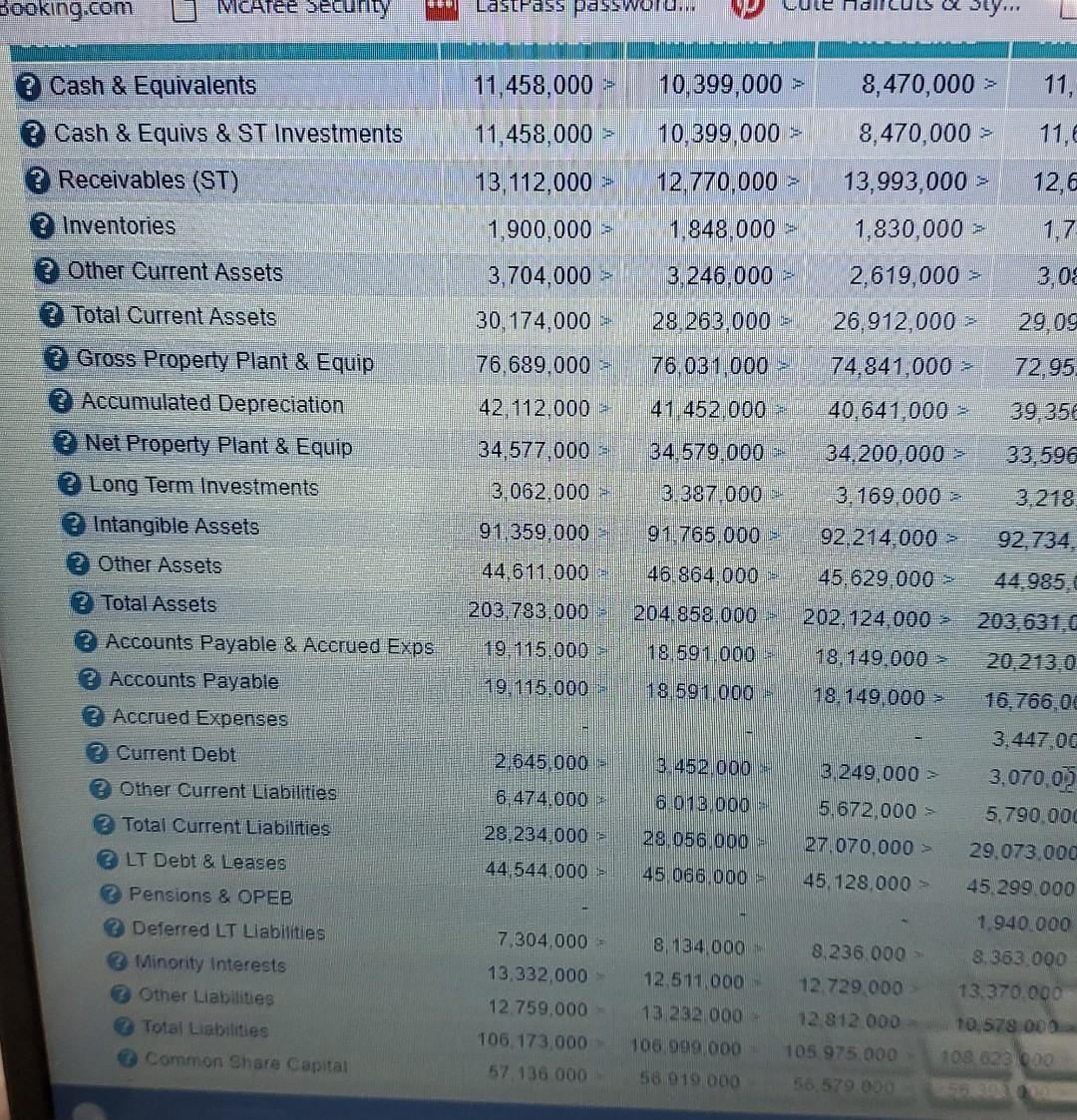

Out of these numbers I am trying to find current assets.

\begin{tabular}{|c|c|c|c|c|} \hline (3) Cash \& Equivalents & 11,458,000> & 10,399,000> & 8,470,000= & 11, \\ \hline (3) Cash \& Equivs \& ST Investments & 11,458,000> & 10,399,000> & 8,470,000= & \\ \hline (3) Receivables (ST) & 13,112,000> & 12,770,000> & 13,993,000= & \\ \hline (3) Inventories & 1,900,000> & 1,848,000= & 1,830,000> & \\ \hline (3) Other Current Assets & 3,704,000> & 3,246,000> & 2,619,000> & \\ \hline (3) Total Current Assets & 30,174,000 & 28,263,000= & 26,912,000> & \\ \hline (3) Gross Property Plant \& Equip & 76,689,000= & 76,031,000> & 74,841,000> & \\ \hline (3) Accumulated Depreciation & 42,112,000> & 41,452,000 & 40,641,000= & \\ \hline (3) Net Property Plant \& Equip & 34,577,000 & 34,579,000= & 34,200,000> & 33 \\ \hline (3) Long Term Investments & 3,062,000 & 3,387,000 & 3,169,000= & 3,21 \\ \hline (3) Intangible Assets & 91,359,000 & 91,765,000= & 92,214,000> & 92,73 \\ \hline (3) Other Assets & 44,611,000 & 46.864,000 & 45,629,000> & 44,98 \\ \hline (3) Total Assets & 203,783,000= & 204,858,000 & 202,124,000= & 203,63 \\ \hline (3) Accounts Payable \& Accrued Exps & 19,115,000 & 18,591.000 & 18,149,000> & 20,213 \\ \hline (3) Accounts Payable & 19,115,000 & 18.591 .000 & 18,149,000> & 16,766,0 \\ \hline (3) Accrued Expenses & & & & 3,447 \\ \hline (3) Current Debt & 2,645,000= & 3.452,000 & 3,249,000= & 3,070,0,2 \\ \hline (3) Other Current Liabilities & 6,474,000 & 6.013,000 & 5,672,000= & 5,790,00 \\ \hline (3) Total Current Liabilities & 28,234,000= & 28.056,000 & 27,070,000> & 29,073,000 \\ \hline (3) LT Debt \& Leases & 44,544,000= & 45.066,000 & 45,128,000= & 45,299,000 \\ \hline (3) Pensions \& OPEB & & & & 1,940.000 \\ \hline (3) Deferred LT Liabilities & 7,304,000= & 8,134,000= & 8,236.000 & 8,363.00 \\ \hline (3) Minority Interests & 13,332,000 & 12,511,000 & 12,729,000 & 13,370,04 \\ \hline (3) Other Liabilites & 12.759,000 & 13232,000 & 12812000 & 10.57800 \\ \hline (6) Total Liabilities & 106,173,000 & 106.999,000 & 105975.000 & \\ \hline Common Share Capital & 57,136.000 & 56919000 & 79000 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline (3) Cash \& Equivalents & 11,458,000> & 10,399,000> & 8,470,000= & 11, \\ \hline (3) Cash \& Equivs \& ST Investments & 11,458,000> & 10,399,000> & 8,470,000= & \\ \hline (3) Receivables (ST) & 13,112,000> & 12,770,000> & 13,993,000= & \\ \hline (3) Inventories & 1,900,000> & 1,848,000= & 1,830,000> & \\ \hline (3) Other Current Assets & 3,704,000> & 3,246,000> & 2,619,000> & \\ \hline (3) Total Current Assets & 30,174,000 & 28,263,000= & 26,912,000> & \\ \hline (3) Gross Property Plant \& Equip & 76,689,000= & 76,031,000> & 74,841,000> & \\ \hline (3) Accumulated Depreciation & 42,112,000> & 41,452,000 & 40,641,000= & \\ \hline (3) Net Property Plant \& Equip & 34,577,000 & 34,579,000= & 34,200,000> & 33 \\ \hline (3) Long Term Investments & 3,062,000 & 3,387,000 & 3,169,000= & 3,21 \\ \hline (3) Intangible Assets & 91,359,000 & 91,765,000= & 92,214,000> & 92,73 \\ \hline (3) Other Assets & 44,611,000 & 46.864,000 & 45,629,000> & 44,98 \\ \hline (3) Total Assets & 203,783,000= & 204,858,000 & 202,124,000= & 203,63 \\ \hline (3) Accounts Payable \& Accrued Exps & 19,115,000 & 18,591.000 & 18,149,000> & 20,213 \\ \hline (3) Accounts Payable & 19,115,000 & 18.591 .000 & 18,149,000> & 16,766,0 \\ \hline (3) Accrued Expenses & & & & 3,447 \\ \hline (3) Current Debt & 2,645,000= & 3.452,000 & 3,249,000= & 3,070,0,2 \\ \hline (3) Other Current Liabilities & 6,474,000 & 6.013,000 & 5,672,000= & 5,790,00 \\ \hline (3) Total Current Liabilities & 28,234,000= & 28.056,000 & 27,070,000> & 29,073,000 \\ \hline (3) LT Debt \& Leases & 44,544,000= & 45.066,000 & 45,128,000= & 45,299,000 \\ \hline (3) Pensions \& OPEB & & & & 1,940.000 \\ \hline (3) Deferred LT Liabilities & 7,304,000= & 8,134,000= & 8,236.000 & 8,363.00 \\ \hline (3) Minority Interests & 13,332,000 & 12,511,000 & 12,729,000 & 13,370,04 \\ \hline (3) Other Liabilites & 12.759,000 & 13232,000 & 12812000 & 10.57800 \\ \hline (6) Total Liabilities & 106,173,000 & 106.999,000 & 105975.000 & \\ \hline Common Share Capital & 57,136.000 & 56919000 & 79000 & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started