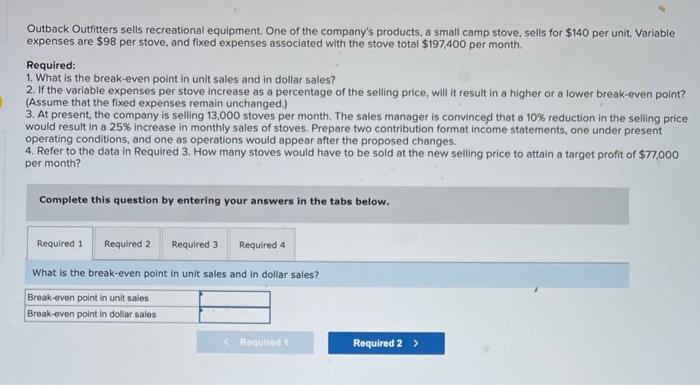

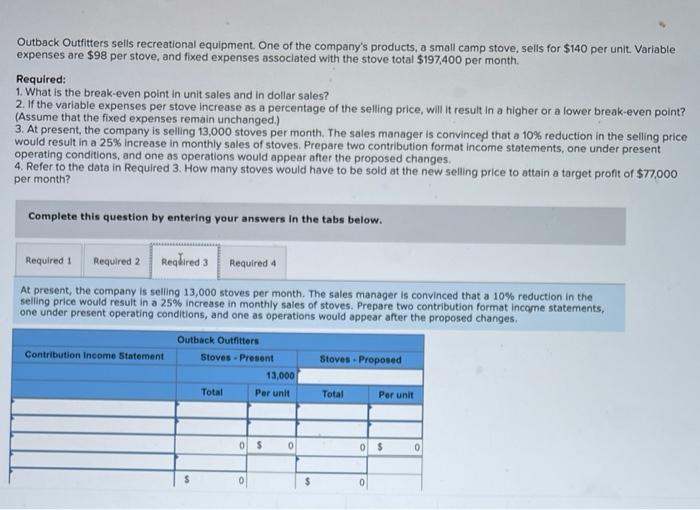

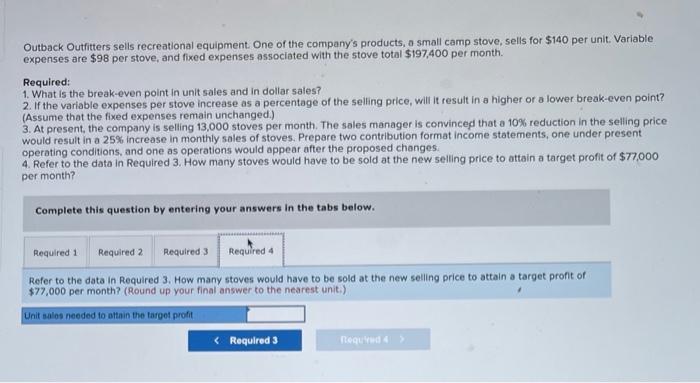

Outback Outfitters sells recreational equipment, One of the company's products, a small camp stove, sells for $140 per unit. Variable expenses are $98 per stove, and fixed expenses associated with the stove total $197,400 per month. Required: 1. What is the break-even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break-even point? (Assume that the fixed expenses remain unchanged.) 3. At present, the company is selling 13,000 stoves per month. The sales manager is convinced that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. 4. Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $77,000 per month? Complete this question by entering your answers in the tabs below. What is the break-even point in unit sales and in dollar sales? Outback Outfitters sells recreational equipment. One of the company's products, a small camp stove, sells for $140 per unit. Variable expenses are $98 per stove, and fixed expenses assoclated with the stove total $197,400 per month. Required: 1. What is the break-even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break-even point? (Assume that the fixed expenses remain unchanged.) 3. At present, the company is selling 13,000 stoves per month. The sales manager is convinceg that a 10% reduction in the selling price would result in a 25\% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. 4. Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $77,000 per month? Complete this question by entering your answers in the tabs below. At present, the company is selling 13,000 stoves per month. The sales manager is convinced that a 10% reduction in the seling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format incame statements, one under present operating conditions, and one as operations would appear after the proposed changes. Outback Outfitters sells recreational equipment. One of the company's products, a small camp stove, sells for $140 per unit. Variable expenses are $98 per stove, and fixed expenses associated with the stove total $197,400 per month. Required: 1. What is the break-oven point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break-even point? (Assume that the fixed expenses remain unchanged.) 3. At present, the company is selling 13,000 stoves per month. The sales manager is convincep that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. 4. Refer to the dato in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $77,000 per month? Complete this question by entering your answers in the tabs below. Refer to the data in Required 3. How many stoves would have to be sold at the new seliling price to attain a target profit of $77,000 per month? (Round up your final answer to the nearest unit.)