please help me answer corret all the question, no explain. Thank you!

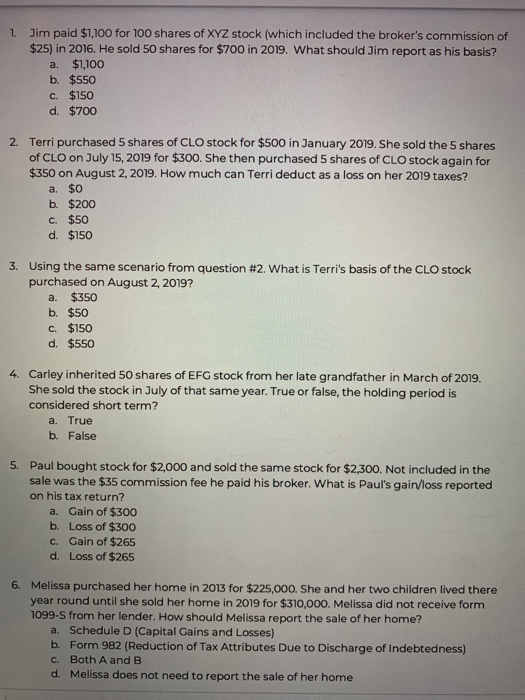

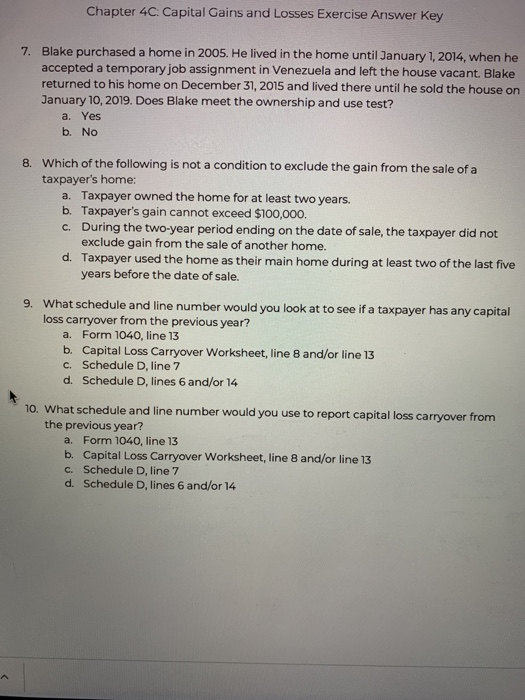

1 Jim paid $1,100 for 100 shares of XYZ stock (which included the broker's commission of $25) in 2016. He sold 50 shares for $700 in 2019. What should Jim report as his basis? a. $1,100 b. $550 c. $150 d. $700 2. Terri purchased 5 shares of CLO stock for $500 in January 2019. She sold the 5 shares of CLO on July 15, 2019 for $300. She then purchased 5 shares of CLO stock again for $350 on August 2, 2019. How much can Terri deduct as a loss on her 2019 taxes? a $0 b. $200 C. $50 d. $150 3. Using the same scenario from question #2. What is Terri's basis of the CLO stock purchased on August 2, 2019? a. $350 b. $50 c. $150 d. $550 4. Carley inherited 50 shares of EFG stock from her late grandfather in March of 2019. She sold the stock in July of that same year. True or false, the holding period is considered short term? a. True b. False 5. Paul bought stock for $2,000 and sold the same stock for $2,300. Not included in the sale was the $35 commission fee he paid his broker. What is Paul's gain/loss reported on his tax return? a. Gain of $300 b. Loss of $300 c. Gain of $265 d. Loss of $265 6. Melissa purchased her home in 2013 for $225,000. She and her two children lived there year round until she sold her home in 2019 for $310,000. Melissa did not receive form 1099-s from her lender. How should Melissa report the sale of her home? a. Schedule D (Capital Gains and Losses) b. Form 982 (Reduction of Tax Attributes Due to Discharge of indebtedness) C. Both A and B d. Melissa does not need to report the sale of her home Chapter 4C: Capital Gains and Losses Exercise Answer Key 7. Blake purchased a home in 2005. He lived in the home until January 1, 2014, when he accepted a temporary job assignment in Venezuela and left the house vacant. Blake returned to his home on December 31, 2015 and lived there until he sold the house on January 10, 2019. Does Blake meet the ownership and use test? a. Yes b. No 8. Which of the following is not a condition to exclude the gain from the sale of a taxpayer's home: a. Taxpayer owned the home for at least two years. b. Taxpayer's gain cannot exceed $100,000. c. During the two-year period ending on the date of sale, the taxpayer did not exclude gain from the sale of another home. d. Taxpayer used the home as their main home during at least two of the last five years before the date of sale. 9. What schedule and line number would you look at to see if a taxpayer has any capital loss carryover from the previous year? a. Form 1040, line 13 b. Capital Loss Carryover Worksheet, line 8 and/or line 13 C. Schedule D, line 7 d. Schedule D, lines 6 and/or 14 10. What schedule and line number would you use to report capital loss carryover from the previous year? a. Form 1040, line 13 b. Capital Loss Carryover Worksheet, line 8 and/or line 13 C. Schedule D line 7 d. Schedule D, lines 6 and/or 14