Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Over a four-year period ending on December 31, 2021, Ms. Brenda Breau had the following financial data: Non-farming business income (loss) Farming business income

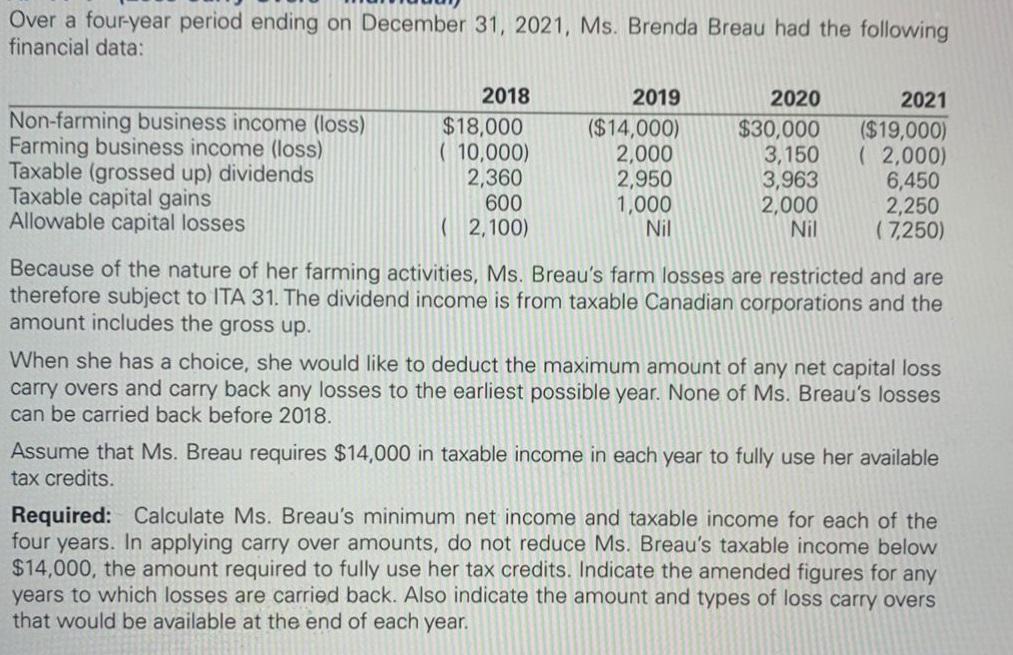

Over a four-year period ending on December 31, 2021, Ms. Brenda Breau had the following financial data: Non-farming business income (loss) Farming business income (loss) Taxable (grossed up) dividends Taxable capital gains Allowable capital losses 2018 $18,000 (10,000) 2,360 600 (2,100) 2019 ($14,000) 2,000 2,950 1,000 Nil 2020 $30,000 3,150 3,963 2,000 Nil 2021 ($19,000) ( 2,000) 6,450 2,250 (7,250) Because of the nature of her farming activities, Ms. Breau's farm losses are restricted and are therefore subject to ITA 31. The dividend income is from taxable Canadian corporations and the amount includes the gross up. When she has a choice, she would like to deduct the maximum amount of any net capital loss carry overs and carry back any losses to the earliest possible year. None of Ms. Breau's losses can be carried back before 2018. Assume that Ms. Breau requires $14,000 in taxable income in each year to fully use her available tax credits. Required: Calculate Ms. Breau's minimum net income and taxable income for each of the four years. In applying carry over amounts, do not reduce Ms. Breau's taxable income below $14,000, the amount required to fully use her tax credits. Indicate the amended figures for any years to which losses are carried back. Also indicate the amount and types of loss carry overs that would be available at the end of each year.

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

2018 Minimum net income 14000 Minimum taxable income 14000 2019 Minimum net income 14000 Minimum tax...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started