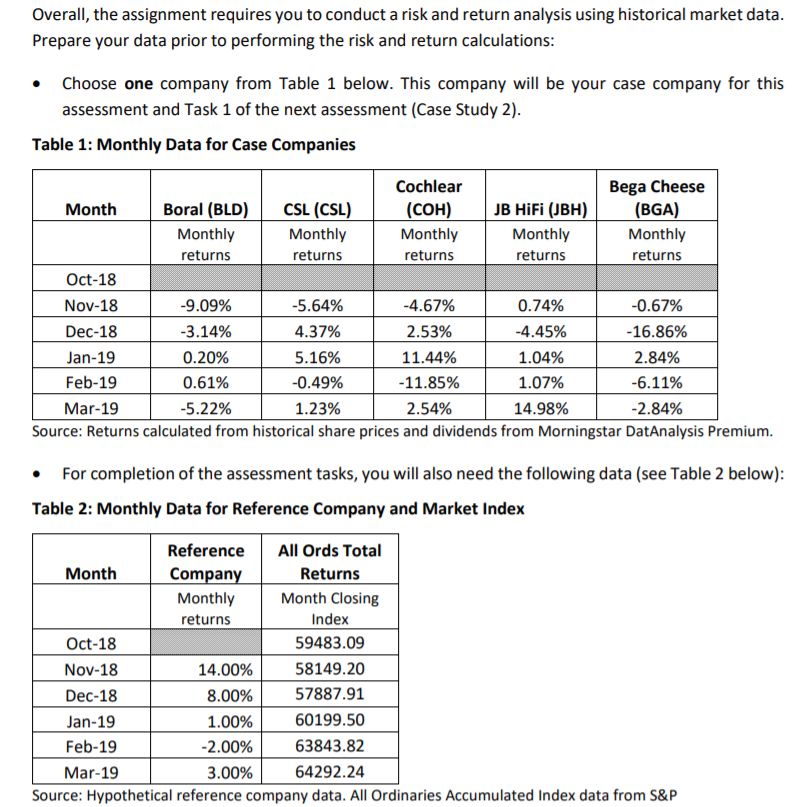

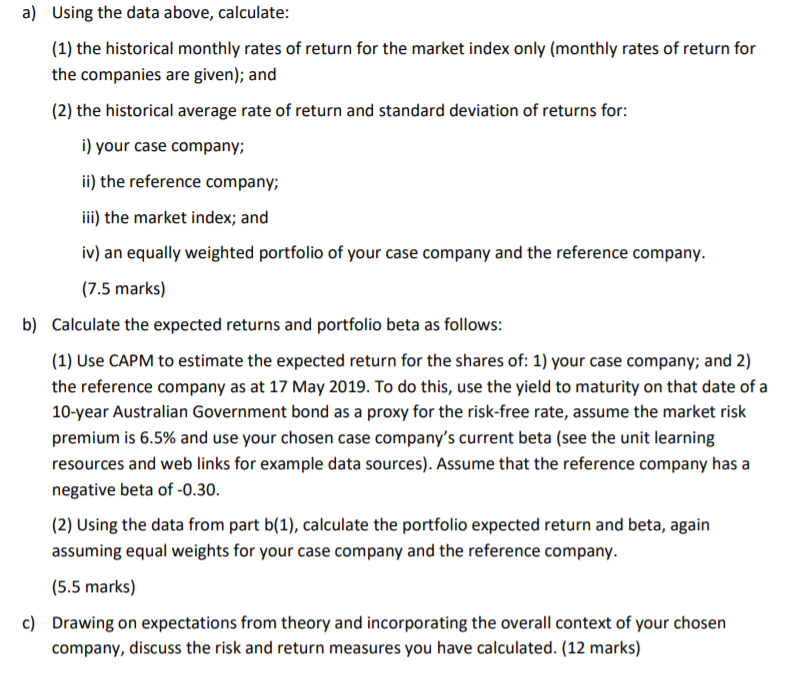

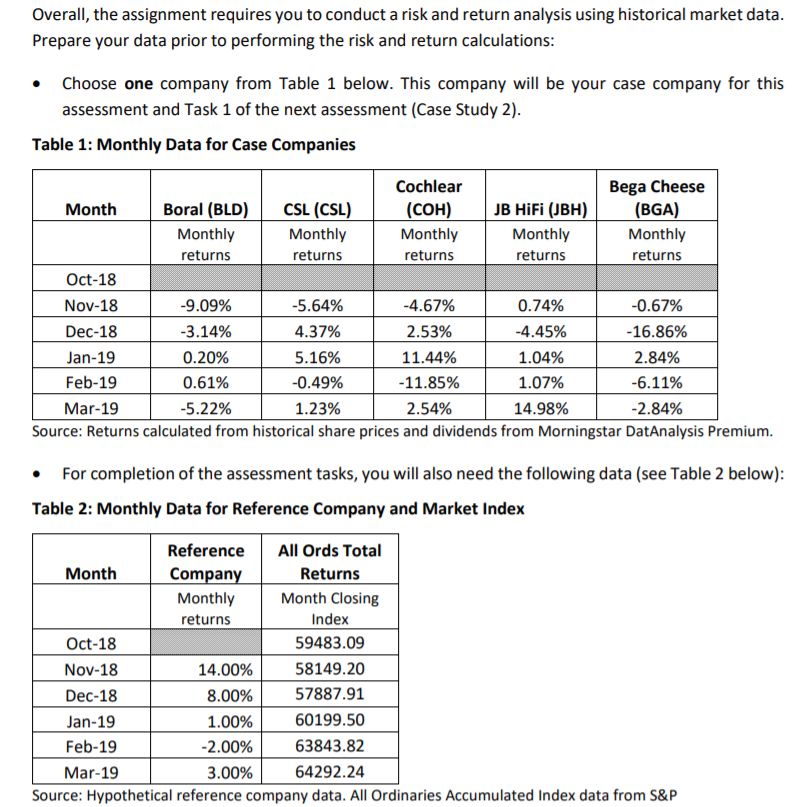

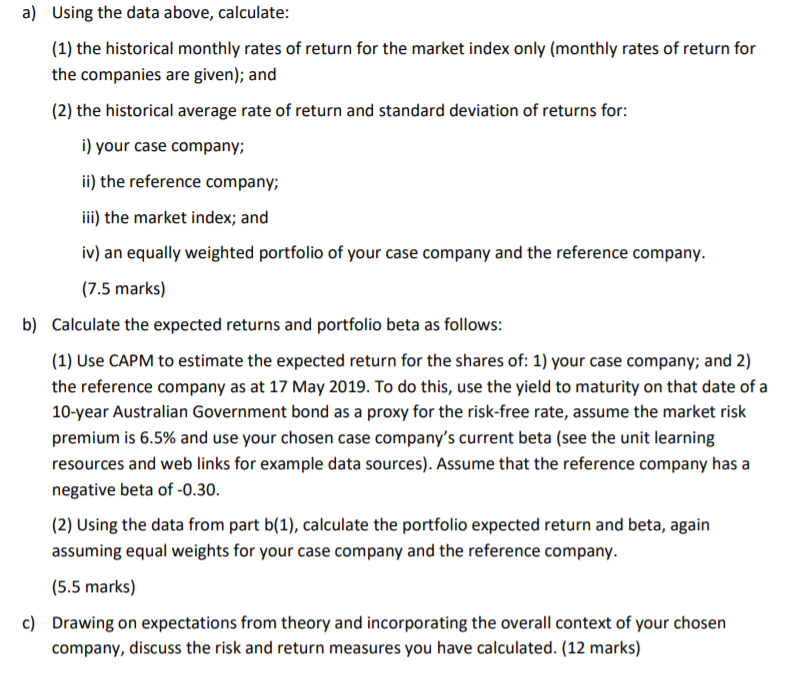

Overall, the assignment requires you to conduct a risk and return analysis using historical market data Prepare your data prior to performing the risk and return calculations Choose one company from Table 1 below. This company will be your case company for this assessment and Task 1 of the next assessment (Case Study 2) Table 1: Monthly Data for Case Companies Cochlear Bega Cheese (COH) JB HiFi (UBH)(BGA) Month Boral (BLD)CSL (CSL) Monthly Monthly Monthly Monthly Monthly returns returns returns returns returns Oct-18 -4.67% Nov-18 -9.09% -5.64% 0.74% -0.67% 4.45% Dec-18 -3.14% 4.37% 2.53% -16.86% Jan-19 1 1.44% 2.84% 0.20% 5.16% 1.04% Feb-19 0.61% -0.49% -11.85% 1.07% -6.11% 1.23% Mar-19 -5.22% 2.54% 14.98% -2.84% Source: Returns calculated from historical share prices and dividends from Morningstar DatAnalysis Premium For completion of the assessment tasks, you will also need the following data (see Table 2 below) Table 2: Monthly Data for Reference Company and Market Index Reference All Ords Total Month Compan Returns Monthly Month Closing Index returns 9483.09 Oct-18 Nov-18 58149.20 14.00% 8.00% 096 | 57887.91 Dec-18 60199.50 Jan-19 1.00% Feb-19 -2.00% 63843.82 4292.24 Mar-19 3.00% Source: Hypothetical reference company data. All Ordinaries Accumulated Index data from S&P a) Using the data above, calculate: (1) the historical monthly rates of return for the market index only (monthly rates of return for the companies are given); and (2) the historical average rate of return and standard deviation of returns for: i) your case company; ii) the reference company; ii) the market index; and iv) an equally weighted portfolio of your case company and the reference company (7.5 marks) Calculate the expected returns and portfolio beta as follows: b) (1) Use CAPM to estimate the expected return for the shares of: 1) your case company; and 2) the reference company as at 17 May 2019. To do this, use the yield to maturity on that date of a 10-year Australian Government bond as a proxy for the risk-free rate, assume the market risk premium is 6.5% and use your chosen case company's current beta (see the unit learning resources and web links for example data sources). Assume that the reference company has a negative beta of -0.30. (2) Using the data from part b(1), calculate the portfolio expected return and beta, again assuming equal weights for your case company and the reference company (5.5 marks) c) Drawing on expectations from theory and incorporating the overall context of your chosen company, discuss the risk and return measures you have calculated. (12 marks) Overall, the assignment requires you to conduct a risk and return analysis using historical market data Prepare your data prior to performing the risk and return calculations Choose one company from Table 1 below. This company will be your case company for this assessment and Task 1 of the next assessment (Case Study 2) Table 1: Monthly Data for Case Companies Cochlear Bega Cheese (COH) JB HiFi (UBH)(BGA) Month Boral (BLD)CSL (CSL) Monthly Monthly Monthly Monthly Monthly returns returns returns returns returns Oct-18 -4.67% Nov-18 -9.09% -5.64% 0.74% -0.67% 4.45% Dec-18 -3.14% 4.37% 2.53% -16.86% Jan-19 1 1.44% 2.84% 0.20% 5.16% 1.04% Feb-19 0.61% -0.49% -11.85% 1.07% -6.11% 1.23% Mar-19 -5.22% 2.54% 14.98% -2.84% Source: Returns calculated from historical share prices and dividends from Morningstar DatAnalysis Premium For completion of the assessment tasks, you will also need the following data (see Table 2 below) Table 2: Monthly Data for Reference Company and Market Index Reference All Ords Total Month Compan Returns Monthly Month Closing Index returns 9483.09 Oct-18 Nov-18 58149.20 14.00% 8.00% 096 | 57887.91 Dec-18 60199.50 Jan-19 1.00% Feb-19 -2.00% 63843.82 4292.24 Mar-19 3.00% Source: Hypothetical reference company data. All Ordinaries Accumulated Index data from S&P a) Using the data above, calculate: (1) the historical monthly rates of return for the market index only (monthly rates of return for the companies are given); and (2) the historical average rate of return and standard deviation of returns for: i) your case company; ii) the reference company; ii) the market index; and iv) an equally weighted portfolio of your case company and the reference company (7.5 marks) Calculate the expected returns and portfolio beta as follows: b) (1) Use CAPM to estimate the expected return for the shares of: 1) your case company; and 2) the reference company as at 17 May 2019. To do this, use the yield to maturity on that date of a 10-year Australian Government bond as a proxy for the risk-free rate, assume the market risk premium is 6.5% and use your chosen case company's current beta (see the unit learning resources and web links for example data sources). Assume that the reference company has a negative beta of -0.30. (2) Using the data from part b(1), calculate the portfolio expected return and beta, again assuming equal weights for your case company and the reference company (5.5 marks) c) Drawing on expectations from theory and incorporating the overall context of your chosen company, discuss the risk and return measures you have calculated. (12 marks)