Answered step by step

Verified Expert Solution

Question

1 Approved Answer

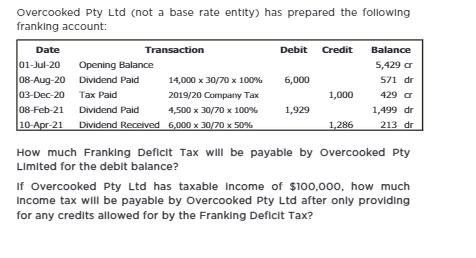

Overcooked Pty Ltd (not a base rate entity) has prepared the following franking account: Transaction Date 01-Jul-20 Opening Balance 08-Aug-20 Dividend Paid 03-Dec-20 Tax

Overcooked Pty Ltd (not a base rate entity) has prepared the following franking account: Transaction Date 01-Jul-20 Opening Balance 08-Aug-20 Dividend Paid 03-Dec-20 Tax Paid 14,000 x 30/70 x 100% 2019/20 Company Tax 08-Feb-21 Dividend Paid 4,500 x 30/70 x 100% 10-Apr-21 Dividend Received 6,000 x 30/70 x 50% Debit Credit 6,000 1,929 1,000 1,286 Balance 5,429 cr 571 dr 429 C 1,499 dr 213 dr How much Franking Deficit Tax will be payable by Overcooked Pty Limited for the debit balance? If Overcooked Pty Ltd has taxable Income of $100,000, how much Income tax will be payable by Overcooked Pty Ltd after only providing for any credits allowed for by the Franking Deficit Tax?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the franking account you provided Overcooked Pty Ltd has a franking deficit of 213 This mea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started