Question

taxpayer purchased and placed in service a computer network for his CPA practice that cost $43,000 on December 17. 2019. He did not take

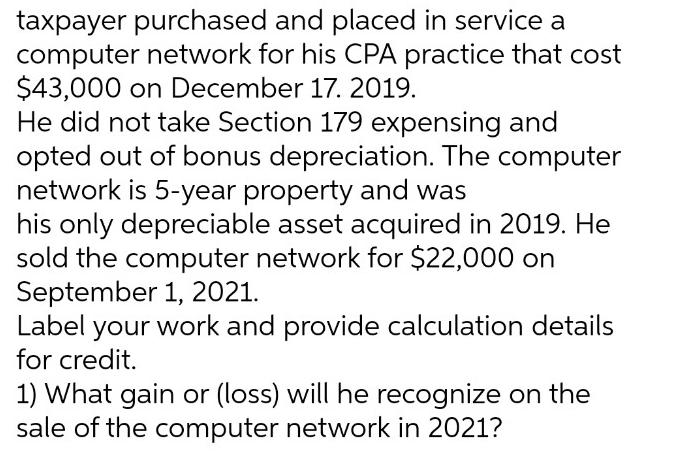

taxpayer purchased and placed in service a computer network for his CPA practice that cost $43,000 on December 17. 2019. He did not take Section 179 expensing and opted out of bonus depreciation. The computer network is 5-year property and was his only depreciable asset acquired in 2019. He sold the computer network for $22,000 on September 1, 2021. Label your work and provide calculation details for credit. 1) What gain or (loss) will he recognize on the sale of the computer network in 2021?

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the gain or loss on the sale of the computer network we need to determine its ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App