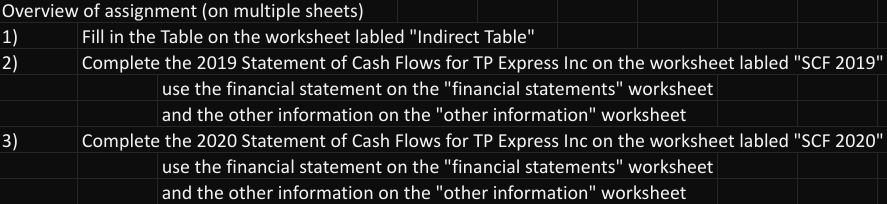

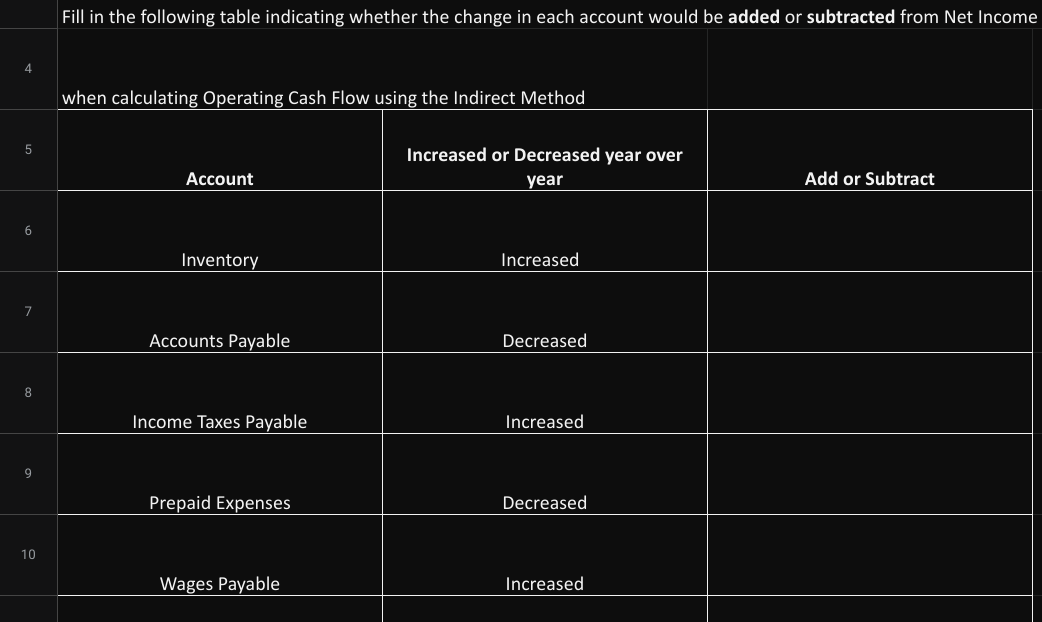

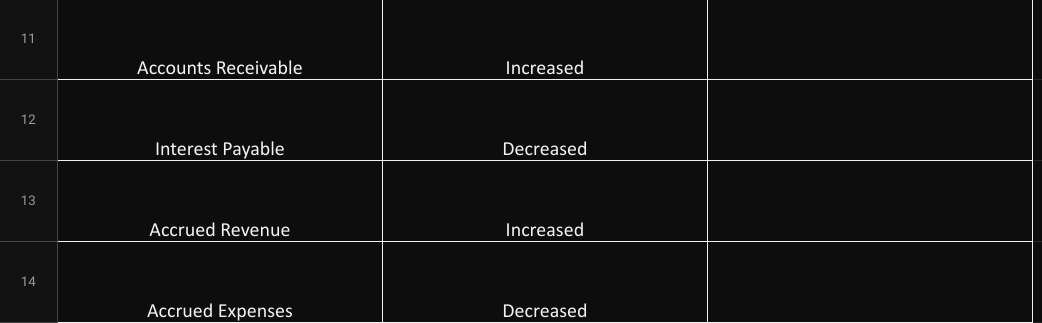

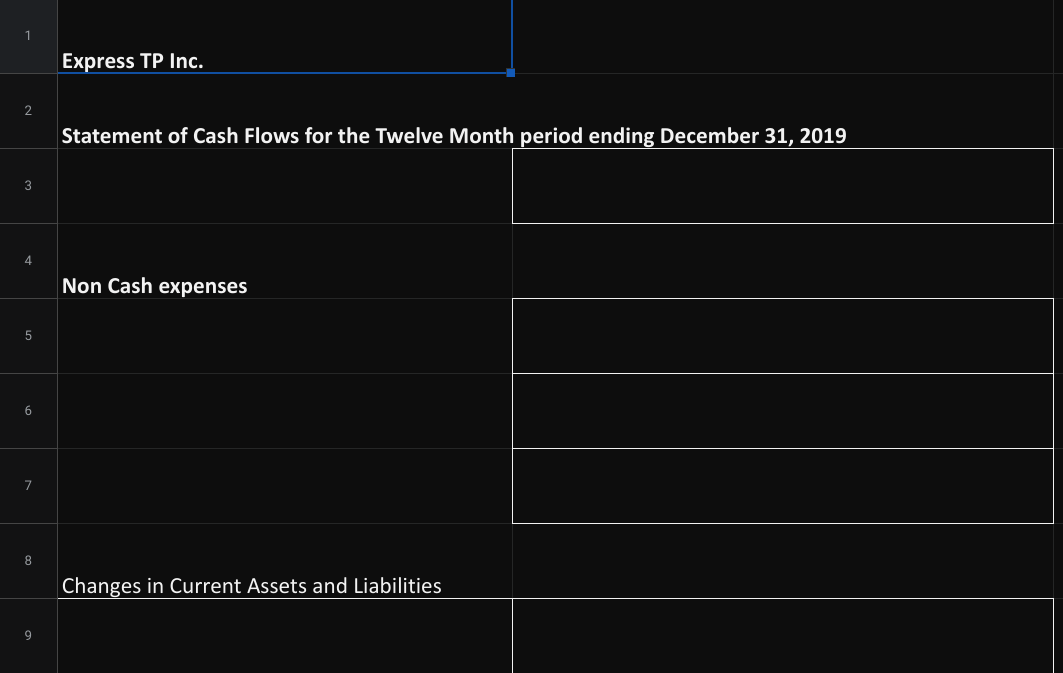

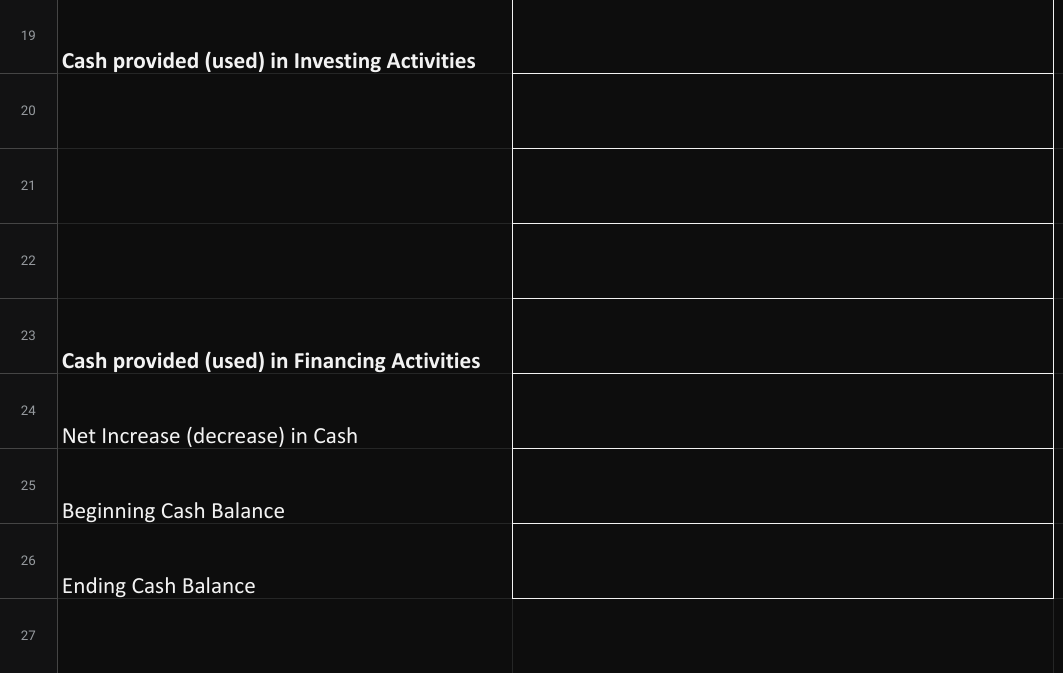

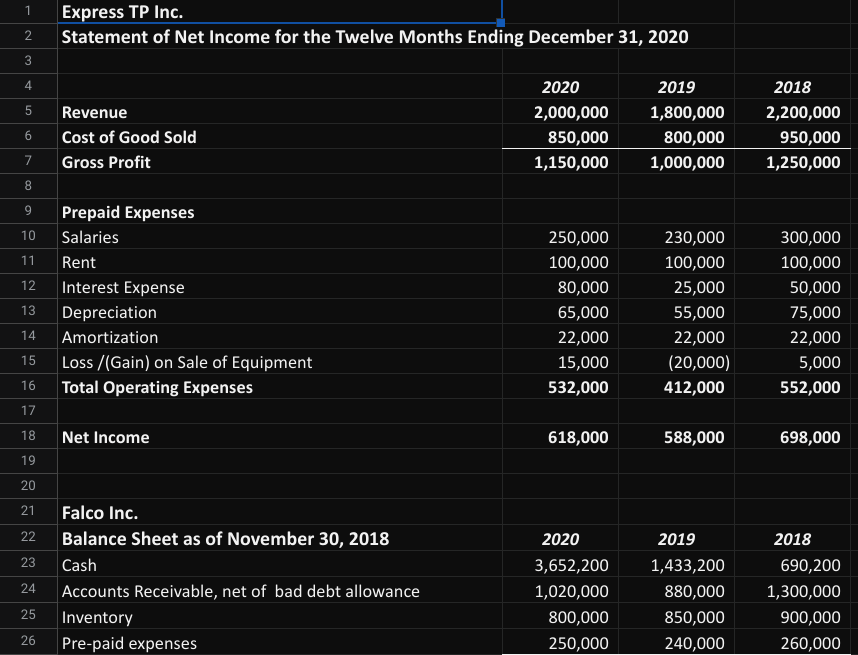

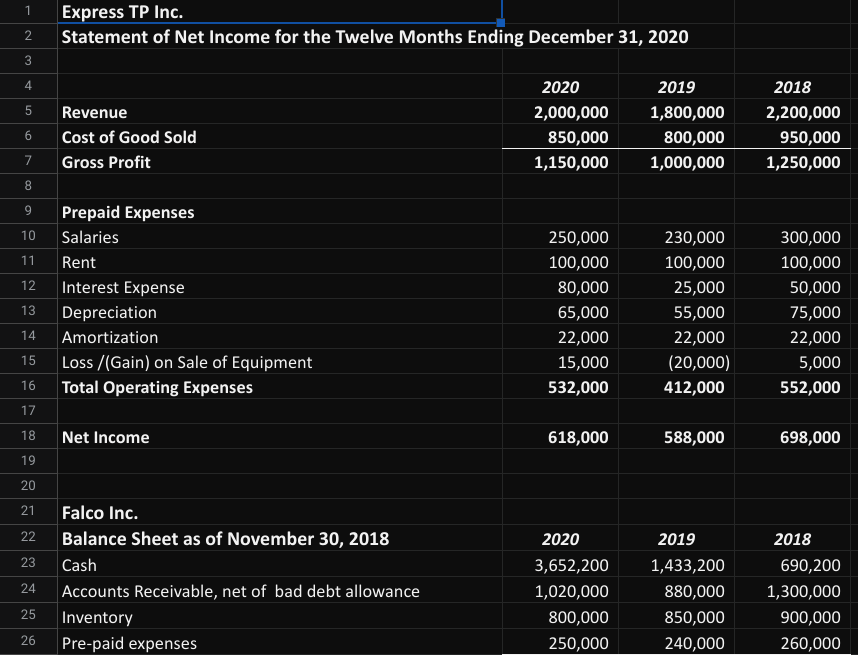

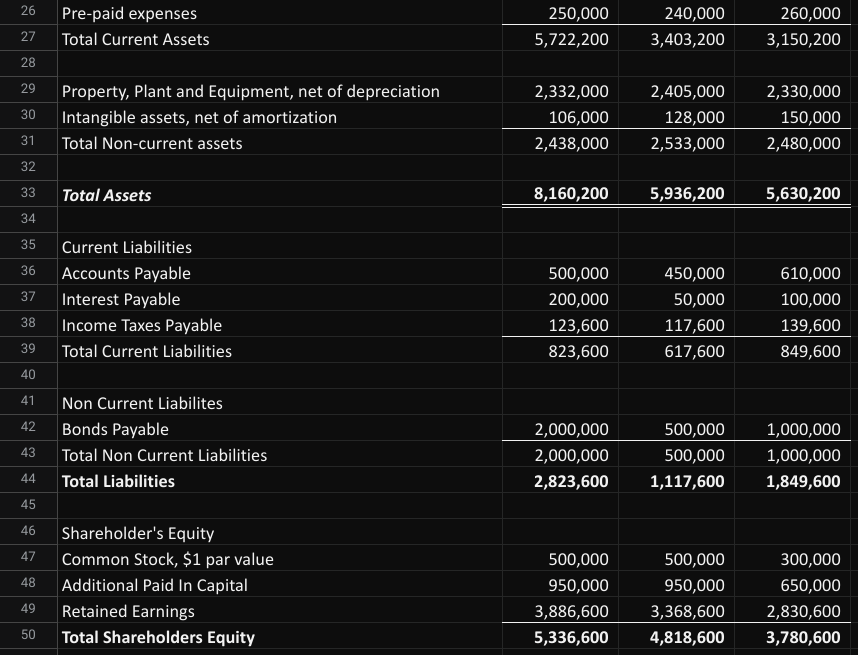

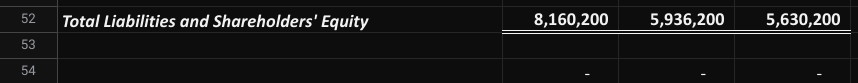

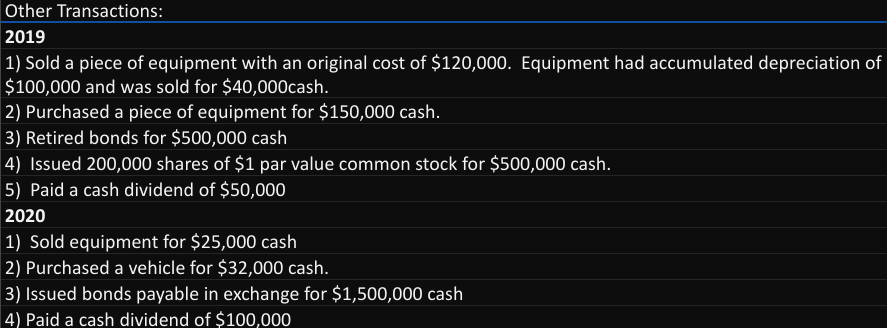

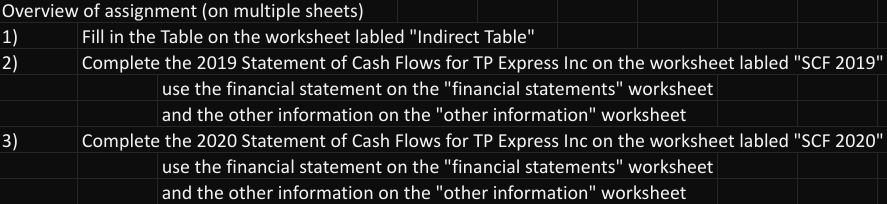

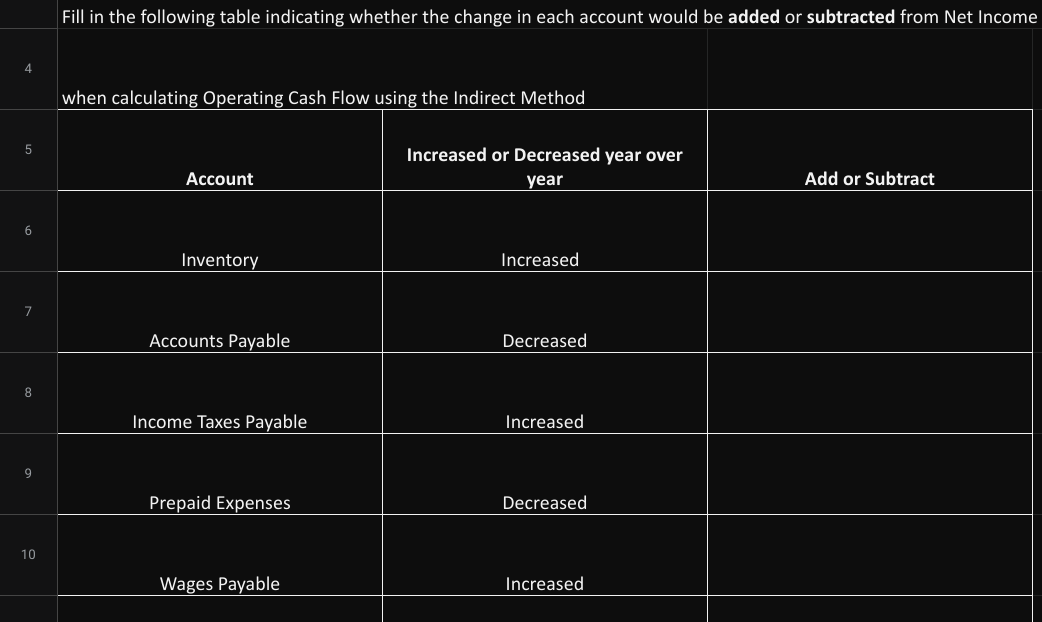

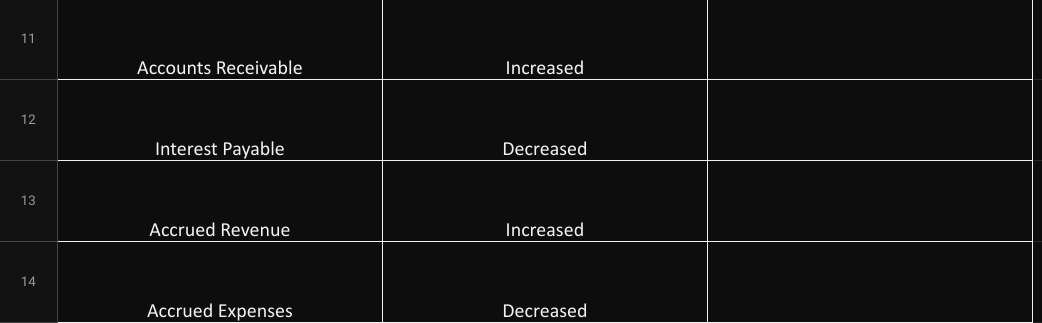

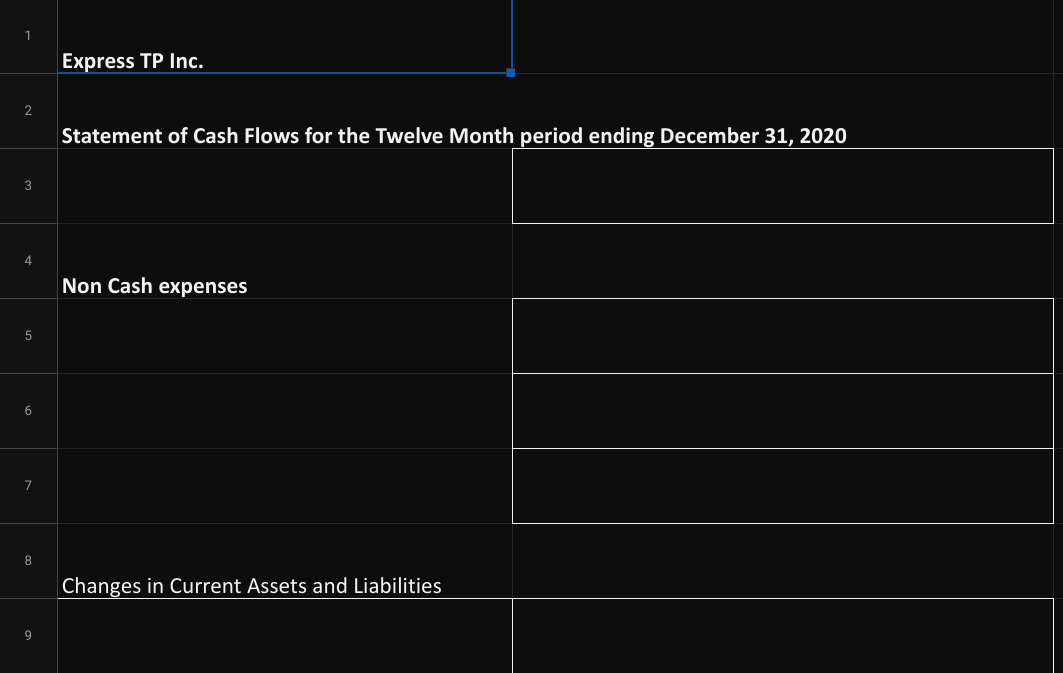

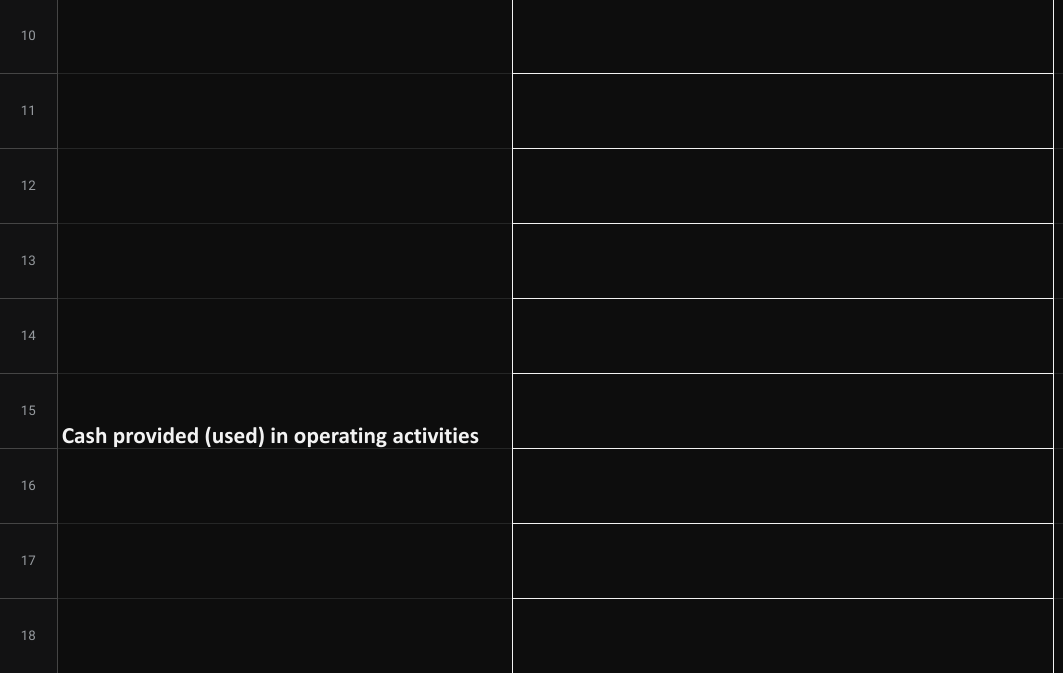

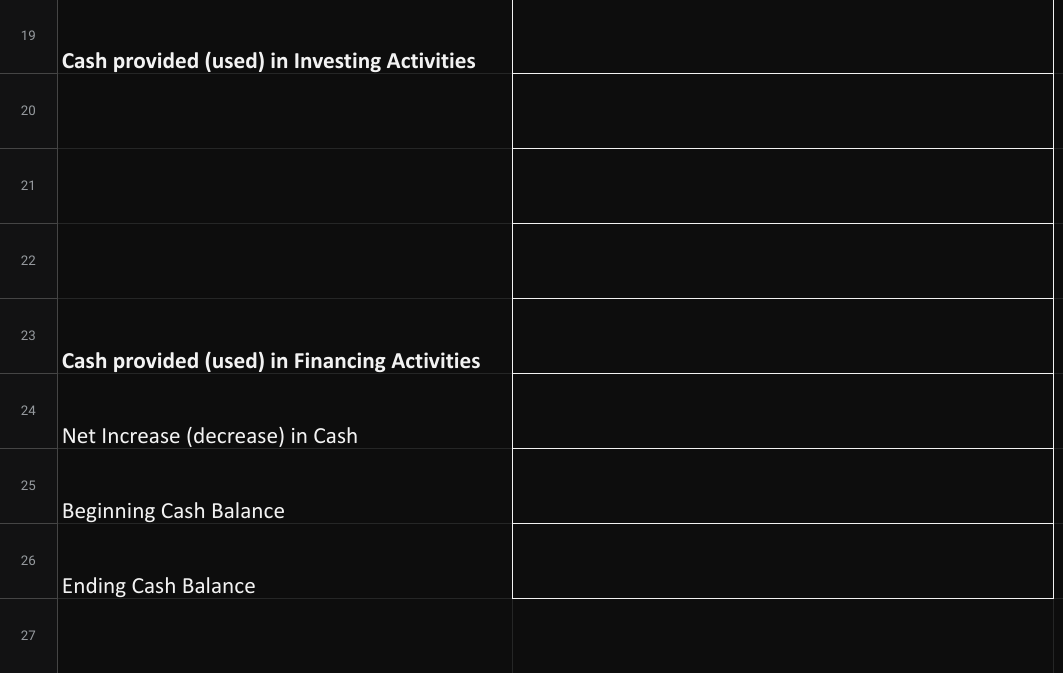

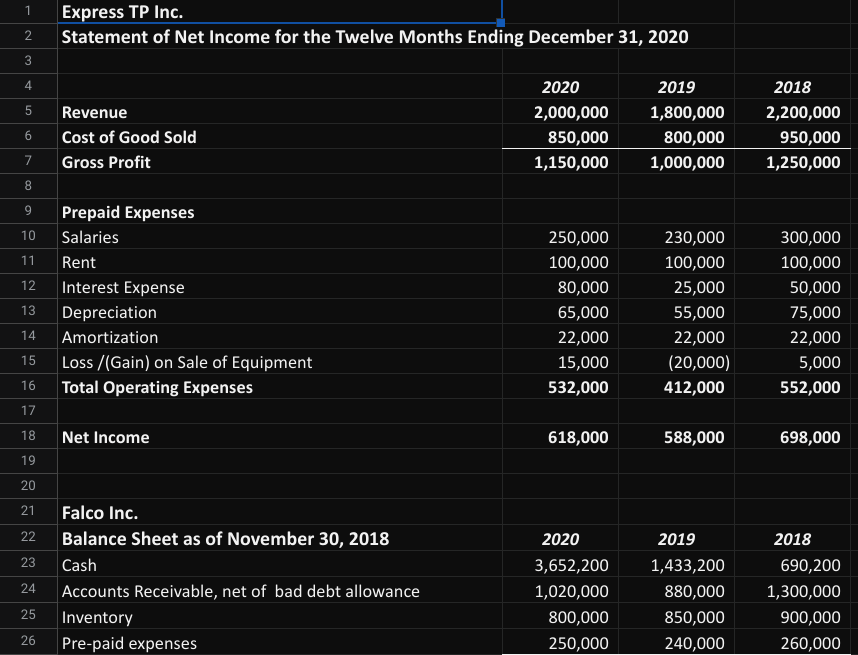

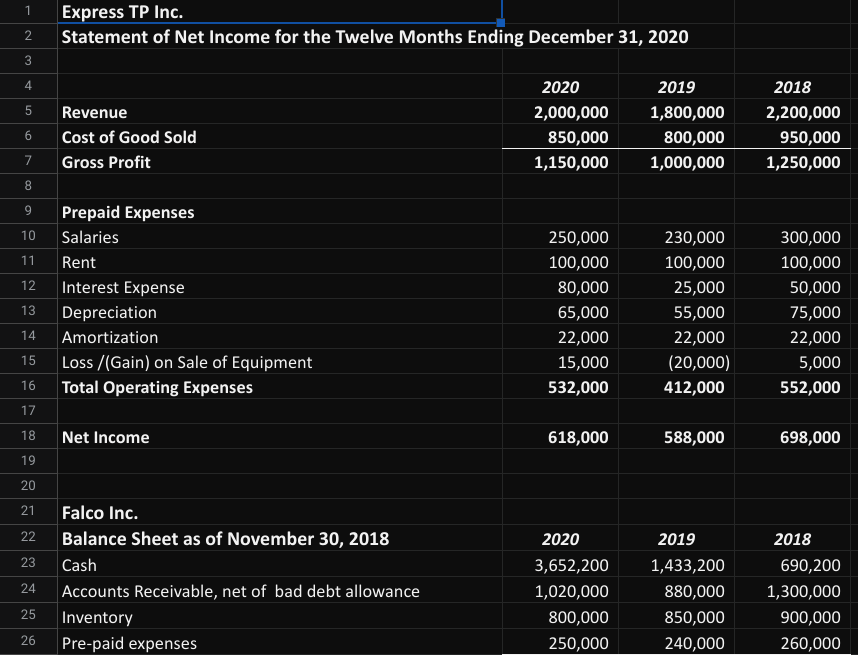

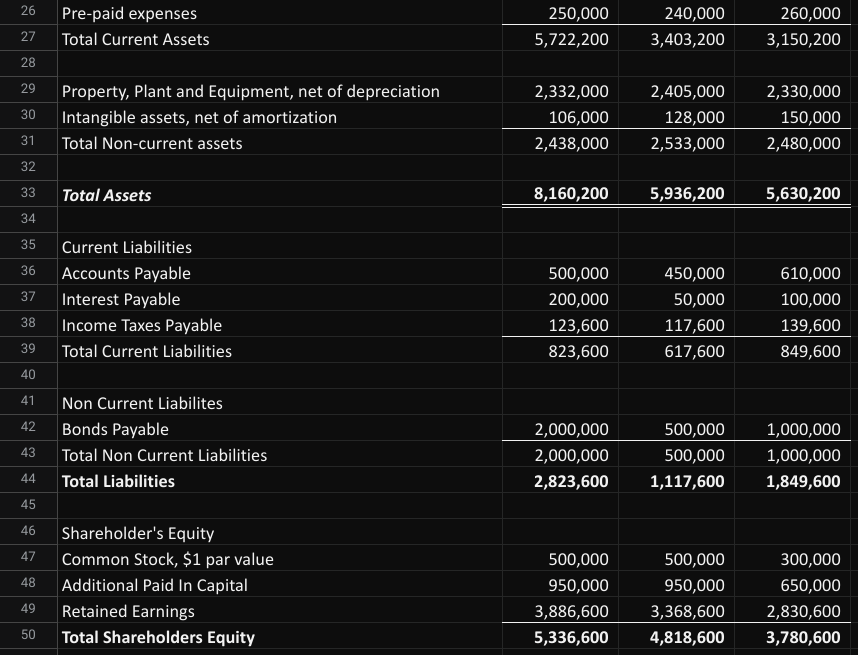

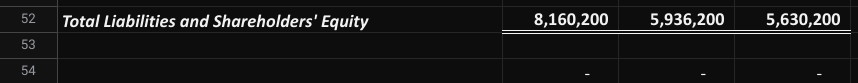

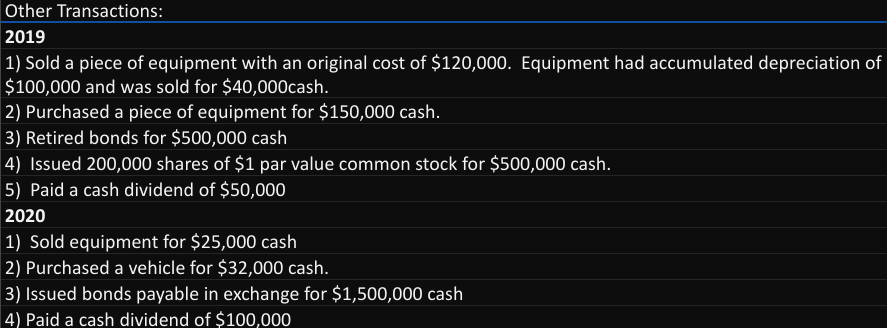

Overview of assignment (on multiple sheets) 1) Fill in the Table on the worksheet labled "Indirect Table" 2) Complete the 2019 Statement of Cash Flows for TP Express Inc on the worksheet labled "SCF 2019" use the financial statement on the "financial statements" worksheet and the other information on the "other information" worksheet ) Complete the 2020 Statement of Cash Flows for TP Express Inc on the worksheet labled "SCF 2020" use the financial statement on the "financial statements" worksheet and the other information on the "other information" worksheet 3) Fill in the following table indicating whether the change in each account would be added or subtracted from Net Income 4 when calculating Operating Cash Flow using the Indirect Method 5 Increased or Decreased year over year Account Add or Subtract 6 Inventory Increased 7 Accounts Payable Decreased 8 Income Taxes Payable Increased 9 Prepaid Expenses Decreased 10 Wages Payable Increased 11 Accounts Receivable Increased 12 Interest Payable Decreased 13 Accrued Revenue Increased 14 Accrued Expenses Decreased Express TP Inc. 2 Statement of Cash Flows for the Twelve Month period ending December 31, 2019 3 4 Non Cash expenses 5 6 7 8 Changes in Current Assets and Liabilities 9 10 11 12 13 14 15 Cash provided (used) in operating activities 16 17 18 19 Cash provided (used) in Investing Activities 20 21 22 23 Cash provided (used) in Financing Activities 24 Net Increase (decrease) in Cash 25 Beginning Cash Balance 26 Ending Cash Balance 27 Express TP Inc. 2 Statement of Cash Flows for the Twelve Month period ending December 31, 2020 3 4 Non Cash expenses 5 6 7 8 Changes in Current Assets and Liabilities 9 10 11 12 13 14 15 Cash provided (used) in operating activities 16 17 18 19 Cash provided (used) in Investing Activities 20 21 22 23 Cash provided (used) in Financing Activities 24 Net Increase (decrease) in Cash 25 Beginning Cash Balance 26 Ending Cash Balance 27 1 Express TP Inc. Statement of Net Income for the Twelve Months Ending December 31, 2020 2 3 4 5 2020 2,000,000 850,000 1,150,000 2019 1,800,000 800,000 1,000,000 Revenue Cost of Good Sold Gross Profit 2018 2,200,000 950,000 1,250,000 a 6 00 7 8 9 10 11 12 Prepaid Expenses Salaries Rent Interest Expense Depreciation Amortization Loss /(Gain) on Sale of Equipment Total Operating Expenses 13 250,000 100,000 80,000 65,000 22,000 15,000 532,000 230,000 100,000 25,000 55,000 22,000 (20,000) 412,000 300,000 100,000 50,000 75,000 22,000 5,000 552,000 14 15 16 17 18 Net Income 618,000 588,000 698,000 19 20 21 22 2018 23 Falco Inc. Balance Sheet as of November 30, 2018 Cash Accounts Receivable, net of bad debt allowance Inventory Pre-paid expenses 24 2020 3,652,200 1,020,000 800,000 250,000 2019 1,433,200 880,000 850,000 240,000 690,200 1,300,000 900,000 260,000 25 26 1 Express TP Inc. Statement of Net Income for the Twelve Months Ending December 31, 2020 2 3 4 5 2020 2,000,000 850,000 1,150,000 2019 1,800,000 800,000 1,000,000 Revenue Cost of Good Sold Gross Profit 2018 2,200,000 950,000 1,250,000 a 6 00 7 8 9 10 11 12 Prepaid Expenses Salaries Rent Interest Expense Depreciation Amortization Loss /(Gain) on Sale of Equipment Total Operating Expenses 13 250,000 100,000 80,000 65,000 22,000 15,000 532,000 230,000 100,000 25,000 55,000 22,000 (20,000) 412,000 300,000 100,000 50,000 75,000 22,000 5,000 552,000 14 15 16 17 18 Net Income 618,000 588,000 698,000 19 20 21 22 2018 23 Falco Inc. Balance Sheet as of November 30, 2018 Cash Accounts Receivable, net of bad debt allowance Inventory Pre-paid expenses 24 2020 3,652,200 1,020,000 800,000 250,000 2019 1,433,200 880,000 850,000 240,000 690,200 1,300,000 900,000 260,000 25 26 26 Pre-paid expenses Total Current Assets 250,000 5,722,200 240,000 3,403,200 260,000 3,150,200 27 28 29 30 Property, Plant and Equipment, net of depreciation Intangible assets, net of amortization Total Non-current assets 2,332,000 106,000 2,438,000 2,405,000 128,000 2,533,000 2,330,000 150,000 2,480,000 31 32 33 Total Assets 8,160,200 5,936,200 5,630,200 34 35 36 37 Current Liabilities Accounts Payable Interest Payable Income Taxes Payable Total Current Liabilities 500,000 200,000 123,600 823,600 450,000 50,000 117,600 617,600 610,000 100,000 139,600 849,600 38 39 40 41 42 Non Current Liabilites Bonds Payable Total Non Current Liabilities Total Liabilities 43 2,000,000 2,000,000 2,823,600 500,000 500,000 1,117,600 1,000,000 1,000,000 1,849,600 44 45 46 47 48 Shareholder's Equity Common Stock, $1 par value Additional Paid In Capital Retained Earnings Total Shareholders Equity 500,000 950,000 3,886,600 5,336,600 500,000 950,000 3,368,600 4,818,600 300,000 650,000 2,830,600 3,780,600 49 50 52 Total Liabilities and Shareholders' Equity 8,160,200 5,936,200 5,630,200 53 54 Other Transactions: 2019 1) Sold a piece of equipment with an original cost of $120,000. Equipment had accumulated depreciation of $100,000 and was sold for $40,000cash. 2) Purchased a piece of equipment for $150,000 cash. 3) Retired bonds for $500,000 cash 4) Issued 200,000 shares of $1 par value common stock for $500,000 cash. 5) Paid a cash dividend of $50,000 2020 1) Sold equipment for $25,000 cash 2) Purchased a vehicle for $32,000 cash. 3) Issued bonds payable in exchange for $1,500,000 cash 4) Paid a cash dividend of $100,000