Question

Owen has discussed with two advisors the possibility of selling his half of the firm. Since KF is not publicly traded, the market value of

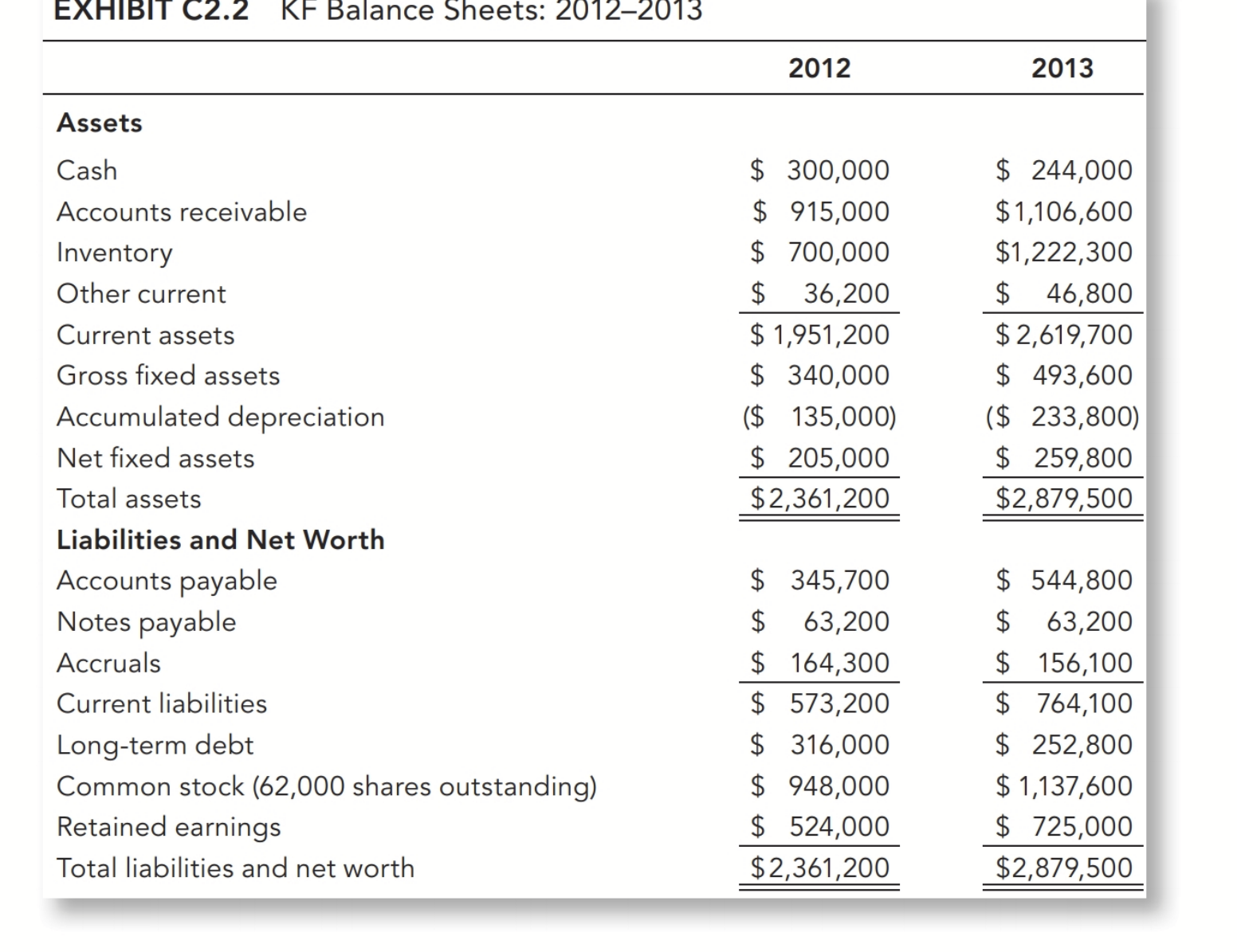

Owen has discussed with two advisors the possibility of selling his half of the firm. Since KF is not publicly traded, the market value of the company's stock must be estimated. The consultants believe that KF is worth between $35 and $40 per share, figures that appear reasonable to Owen.

Is the estimate of $35 to $40 for Owen's shares a fair evaluation?

Please explain why

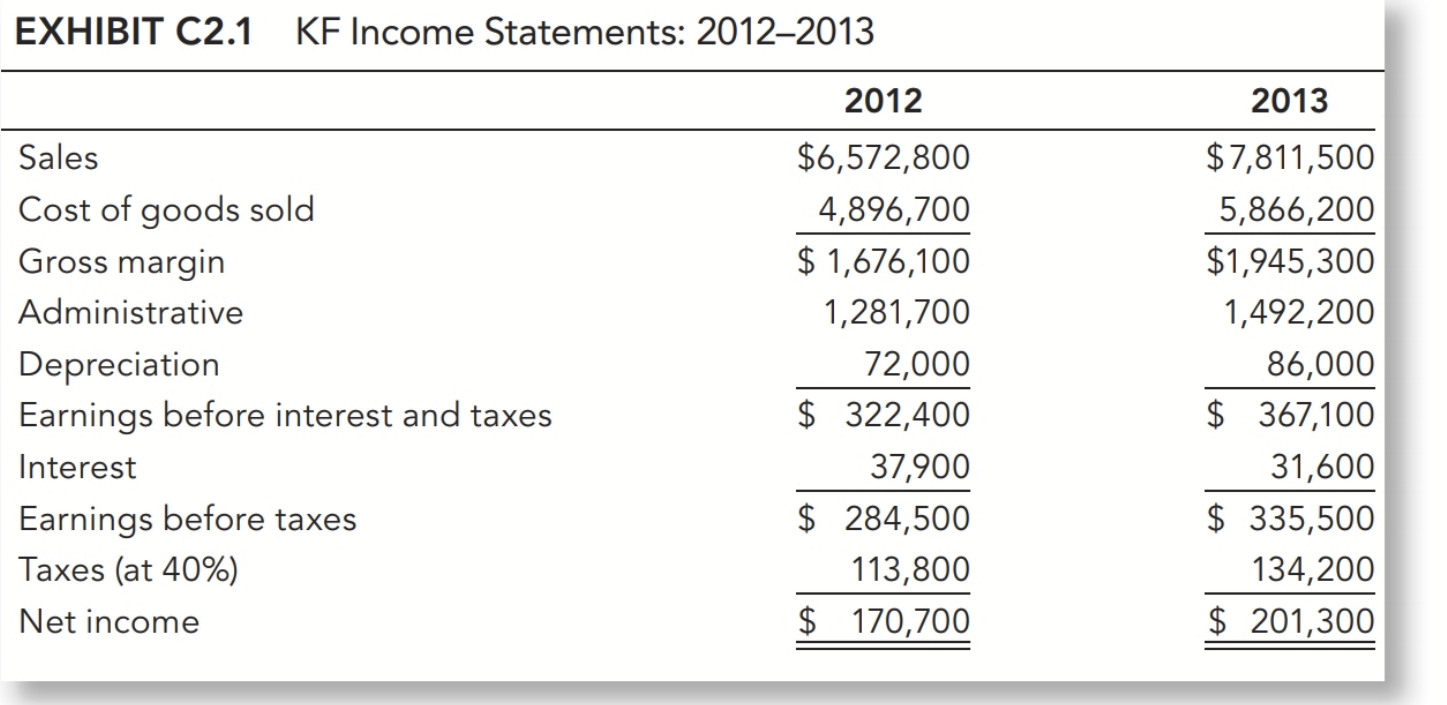

EXHIBIT C2.1 KF Income Statements: 2012-2013 Sales Cost of goods sold Gross margin Administrative Depreciation Interest 2012 $6,572,800 4,896,700 $ 1,676,100 1,281,700 72,000 37,900 Earnings before interest and taxes $ 322,400 Earnings before taxes Taxes (at 40%) Net income $ 284,500 113,800 $ 170,700 2013 $7,811,500 5,866,200 $1,945,300 1,492,200 86,000 $ 367,100 31,600 $ 335,500 134,200 $ 201,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing Cases An Interactive Learning Approach

Authors: Steven M Glover, Douglas F Prawitt

4th Edition

0132423502, 978-0132423502

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App