Answered step by step

Verified Expert Solution

Question

1 Approved Answer

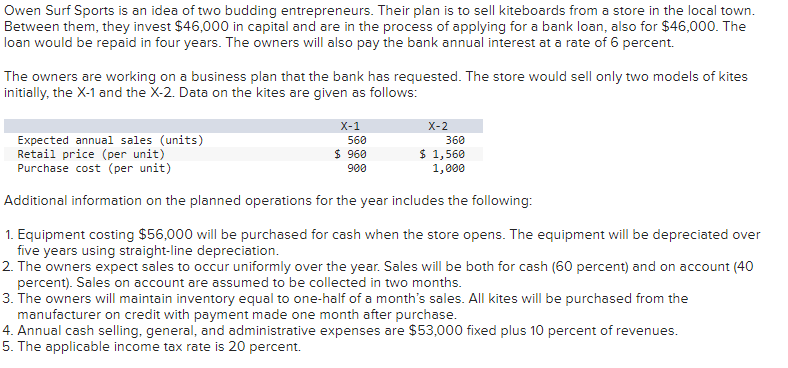

Owen Surf Sports is an idea of two budding entrepreneurs. Their plan is to sell kiteboards from a store in the local town. Between them,

Owen Surf Sports is an idea of two budding entrepreneurs. Their plan is to sell kiteboards from a store in the local town.

Between them, they invest $ in capital and are in the process of applying for a bank loan, also for $ The

loan would be repaid in four years. The owners will also pay the bank annual interest at a rate of percent.

The owners are working on a business plan that the bank has requested. The store would sell only two models of kites

initially, the and the Data on the kites are given as follows:

Additional information on the planned operations for the year includes the following:

Equipment costing $ will be purchased for cash when the store opens. The equipment will be depreciated over

five years using straightline depreciation.

The owners expect sales to occur uniformly over the year. Sales will be both for cash percent and on account

percent Sales on account are assumed to be collected in two months.

The owners will maintain inventory equal to onehalf of a month's sales. All kites will be purchased from the

manufacturer on credit with payment made one month after purchase.

Annual cash selling, general, and administrative expenses are $ fixed plus percent of revenues.

The applicable income tax rate is percent.

Required:

a Prepare a cash budget for the year.

b The owners want to ensure that they have cash on hand at the end of the year equal to the current accounts payable balance on December Will the store meet that requirement?

c Consider only the assumption about the percentage of sales that will be made on account currently percent What assumption about this percentage would exactly achieve the goal set by the owners in requirement b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started