Answered step by step

Verified Expert Solution

Question

1 Approved Answer

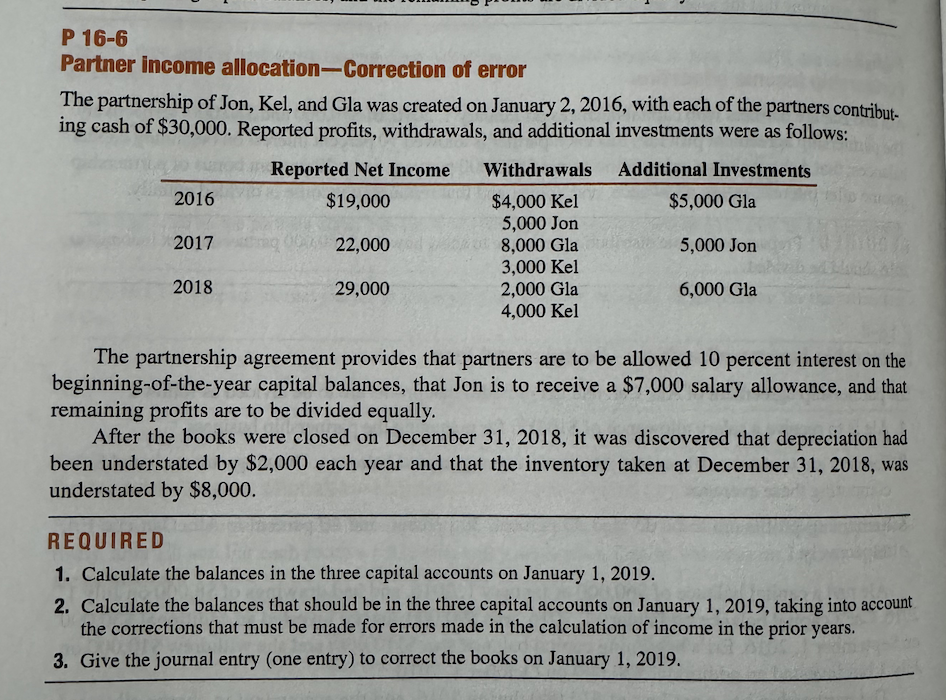

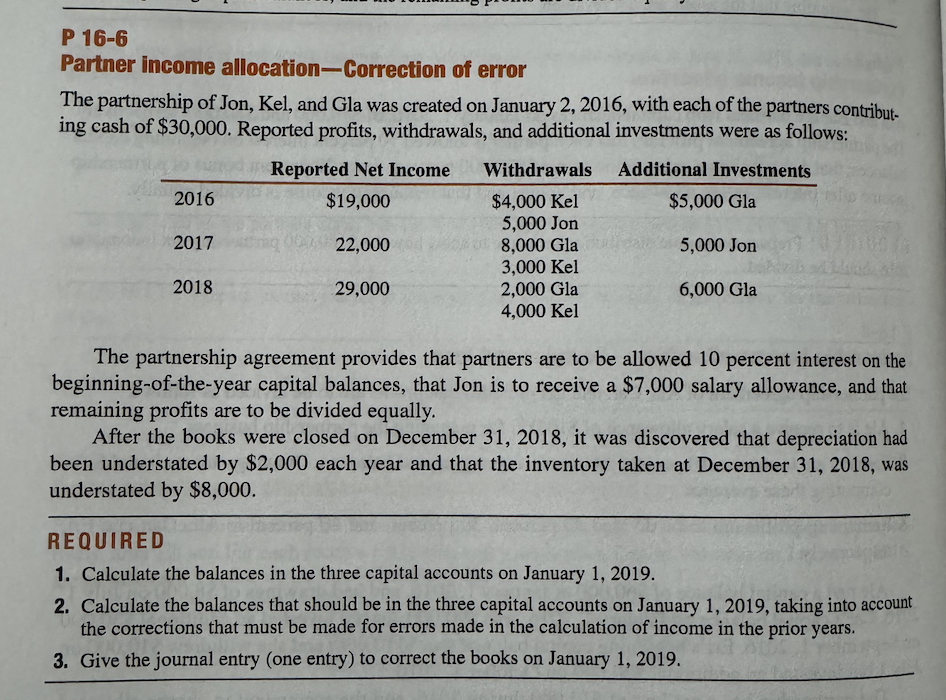

P 1 6 - 6 Partner income allocation - Correction of error The partnership of Jon, Kel, and Gla was created on January 2 ,

P

Partner income allocationCorrection of error

The partnership of Jon, Kel, and Gla was created on January with each of the partners contribut

ing cash of $ Reported profits, withdrawals, and additional investments were as follows:

The partnership agreement provides that partners are to be allowed percent interest on the

beginningoftheyear capital balances, that Jon is to receive a $ salary allowance, and that

remaining profits are to be divided equally.

After the books were closed on December it was discovered that depreciation had

been understated by $ each year and that the inventory taken at December was

understated by $

REQUIRED

Calculate the balances in the three capital accounts on January

Calculate the balances that should be in the three capital accounts on January taking into account

the corrections that must be made for errors made in the calculation of income in the prior years.

Give the journal entry one entry to correct the books on January

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started