Answered step by step

Verified Expert Solution

Question

1 Approved Answer

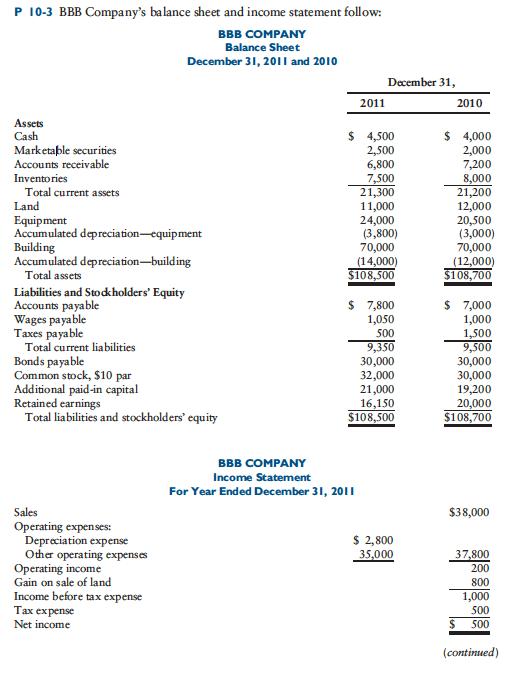

P 10-3 BBB Company's balance sheet and income statement follow: OMPANY Balance Sheet December 31, 2011 and 2010 December 31, 2011 2010 Assets $

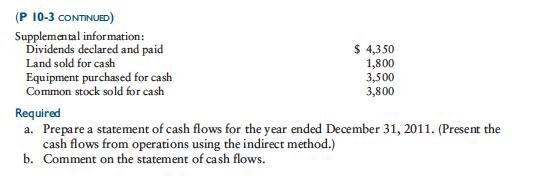

P 10-3 BBB Company's balance sheet and income statement follow: OMPANY Balance Sheet December 31, 2011 and 2010 December 31, 2011 2010 Assets $ 4,500 2,500 6,800 7,500 21,300 $ 4,000 Cash Marketable securities Accounts receivable 2,000 7,200 8,000 21,200 12,000 20,500 (3,000) 70,000 (12,000) $108,700 Inventories Total current assets Land Equipment Accumulated depreciation-equipment Building Accumulated depreciation-building Total assets 11,000 24,000 (3,800) 70,000 (14,000) $108,500 Liabilities and Stodkholders' Equity Accounts payable Wages payable Taxes payable Total current liabilities Bonds payable Common stock, $10 par Additional paid-in capital Retained earnings Total liabilities and stockholders' equity $ 7,800 1,050 $ 7,000 1,000 1,500 9,500 30,000 30,000 19,200 20,000 $108,700 500 9,350 30,000 32,000 21,000 16,150 $108,500 OMPANY Income Statement For Year Ended December 31, 2011 Sales Operating expenses: Depreciation expense Other operating expenses Operating income Gain on sale of land Income before tax expense xpense Net income $38,000 $ 2,800 35,000 37,800 200 800 1,000 500 500 (continued) (P 10-3 CONTINUED) Supplemental information: Dividends declared and paid Land sold for cash Equipment purchased for cash Common stock sold for cash $ 4,3 50 1,800 3,500 3,800 Required a. Prepare a statement of cash flows for the year ended December 31, 2011. (Present the cash flows from operations using the indirect method.) b. Comment on the statement of cash flows.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

BBB Company Operating Cashflow has g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started